Mumbai: Investors are piling into multiplex operators' stocks in India despite the box-office window being shut for four months, hoping that cost cuts and sufficient liquidity will aid the companies to ride through the disruption.

Theater operators PVR and Inox Leisure have rebounded about 50 per cent since May, after at least three consecutive months of losses when the world's strictest lockdown halted visits to shopping malls, restaurants and the movies. Cinemas are still waiting for restrictions to ease to welcome back the audience with safety measures ranging from socially-distance seating and sanitized auditoriums, to snacks prepared with stricter hygiene checks.

"We expect this fiscal year to be largely a disrupted year due to COVID-19. Nonetheless, we are encouraged by the initial response seen in other markets where theaters have reopened," Anurag Dayal and Amit Sachdeva, analysts with HSBC Securities and Capital Market India Pvt. said in a note.

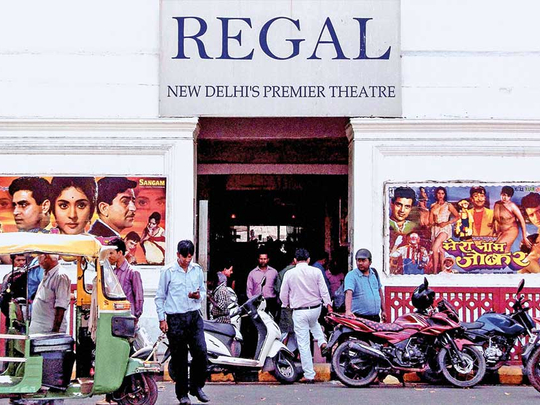

India makes the most number of films in the world, and Bollywood - as India's mainstream film industry is called - has long been resistant to shifting releases online. The prolonged stay-at-home order gave streaming platforms owned by Netflix, Disney, and Amazon an opportunity to lure new subscribers as producers were driven to them for new releases.

"We see multiplexes as an exponential growth opportunity, a phase that is still due in India," the analysts wrote in the note. "We expect multiplex to remain a preferred choice for big launches for the buzz and experience it provides."