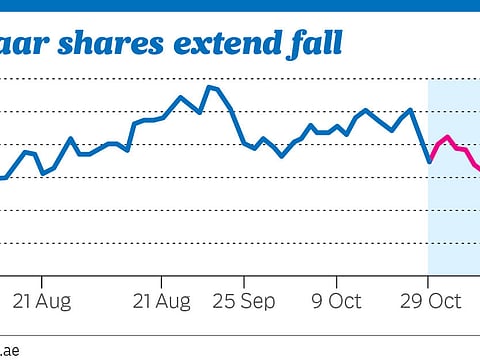

Dubai index posts sharpest daily fall in 2017, Emaar Properties worst hit

Gulf traders shun risk as Emaar falls to a near 5-month low

Dubai

Dubai index on Wednesday witnessed sharpest daily fall in 2017, leading regional losses amid geopolitical uncertainty even as Emaar Properties was worst hit, falling to its lowest level in nearly 5 months.

The Dubai Financial Market General Index closed 1.89 per cent lower at 3,414.92, the sharpest fall in 2017. The Abu Dhabi Securities Exchange index closed 1.14 per cent lower at 4,369.06.

“Market sentiment has been adversely affected, with investors clearly shunning regional equity market risk in their portfolios. Market liquidity has been drained in the ensuing sell off, its been red across the board,” Farid Samji, a Dubai-based market strategist said.

“There has clearly been a spike in the geopolitical uncertainty in the region, the recent Emaar Development IPO has sapped whatever scant liquidity there was in the system and tighter controls of margin accounts at brokerages have all contributed to the sell-off,” Samji said.

Emaar Properties has fallen 13.7 per cent from a high of Dh8.81 seen on October 22 ahead of its unit IPO. The rally seen for the past four months was wiped off in only 14 trading sessions. Emaar Properties hit a low of Dh7.60, the lowest level since June 12.

Gulf Finance House closed 5.41 per cent lower at Dh1.40. “Traders may look to sell Gulf Finance House on a rally, and the stock may hit Dh1.30 in the medium term,” said Shiv Prakash, senior analyst with National Bank of Abu Dhabi Securities in a note.

Damac Properties, which closed more than 4 per cent lower at Dh3.42, may fall to Dh3.15 in the near-term, said Prakash. Drake and Scull closed more than 5 per cent to end at Dh1.70.

Passing clouds

“We have been here before, and in my view these are passing clouds and as we approach the year-end, attractive valuations and growth stories will surface over the next few weeks and these clouds will clear,” Samji said.

The Dubai index has been on downward trend since last five trading sessions, and has shed 6 per cent of its value. The index has been trading below the 100-day or 200-day moving averages, indicating medium term bearishness.

“Any recovery if seen may attract renewed selling pressure from higher resistance levels. Traders should look to sell on rally and buy back from lower support levels,” Shiv Prakash, senior analyst with National Bank of Abu Dhabi Securities said in a note.

In other stocks, Etisalat closed 1.43 per cent lower at Dh17.20. First Abu Dhabi Bank closed 1.45 per cent lower at Dh10.20. Aldar closed 2.19 per cent lower at Dh2.23.

Elsewhere in the Gulf, Tadawul index was 0.7 per cent lower at 6,878.74. The Qatar Exchange index closed flat at 7,930.78. The Muscat MSM 30 index closed 0.93 per cent lower at 5,031.16.