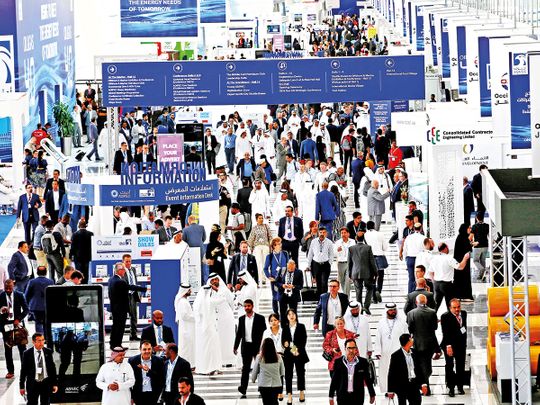

Abu Dhabi: Oil will continue to be a major source of world’s energy despite the current market challenges and competition from other energy sources such as renewables — that was the consensus that came out of the four-day Abu Dhabi Petroleum Exhbition and Conference (Adipec), which officially came to a close on Thursday.

On Wednesday, Opec released its latest annual World Oil Outlook Report, which said that oil demand would go up to 110.6 million barrels per day (bdp) by 2040, citing growing energy demands brought on by a growing world population that is expected to grow by 1.9 billion people.

“The major oil trade group remains the Middle East to the Asia Pacific, with the UAE continuing to be the key hub. Total Middle East exports are set to increase by around 7 million bpd by 2020 and [by] 2040 to reach close to 23 million bpd,” said Mohammad Barkindo, Opec secretary-general, during Adipec, highlighting how the Middle East and the UAE would be at the forefront of oil’s growth.

Adnoc makes moves

With the Middle East set to play a key role in oil’s future demand, Adnoc has set its sights on being able to meet that challenge, with its executives at Adipec assuring the industry that the group was on target to increase its oil production capacity to 4 million bpd by 2020 and 5 million bpd by 2030. “Our progress is picking up pace, new discoveries this year include over 7 billion barrels in oil reserves, 58 trillion cubic feet of conventional gas, and significantly over 160 trillion cubic feet of unconventional gas. And as a result, the UAE has moved up from seventh to sixth place in the rankings of the largest oil and gas reserves,” said Dr Sultan Al Jaber, Minister of State and Adnoc Group chief executive officer.

In the biggest deal of Adipec, Adnoc announced a Dh1.8 billion investment to upgrade its Bab onshore field, one of its largest onshore producing assets. The signing was just one of many over the event as Adnoc signed agreements with BP, Total and China’s Rongsheng Petrochemical.

Adnoc also unveiled further details regarding its historic decision to list its Murban crude oil on a futures exchange market next year, as it was announced that Intercontinental Exchange had officially established ICE Futures Abu Dhabi at the Abu Dhabi Global Market to host Murban’s futures contracts.

“For the first time, Murban will be priced on a forward-looking, market-driven basis … The Murban futures contract will allow our customers to hedge their risk in the open market and will also allow for us to maximise value on every barrel we produce,” Al Jaber said.