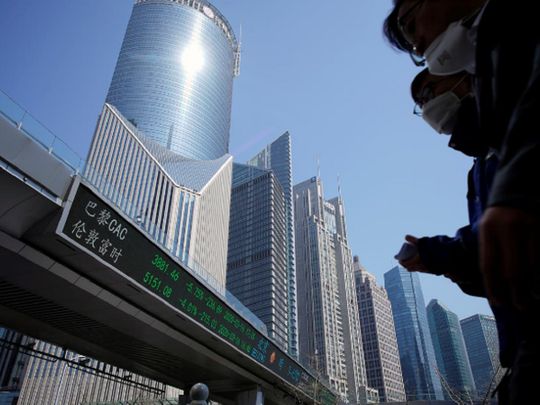

TOKYO/NEW YORK (Reuters) - Oil prices retreated on Friday after massive gains, while stocks in Asia edged down, as doubts grew over an oil price deal between Saudi Arabia and Russia that U.S. President Donald Trump said he had brokered.

With the coronavirus pandemic raising the risk of a prolonged global downturn, investors continued to seek the safety of the U.S. dollar and government bonds, pushing U.S. Treasuries yield near their lowest in three weeks.

With the coronavirus pandemic raising the risk of a prolonged global downturn, investors continued to seek the safety of the U.S. dollar and government bonds, pushing U.S. Treasuries yield near their lowest in three weeks.

U.S. West Texas Intermediate (WTI) crude CLc1 lost $1.14, or 4.5% to $24.18 a barrel in early Asian trade after having surged a record 24.7% on Thursday. Brent futures LCOc1 dropped $0.70, or 2.67% to $29.24.

Trump said on Thursday he had spoken to Saudi Crown Prince Mohammed Bin Salman, and expects Saudi Arabia and Russia to cut oil output by as much as 10 million to 15 million barrels, as the two countries signalled willingness to make a deal.

Saudi Arabia said it would call an emergency meeting of the Organization of the Petroleum Exporting Countries, Saudi state media reported.

The amount Trump talked about would represent an unprecedented cut amounting to 10% to 15% of global supply, if he meant output per day - a common unit of measurement.

But Trump did not specify and some analysts say the omission may be intentional.

“He is a business man and smart enough to know these things. A cut of 10-15 million barrel per day (bpd) would be simply impossible,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities.

“How could Riyadh and Moscow agree on such a big cut, just about a month after they had fought over a cut of 1.5 million.”

In early March, talks over production cuts between the two countries collapsed, leading them to start a price war that pushed oil prices to the lowest levels in nearly two decades.

Nor did Trump make any offer to reduce U.S. production, now the world’s largest.

“Both Riyadh and Moscow will also be looking for participation from U.S. producers, and this may prove now to be the biggest obstacle to an agreement,” Royal Bank of Canada analysts said in a note.

As oil prices retreated, E-Mini futures for the S&P 500 EScv1 also fell 0.78% in Asia.