World sugar supply still hit by lingering drought

Harvests miss target in several producing countries due to lingering frought

Dubai: The sugar industry is going through stormy times, a leading industry expert said at the sixth Dubai Sugar Conference on Monday.

After two years of surpluses, the sugar market is now in its second deficit year with stocks running low in a number of top producing countries, said Jonathan Kingsman, managing director of consultancy firm Kingsman SA.

Despite the low numbers from sugar producing countries, a leading sugar refinery in the UAE is confident of meeting its supply requirements, particularly from Brazil, which is one of the country's biggest suppliers.

"Brazil is the biggest exporter of raw sugar and we have a long-term contract agreement with them. I think there is no problem in getting our supply from Brazil," said Jamal Al Ghurair, Managing Director of Al Khaleej Sugar Co.

The El Nino weather phenomenon has been blamed for the poor production in Brazil and India, two of the world's top sugar producing countries, as long-range forecast suggests that the situation could linger at least until May, hampering harvest levels.

Expert analysis also points to huge trade flow deficits on both the raw and white sugar markets and this could leave importers with no choice but to bid against each other to secure limited supplies. These deficits are expected to last to at least the fourth quarter of 2010 and even then the market might have to wait for the Indian and northern hemisphere harvests to build up momentum.

Meanwhile, analysts say that even if India's production substantially increases next year, the country will still need to import to replenish its stocks.

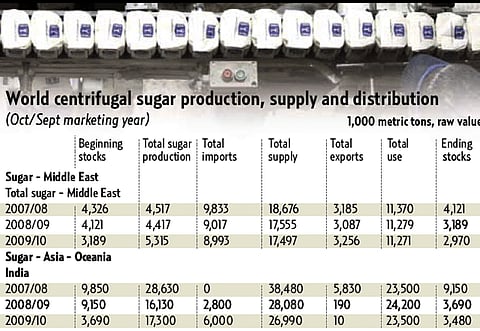

As such, India was expected to be the world's largest net sugar importer in 2009 and 2010 at six million tonnes, according to a United States Department of Agriculture (USDA) report last November.

The report also said that world sugar production for the 2009-2010 marketing year was estimated at 153.3 million tonnes, raw value, down 6.4 million from the May 2009 forecast.

Consumption forecast was at 153.7 million tonnes, down 5.3 million tonnes from the May forecast.

Exports were estimated at 51.2 million tonnes, unchanged from May and ending stocks were estimated at 26.0 million tonnes, down 5.2 million tonnes.