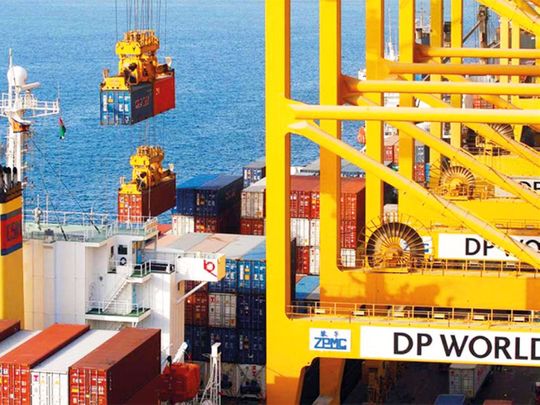

Dubai: Dubai's DP World had revenues of $4 billion plus in the first six months of 2020, representing a 17.7 per cent gain over last year. The increases were brought on by recent acquisitions the ports operator had across global hubs.

But on a like-for-like basis, revenues were down 11.6 per cent, and down by 3.4 per cent when excluding the land sale to Emaar land sale last year. But at a time when global trade and supply chains are only limping back to normal, DP World’s first-half profits for 2020 are down 55.7 per cent to $333 million from $753 million.

In terms of throughput, the Dubai entity handled 33.89 million tonnes, down 5.3 per cent from first-half 2019. Cash from operating activities "remains strong" at $112 billion against $1.04 billion a year ago.

_resources1_16a30b35423_author.jpg)

We have focused our efforts on digitizing logistics and developed solutions for several verticals including the automotive, oil and gas and FMCG industries

More buys

On Wednesday, Unifeeder announced the purchase of Transworld Feeders, Avana Logistek (including its subsidiary Avana Global FZCO), and Transworld Feeders Pvt. Ltd. (the containerized Indian coastal and EX-IM feeder shipping operations of Shreyas Shipping and Logistics, excluding vessels and bulk operations)

This was done through the Unifeeder ISC platform, a majority owned subsidiary of DP World Ltd.

Transworld Feeders FZCO and Avana Global are independent feeder and NVOCC (non-vessel operating common carriers) operators, offering container feedering services and regional trade solutions connecting a range of ports in the Middle East, the Subcontinent and Far East.

The hub port at Jebel Ali (UAE) plays a pivotal role for a large part of the services.

We are encouraged that our business has performed better than expected given the pandemic and, while the outlook is still uncertain, we remain positive on the medium to long-term fundamentals of the industry

Cash-rich

On the operating side, DP World's cash from operating activities "remains strong" at $1.12 billion as of end June, against $1.04 billion same time last year.

“The COVID-19 outbreak has undoubtedly resulted in one of the most challenging periods in the history of our industry," said Sultan Ahmed Bin Sulayem, Chairman and CEO. "Our gross volumes have declined by 3.9 per cent, which compares favourably against an estimated industry decline of 10 per cent.

"This outperformance once again demonstrates that we are in the right locations and a focus on origin and destination cargo will continue to deliver the right balance between growth and resilience."