These days, someone proposing a remote meeting or virtual happy hour is very likely to say, "Let's Zoom." While the coronavirus-induced lockdown has made Zoom Video Communications Inc. synonymous with video calls, it has also created a broader market, and whet investor appetite for stocks well placed to profit from the move to working from home.

Pexip Holding ASA has satisfied some of that demand with Europe's biggest technology initial public offering this year. The Thursday listing valued the Oslo-based company at some 9 billion Norwegian krone ($880 million), not shabby for a business with just 370 million krone in revenue last year.

The company is trading at a discount to its bigger, better-known competitor. If Pexip grows at the same pace for the rest of this year as it did in the first quarter, and profitability is consistent with previous years, then the listing gives it an enterprise value of more than 70 times forward Ebitda (a measure of a company's operating performance). Zoom is considerably pricier, with a valuation on the same basis of more than 370 times.

If this were primarily a classic consumer-facing market, then investors would have to weigh up the prospect of a winner-takes-all battle. After all, that's how things have tended to pan out for online services: Alphabet Inc.'s Google took search, Facebook Inc. dominates social media, Microsoft Corp.'s LinkedIn has professional contacts and so on. And Zoom has already entered the lexicon as a verb in much the same way as google or tweet.

Different business model

But the video-conferencing business model differs from those advertising-driven offerings: Most of the money is to be made from companies paying for premium services. Chief technology officers care less about what's in vogue than about the best solution for their needs from both a technical and cost perspective. So while Pexip's valuation is still punchy, there is room for multiple players. Concentrating on a business-to-business solution is far more likely to build a sustainable concern built on rational purchases "- Pexip already boasts customers such as Vodafone Group Plc, General Electric Co. and Accenture Plc and annual recurring revenue from multi-year contracts jumped 50% in the first quarter. With 1.1 billion krone in IPO proceeds, it now has capital to accelerate that pace of growth.

Work-from-home trend

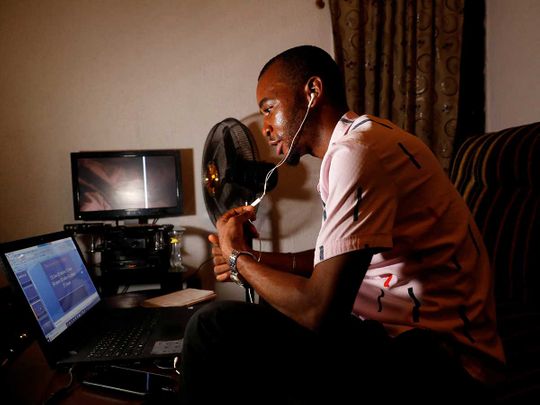

There's significant demand to capitalize on the work-from-home trend. Shares in TeamViewer AG, a German maker of software that facilitates remote working, have climbed 33% this year, while the benchmark DAX Index has fallen 22%. Even at enterprise software giant SAP SE, Chief Executive Officer Christian Klein told Bloomberg News this week he'd love to have a video-conferencing solution in the company's portfolio right now.

Pexip must do a lot to justify its valuation, which prices in a huge increase in earnings over the next few years. It may be telling that many of its investors are using the offering as an opportunity to sell their stakes: The company will have a free float of some 80% of the share capital. Perhaps they're sensing an opportunity to make hay while the sun shines. But if work from home is here to stay, then there will likely be plenty of seats around the (dining room) table.