Smart is getting into the kitchen space

These enabled devices can help you count calories and even suggest recipes

San Francisco: On a recent Saturday night, German Salazar made chicken tacos for his friends while they chatted with him in his kitchen. Occasionally, he interrupted the conversation to talk to another friend: Google.

Salazar was speaking to Google Home, the artificially intelligent speaker living on his kitchen counter. “Hey Google, set a timer for 20 minutes,” he said, to activate a countdown for when the chicken would be cooked and ready for shredding.

At first, Salazar’s friends snickered when he talked to the speaker. But everyone began grilling Google Home with questions and requests: “How much did Jamie Lee Curtis make in ‘True Lies’?” and “Tell me a joke.”

For many people, the kitchen is the centre of the home and a locus for interactions that go beyond preparing and eating food. Now tech companies and appliance makers, aiming to deepen their relationships with customers, are increasingly targeting the room that is synonymous with togetherness.

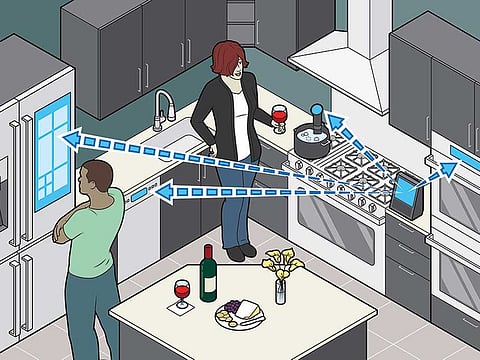

Household brands like Whirlpool, Samsung and Bosch are racing against tech behemoths like Google and Amazon to dominate the kitchen with internet-connected appliances and cooking gadgets that include refrigerators embedded with touchscreens, smart dishwashers and connected countertop screens with artificially intelligent assistants that react to spoken commands.

Yet the “smart kitchen” remains a tough sell. With the kitchen often a hub for families and friends, habits there can be hard to change. And many people see the kitchen and mealtimes as a haven from their otherwise always-connected lifestyle.

Only 5 per cent of US households own smart appliances today, up from 3 per cent in 2014, according to the research firm Parks Associates.

“Will we see a reinvention of the kitchen like we saw in the living room?” said Michael Wolf, a tech analyst who hosts a podcast and a conference about the smart kitchen. “I don’t think it will happen overnight. There’s going to be a lot of scepticism.”

Apart from their fears of disrupting the rhythms and patterns in the heart of the home, people may be hesitant to incorporate smart devices into their kitchens because of the costs of maintaining such appliances, which are often difficult to repair and use expensive components like touchscreens.

They also may worry about longevity: A touchscreen refrigerator may look modern today, but who knows how dated it may appear in five years?

And with many smart kitchen appliances incorporating internet connections, cameras or microphones, digital privacy has become a concern. Security researchers said that one problem with smart appliances is that, unlike tech companies, household brands lack the cybersecurity expertise to vet products for vulnerabilities.

Julie Kim-Whinston had some of those misgivings when she renovated her San Francisco home recently. For the revamped kitchen, she bought appliances from Wolf, Viking and Bosch — all lacking big screens, virtual assistants or internet connections. Kim-Whinston, a consultant in outerwear and sportswear, said she found smart appliances unappealing because the tech components could quickly go obsolete.

The kitchen and the dining area are also where she, her husband and their two sons, ages 5 and 7, congregate and converse, she said. She said she did not want her children to be exposed to a refrigerator with a big touchscreen.

“Knowing how addictive their personalities are, they would literally stare at the refrigerator screen hoping for something to come up,” she said. “They’d be touching it and moving it, hoping it’s a video game.”

But the potential payoff for manufacturers makes the kitchen an enticing target. The global kitchen appliances market is expected to balloon to $253.4 billion by 2020, up from about $175 billion in 2014, according to Allied Market Research.

That has companies spreading their tech tentacles into kitchens with a variety of approaches. Samsung, the No. 1 phone maker that popularised smartphones with extra-large screens, unveiled a new version of Family Hub, a smart refrigerator that understands voice commands and sports a 21.5-inch touchscreen.

The appliance has three built-in cameras, which can beam live images of the fridge’s contents to a phone.

Samsung bills the fridge as the next control centre for a home — albeit a pricey one. Family Hub refrigerators start at about $3,500.

“We’d really like consumers, at some point of time, to look back and say, ‘These days, a refrigerator without a screen feels awkward,’” said Sunggy Koo, Samsung’s vice-president for smart appliances.

Samsung’s aim is for people to someday conduct their digital lives with equal ease from a fridge, a phone, a television or a car. Fed by data about you in the cloud — and with the help of a virtual assistant — all of the machines will operate in perfect synchrony to enable a maximally efficient domestic life.

For now, Amazon and Google are having some of the most notable successes in the kitchen, even though their devices are not specific to that room. Many people use Amazon’s Echo speaker or Google Home, both of which are embedded with the companies’ smart virtual assistants, for setting kitchen timers or looking up recipes.

—New York Times News Service