Gellify Middle East, a multinational B2B innovation platform managing digital transformation, has released a new corporate venturing-focused study that provides a unique overview of how leading international companies across different industries are developing initiatives that enable them to achieve their strategic objectives, promote an agile approach to processes, and work towards a culture of innovation inspired by the world of startups.

The new study, The 4 W’s of Corporate Venturing, highlights the results of a series of video interviews and qualitative questionnaires conducted with 21 corporate venturing experts, innovation managers, and other C-level managers of 18 market-leading companies in the United Arab Emirates (UAE), Italy, Spain and Switzerland, operating in the services (including telecom and infrastructure), energy, manufacturing, banking, and insurance sectors, and functioning on a global scale.

The study is created and designed by Gellify's team under the framework of the 4 W´s of corporate venturing (Why, What, Who, and Where).

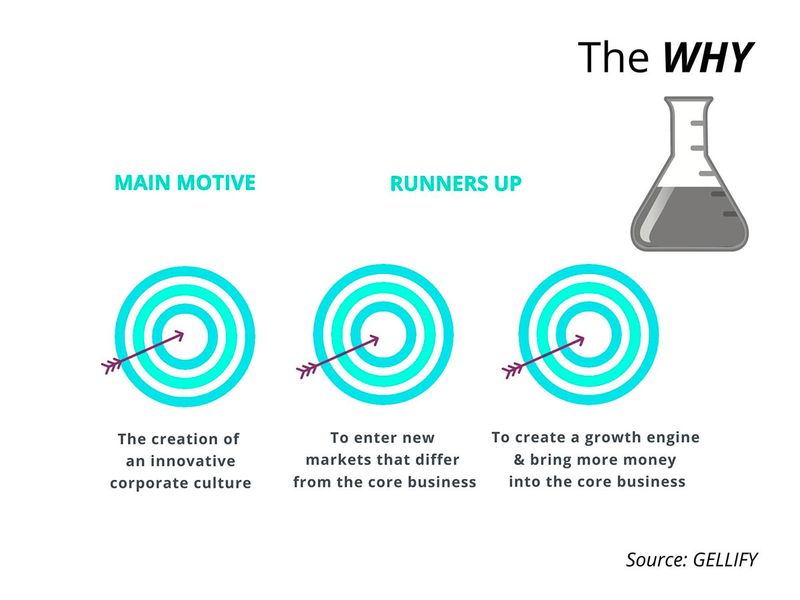

The Why

Most study respondents reported that the reason they began corporate venturing was in order to create an innovative corporate culture internally. For others, having an internal startup acts as a driving force to attract young talent.

Meanwhile, for other companies, investing in startups that operate in adjacent sectors, or sectors that are far from their core business, has proved to be an opportunity for diversification and allowed them to anticipate the needs of markets in which competitors operate in more traditional ways. Others also see corporate venturing as a growth opportunity to reinvest in their core business.

The What

There is no single rule as to what type of corporate venturing strategy a company should adopt. The companies surveyed indicate a strategy of diversifying investments between the short, medium and long term, in order to reap the benefits, while diversifying the risks.

Regarding the size of investments, the Gellify study found that around 50% of the well-established companies surveyed provide more than AED43.38 million ($11.81 million) in capital to their CVC (Corporate Venture Capital) each year, while 36% provide less than AED21.67 million ($5.90 million), and 14% provide between AED21.67 million ($5.90 million) and AED43.38 million ($11.81 million).

The Who

The involvement of the CEO is crucial to the startup of a new venturing unit, as is the board of directors and other C-level executives in an organisation. Of all the companies surveyed, about 60% reported that their venturing unit team comes from their parent company, about 21% from other sources, 7.1% from the corporate venture capital division itself, and 7.1% from a startup/scaleup.

Another aspect to consider when involving key people from the parent company is the level of risk the company is willing to tolerate. A total of 86% of the respondents answered that their company was only willing to tolerate a medium level of risk - even though these types of investments tend to generate returns over the long term (at least 5-7 years): 7% a high level and the other 7% a low level.

The Where

Where should the company concentrate their efforts? In response to this question, survey respondents were divided, with 50% hosting calls for startups, 43% searching internally for recommendations from a corporate venture capital or parent company, and 7% relying upon traditional venture capital funds.

The most common investment strategy used by the companies surveyed was direct investments (64.6%), while 7% preferred to invest through co-investments and another 7% through indirect investments.

Commenting on the study’s findings, Michele Giordani, Managing Partner and Founder of Gellify, said: “Two fundamental aspects emerge that all companies will have to take into account more and more. First of all, if they do not want to run the risk of losing relevance to new fully digital players, they will have to innovate; starting collaborations with external startups. The second important aspect concerns the culture of innovation in a company and its perception on the market in terms of innovation.”

“Corporate venturing initiatives give a great impetus to both of these strategic levers and also provide a benchmark on the speed and dynamics emerging in the market,” Giordani added.

To read the full results of the study, visit bit.ly/The4WsOfCVC