Highlights

- The Philippine government is hungry for cash to fund massive infrastructure spending

- There are at least three secure savings schemes open to Filipino expats and residents

- These options offer decent returns, generally better than mutual funds/UITFs, especially when markets are down

- These are secure, as they are government-guaranteed investment schemes

They are better than savings and time deposits, for sure. And it is possible to earn Php20,000 ($386) a year by saving Php5,000 ($96) a month.

In some cases, they even outperform unit investment trust funds (UITFs), mutual funds (MFs), and exchange-traded funds (ETFs), especially in a bear market.

They require no day-trading skills. They need no information the market doesn't know yet or already factored into stock prices. More important, the risk of losing is extremely low.

I'm talking about state-guaranteed investment instruments open to Filipinos: Retail Treasury bonds (RTBs), SSS Flexi Fund, Pag-Ibig MP (Modified Program) 2.

Earn $386 a year, from $96 a month

If you're a gainfully employed expat Filipino, there's no better time to realise some decent income on secured schemes. Potentially, it is possible to earn $386 a year, off your $96 a month, over a 10-year period.

These are all within reach. It just requires a bit of discipline — save first, so there's money (not your grocery budget) set aside to build a nest egg.

Here's the low-down on each:

1. Retail Treasury Bonds (RTBs)

What is it?

RTBs are similar to "I-owe-you" checks, or bonds. They are regularly issued by the Bureau of the Treasury (BTr) of the Philippines to cover deficits in the national budget (not enough taxes are collected to fund budgeted government expenses or projects).

The "retail" part is key. It allows small investors, you and me, instead of just the big banks or money managers, to take part in this state borrowing scheme, as a matter of national policy. It encourages saving and spreads the benefits of government bond offers to a wides base.

Benefits:

- Affordable: You can invest for as low as Php5,000, during the public offering

- Short term: You may redeem the instrument after the offer period (five years)

- Government guarantee: They are direct, unconditional and general obligations of the Republic of the Philippines

- Higher Yielding: Better returns than time deposit

- Quarter interest payment: Cash flow to investor is more frequent, as it is paid every quarter. Interest payments will be made quarterly compared to regular Treasury bonds, which are paid every six months.

How can I invest?

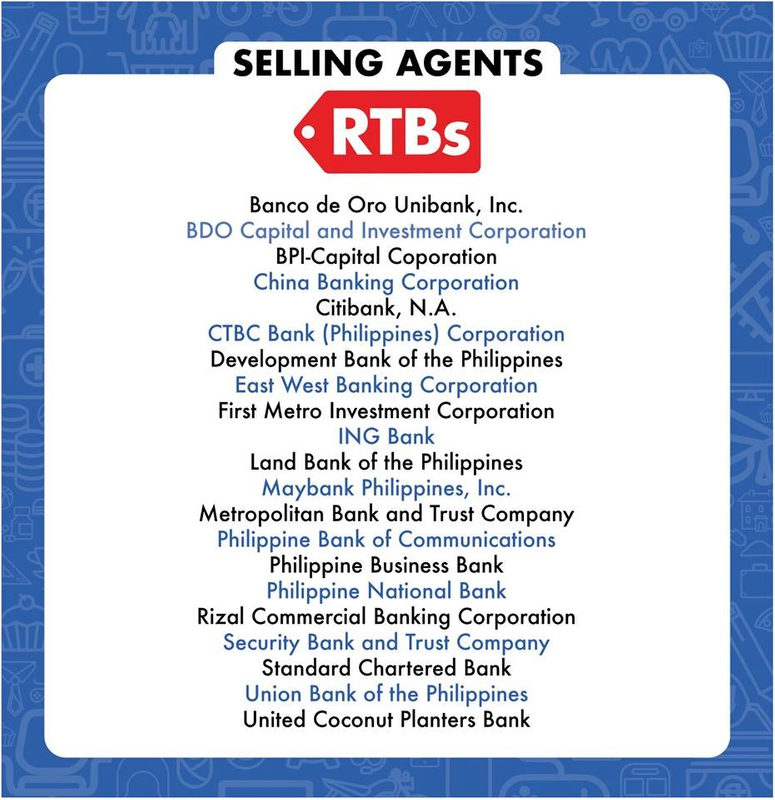

It's really convenient. Make sure you have at least Php5,000 in your bank. If your bank is one of the 21 banks and selling agents appointed by BTr, talk to them (or ask someone you trust to do it for you) before March 8, 2019.

When is the best time to invest?

Public offers from the Bureau of Treasury happen all the time. For example, from February 26, 2019 to March 8, 2019 (issue date on March 12, 2019), the government sold 30-billion-peso ($579 million) RTBs to help augment state funds. If you missed that public offering, prepare for more. The Duterte administration has earmarked $171 billion for "Build-Build-Build" until 2022.

Update: The BTr regularly offers Treasury Bills to the public. For example on April 22, Tuesday, a Php15 billion ($290 million) T-bills offer is up, chunked up into three series — 91-day, 182-day and 364-day bills. Watch out for public notices labelled "RTBs" in regular BTr releases, and talk to your local bank (branch or marketing manager) if they're on the list of selling agents.

Income/interest rate:

6.25%

Tax on earnings:

Yes (20%)

Denomination/minimum investment:

Php5,000 ($96.37) (and additional amounts of Php5,000)

Source: treasury.gov.ph

SSS Flexi Fund

What is it?

Flexi Fund is the investment scheme offered by the Social Security System (SSS) for Filipinos who are active members of the system, under the age of 60. You have to be pay the monthly membership contribution of Php1,760 ($33.92) in order to be eligible to invest in Flexi Fund.

Benefits:

- It's a forced savings at two levels. You, the member, must first pay regular contribution, which guarantees pension upon retirement; then it forces allows you to save more with Flexi Fund

- A Flexi Fund investor guarantees a minimum income of of 4%, plus earnings depending on gains made at the end of a given year.

- In a down market, it is better than privately-run mutual fund, pre-need or investment scheme in terms of guaranteed earnings (your money invested in a trust fund or mutual fund could negative or stay dormant during a down market)

- Capital is more secure than other investment schemes.

Income/Interest rate:

4% (tax free) + annual incentive benefits

Tax on earnings:

No

Denomination/minimum investment:

Php200 ($3.73)

How to sign up with SSS Flexi Fund?

Fill up the and submit your enrollment form at the nearest SSS branch or the SSS office in the Philippine consulate/embassy near you. Bring valid ID, passport, passbook or ATM card of your nominated bank account.

Source: SSS Flexi Fund

Best time to invest:

Anytime. Just visit the SSS branch (if you're already a member) or office within the consulate/embassary nearest you.

Pag-Ibig Modified Program 2 (MP2)

What is it?

It is a savings scheme of members of Pag-Ibig, a government-owned agency, formally known as the Home Mutual Development Fund (HMDF). It's a sort of Pag-Ibig 2.0. If you're an active member and wish to save more, this programme is for you.

Benefits:

- Open to active Pag-Ibig member and former members with source of monthly income and/or pensioners

- A member with an equivalent of 24 monthly savings is eligible to MP2

- Secure, state-guaranteed savings scheme, with higher earnings than time or savings deposits

- Voluntary for Pag-Ibig Members (membership to Pag-Ibig 1 is mandatory for OFWs)

- Minimum monthly deposit of Php500

- If you miss a monthly deposit, your money does not get forfeited, unlike many insurance plans

- No limit to the amount invested

- Higher dividend earnings than the regular Pag-Ibig savings program (dividends are derived from at least 70% of Pag-Ibig Fund's annual net income)

- Tax-free earnings

Denomination/minimum investment:

Php500 (about $10)

Income/Interest rate:

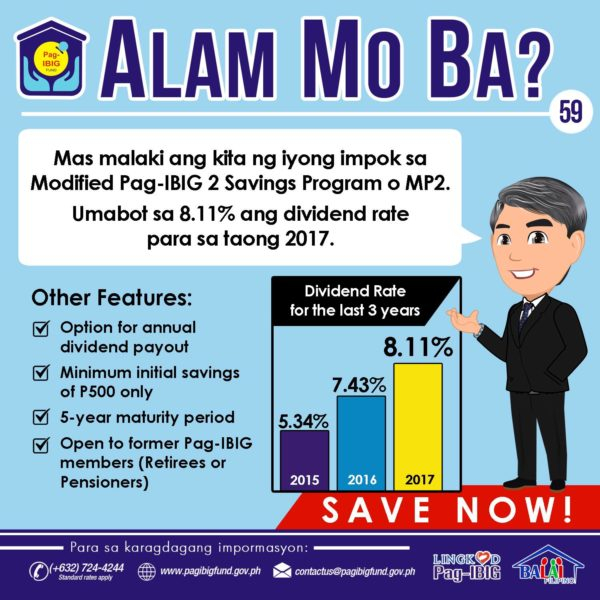

6.96 % annually [based on 5.34 % for 2015; 7.43% for 2016; 8.11% for 2017]

How income/dividends are received

- Upon 5-year maturity, with dividends compounded

- Annually, with MP2 dividends credited to your savings or checking account with accredited banks

- Via cheque payable to the saver (if you no Philippine bank account)

How to sign up?

Fill up and submit your MP2 savings application form at nearest branch or at Pag-Ibig office at the Philippine consulate/embassy near you. Bring valid ID, passport, passbook or ATM card of your nominated bank account.

Based on this published MP2 earnings table, if you save Php5,000 ($96) a month, your money could potentially grow to Php795,000 after a 10-year period, equivalent to a Php195,530 ($3,775) gain after 10 years — or a yearly income of Php19,553 ($386).

When is the best time to invest?

Any time. MP2 posted an average dividend rate of 6.96 per cent per year for the past three (3) years. Most important, earnings are tax-free.

Source: Pag-Ibig MP2

Happy investing, Kabayan.

Disclaimer: These are indicative figures. Deal directly with the concerned institutions to know the risks and rewards that go with every savings option.