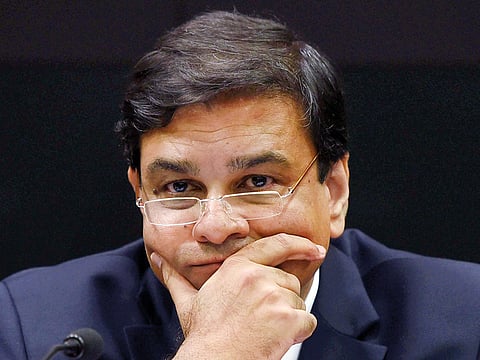

India's former central bank governor sets out reason for resignation

Urjit Patel says Modi government had diluted much touted Bankruptcy Law

Also In This Package

Mumbai: Moves to dilute a new bankruptcy law caused disagreements between Prime Minister Narendra Modi's government and the central bank, according to former Reserve Bank of India Governor Urjit Patel.

The rift centered around a February 2018 circular issued by the RBI, which forced banks to immediately classify borrowers as defaulters when they delayed repayments, barred defaulting company founders from trying to buy back their firms during insolvency auctions, and push them into bankruptcy if a resolution timeline wasn't met.

In a book released Friday, Patel - who headed the RBI between September 2016 and his unexpected resignation in December 2018 - said the government seemed to lose enthusiasm for the legislation in the middle of the year he left the central bank.

"Instead of buttressing and future-proofing the gains thus far, an atmosphere to go easy on the pedal ensued," Patel wrote. "Until then, for the most part, the finance minister and I were on the same page, with frequent conversations on enhancing the landmark legislation's operational efficiency."

More a threat than the stick

The government was probably of the view that the "deterrence effect - 'future defaulters beware, you may lose your business'" had been achieved, Patel said. He adds that "there were requests for rolling back the February circular" and "a canard was spread" to discredit the rules, including by incorrectly suggesting that small businesses would suffer disproportionately.

Patel's comments offer a first glimpse into a tussle between the RBI and the government, which led eventually to a U-turn that stunned the Indian business world when the Supreme Court last year struck down the RBI's February circular. The decision "made the insolvency regime vulnerable, possibly brittle," Patel wrote, and warned that subsequent changes risk reversing gains from efforts to clean one of the world's largest bad-loan piles.

Patel's successor Shaktikanta Das in June 2019 eased rules to give lenders 30 days to review a delinquent account and a further 180 days to implement a resolution plan, loosening the previous timeline. It also lifted the deadline to push defaulters into bankruptcy.

No good outcomes

"Since the time-bound threat of insolvency application is not credible anymore, it is unclear what threat points will compel resolution in 180 days (or, for that matter, even 365 days)," Patel wrote in his book.

The average time to resolve a case is about 400 days under the Indian Bankruptcy Code versus more than four years before the law was enacted, according to a government report in March.

The risk is that if banks fail to recover bad loans, they will need to find the capital elsewhere. The government has infused 2.6 trillion rupees ($34.7 billion) into state-run banks in the last three financial years, more than double that in the previous nine years. The central bank did not respond to an email seeking comment.

"Periodic bailout by government and official entities will likely continue, at least for some banks," Patel said.

Turning sour

Bad loans at Indian banks are expected to swell to 12.5 per cent of outstanding credit by March 2021, according to the Reserve Bank of India, after a prolonged lockdown hurt businesses and left millions jobless. The ratio was already one of the highest among major economies at 8.5 per cent at the end of March, as a two-year shadow banking crisis in India soured debt. If the macroeconomic environment worsens further, the ratio may escalate to 14.7 per cent under the very severely stressed scenario, the RBI said in its semi-annual financial stability report on Friday. Any worsening of banks' loan books would hurt their capital buffers and make it more difficult to extend credit just when companies need it most. A moratorium on loan repayments is providing some cushion for struggling businesses, but lenders may find a wave of loans turning bad after that relief ends in August.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox