South Africa to delay deficit cuts

Deficit target raised to 5.2% of gross domestic product

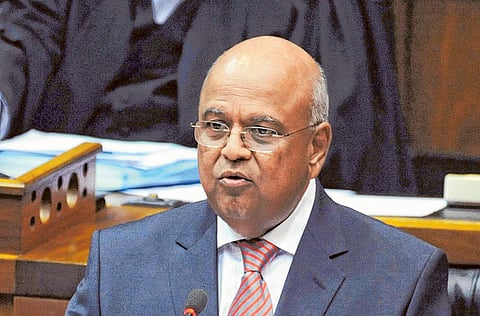

Cape Town: South African Finance Minister Pravin Gordhan will delay plans to narrow the budget deficit as mining strikes and a slow recovery in Africa’s biggest economy curb tax revenue. The deficit target was raised to 5.2 per cent of gross domestic product in the year through March from 4.8 per cent estimated in October, Gordhan said in his budget speech in Cape Town on Wednesday. The government will cut spending to help bring the shortfall down to 4.6 per cent next year, compared with an earlier projection of 4.5 per cent, and 3.9 per cent in 2014/15. “We do have a revenue squeeze,” he said. “You have to cut your suit according to the cloth available.” Gordhan, 63, is struggling to rein in the fiscal deficit and restore investor confidence after credit-rating downgrades from three companies since September. At the same time, he’s facing increasing pressure to step up spending as the ruling African National Congress pledges to cut joblessness ahead of elections next year.

Cut revenue

The median estimate in a Bloomberg survey of 11 economists was for the deficit to reach 4.8 per cent this year and 4.5 in 2013/14. As recently as 2012, Gordhan was targeting a 3 per cent gap by 2014/15. A former head of the nation’s tax agency, Gordhan was forced to cut revenue projections as a slump in export demand from Europe and strikes in the mining industry curtailed growth. South Africa will miss its revenue target by 16.3 billion rand (Dh6.6 billion, $1.8 billion) this year and reduce spending by 10.4 billion rand in the next three years, Gordhan said. The state will limit expenditure growth to an average of 2.3 per cent a year from 2.9 per cent previously. “It will be quite difficult for them to cut back on their expenditures,” Michelle Pingo-de Abreu, an economist at Nedbank, said in a phone interview from Johannesburg. “The ratings agencies will be looking at that. It is something that will be factored into the market and will create a base for a weaker rand going forward.”

The economy will probably expand 2.7 per cent this year, lower than the 3 per cent estimated in October, Gordhan said. That’s less than half the pace the 7 per cent pace the government says is necessary to slash the jobless rate to 14 per cent by 2020 from 25 per cent currently. Growth is set to quicken to 3.5 per cent next year and 3.8 per cent in 2015, the finance minister said. “South Africa’s economic outlook is improving, but it requires that we actively pursue a different trajectory if we are to address the challenges ahead,” Gordhan said. The government will give companies a tax break for hiring young people entering the labour market, he said. The worst mining strikes since the end of apartheid that shut gold and platinum mines last year cost the economy 15.3 billion rand in lost output, higher than a previous estimate of about 10 billion rand, the Treasury said.

Concessions

Mining companies will contribute 7.5 per cent of corporate taxes in the year through March, down from 11 per cent last year, it said. The government plans to collect 985.7 billion rand in revenue in the coming fiscal year, down from 986.1 billion rand estimated in October. Spending will be little changed at 1.15 trillion rand. “There are some nuggets in there,” Oupa Magashula, the head of the tax agency, said in an interview. “Under the circumstances when revenue is coming down, we are still giving some concessions.” Rising debt is putting pressure on South Africa’s credit rating, which was lowered by one level by Standard & Poor’s, Moody’s Investors Service and Fitch Ratings.

Net debt is set to climb to 40.3 per cent of GDP in the year through March 2016, up from an earlier projection of 39.2 per cent, according to the Treasury. An increase in borrowing to plug the deficit may curb a rally in bonds. The yield on notes due December 2026 has dropped 37 basis points to 7.22 per cent in the past six months. It fell to a six-week low of 7.21 per cent on February 20 after a report showed inflation slowed for the first time in five months to 5.4 per cent in January. With weak consumer spending and mounting job losses, Gordhan has little room to raise income taxes to help finance the budget deficit. While the government plans to impose a tax on carbon emissions and increase fuel levies, new policy programmes will mainly be funded from the budget, he said. “If we succeed in driving growth towards 5 per cent a year and government revenue doubles in the next 20 years, major infrastructure projects and new policy initiatives such as national health insurance and expanded vocational education will be affordable with limited adjustments to tax policy,” Gordhan said.