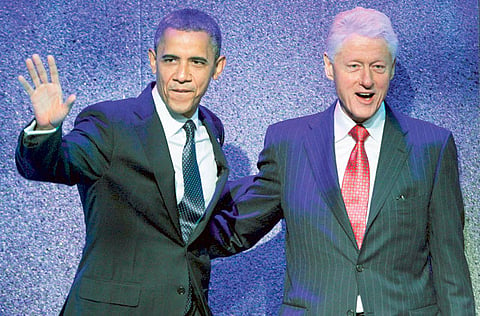

Barack Obama emulating Bill Clinton with 2013 data

Policy parallels suggest better economic times may lie ahead

A newly-elected Democratic president pushes a controversial tax increase through Congress without a single Republican vote. A veteran Federal Reserve chairman holds short-term interest rates at record lows. And the economy struggles to recover from a financial crisis.

2013? No, 1993, when Bill Clinton was president, Alan Greenspan headed the central bank and the US was coping with the savings and loan collapse. The parallels between then and now, particularly on the policy front, suggest better economic times may lie ahead.

“We had tight fiscal and easy-money policies in the 1990s, and we had the longest peace-time expansion,” said Allen Sinai, chief executive officer of Decision Economics Inc. in New York. “Now that same sort of combination may give us stronger growth and another three to five years” of expansion.

The magnitudes are different: The budget deficit is bigger and interest rates are lower, as President Barack Obama and Fed Chairman Ben S. Bernanke were forced to respond to the worst contraction since the Great Depression. That slump was more than three times as deep and lasted more than twice as long as the eight-month recession that preceded Clinton’s tenure.

The policy mix 20 years ago proved to be a tonic for the financial markets. The Standard & Poor’s 500 Index of stocks more than tripled from 1993 to a peak of 1,527 in 2000.

While bond yields rose in 1994 as the Fed increased the federal funds rate from a then-record-low 3 percent, yields subsequently tumbled as the central bank eased policy for much of the rest of the decade. And the dollar ended 2000 more than 15 percent stronger than at the start of 1993 against a basket of major currencies.

Something Similar

Something similar could be in store this time, provided the economy keeps growing.

“If this cycle can extend out three or more years, the S&P has a solid chance of reaching a new all-time high in real terms,” Michael Darda, chief economist at MKM Partners LLC in Stamford, Connecticut, said in an April 2 e-mail to clients. That would push the index over 2,000, he added.

While the stock gauge fell 0.4 per cent to 1,553.28 on April 5 following news of a smaller-than-forecast rise in payrolls, it is still 9 per cent higher than at the start of the year, in spite of higher taxes and reduced government spending.

Investors have been “looking beyond the braking effect” of those steps on the economy and taking comfort from the Fed’s accommodative actions, said Michael Holland, chairman and founder of New York-based Holland & Co., which oversees more than $4 billion (Dh14.7 billion). “There are some reverberations of things that were going on in the 1990s in the mix of the two” policies.

Obama-Congress Squabbles

Squabbling over the budget between Obama and congressional Republicans has resulted in real savings — as budget squabbles did 20 years ago.

“It’s not been a pretty process,” said Roberto Perli, a former Fed official who is now a managing director at International Strategy & Investment Group LLC in Washington. “But we have accomplished something. And the market internalises that.”

The Congressional Budget Office forecasts that discretionary expenditures by the federal government will decline to 6.4 per cent of the economy in 2016 from 8.9 per cent in 2009, when Obama first took office. Military spending is projected to fall to 3.3 per cent from 4.7 per cent, helped by the end of the wars in Iraq and Afghanistan.

Budget Surplus

While the policy mix now echoes that of the 1990s, the orders of magnitude are different. The confrontation between Clinton and House Speaker Newt Gingrich eventually resulted in a budget surplus for fiscal 1998, the first in 29 years.

“Today you’re going from a huge deficit to a still-large deficit,” Perli said. “But the direction is similar.”

The shortfall will drop to $476 billion in 2016 from a record $1.4 trillion in 2009, according to the CBO.

Monetary policy, too, is on a different scale: It’s “much more radical,” said John Makin, a resident scholar at the American Enterprise Institute in Washington and a senior adviser to Cornwall Capital Inc.

The Fed cut the target for the fed funds rate to near zero in December 2008, and in December 2012 pledged to keep it there as long as unemployment exceeds 6.5 per cent and projected inflation isn’t more than 2.5 per cent — the first time policy makers linked the benchmark borrowing cost to economic indicators.

Eight-Month Recession

The economy also is in a much different place. When Clinton assumed the presidency in 1993, the US already was recovering from the 1990-91 recession, which took 1.4 per cent off GDP. The high for the unemployment rate was 7.8 per cent, in 1992, and during his two terms, it averaged 5.2 per cent.

When Obama became president in January 2009, the US was still in the midst of an 18-month recession that didn’t end until June. By that time, it had lopped 4.7 per cent off GDP. Unemployment rose to a 26-year high of 10 per cent that year. It was 7.6 per cent last month.

To help the labour market heal faster, Robert Rubin suggests twinning a “moderate upfront stimulus” with the same kind of budget-balancing strategy he championed in the 1990s as Clinton’s Treasury secretary. Such an approach would embolden companies to hire more workers, in part by restoring executives’ faith in the government’s ability to corral the deficit, he told a March 13 conference convened by The Atlantic magazine.

Discretionary Squeeze

“It’s the opposite of what we’ve done,” said Rubin, who is now co-chairman of the Council on Foreign Relations in New York. He criticised as “counter-productive” the squeeze on discretionary spending, saying it would deprive the economy of needed public investment.

Federal Reserve Bank of New York President William C. Dudley also took issue with the size of fiscal restraint, arguing that it’s putting an unnecessarily large drag of about 1.75 per cent of GDP on the economy this year.

This is “an unfortunate outcome,” he told the Economic Club of New York on March 25.

The result, said Priya Misra, head of US rates strategy at Bank of America Merrill Lynch in New York, is that monetary policy will have to “stay easy, longer,” to offset the restrictive fiscal posture.

That will be good for the economy in the longer term, Sinai said. He sees growth strengthening to 2.7 per cent this year on a fourth quarter over fourth quarter basis, from 1.7 per cent in 2012. Next year, it will hit 3 per cent to 3.5 per cent, he said.

Economic Footprint

The government’s smaller economic footprint gives the more productive private sector additional room to grow, Sinai said. Low borrowing costs encourage companies to invest and expand, helping to lift the economy’s potential.

“The private sector benefits more over the long run from easy money than it is hurt by tighter fiscal policy,” he said.

United Technologies Corp., maker of Pratt & Whitney jet engines and Otis elevators, predicts the expansion will remain intact, even though cuts in US military spending may trim the Hartford, Connecticut-based company’s profits.

“The US economy is better, and it is going to continue to get better,” chief financial officer Gregory Hayes said at a March 14 analyst meeting. “We’ve got another year-and-a-half or so probably of low interest-rate environment, which we could hope to capitalise on.”

The unconventional nature of monetary policy — in particular the Fed’s use of asset purchases to influence long-term interest rates — opens up another avenue for it to dovetail with the budget, according to David Ader, head of US government-bond strategy at CRT Capital Group LLC in Stamford, Connecticut.

As the Fed cuts back on its purchases of Treasuries, the federal government will be reducing its issuance of such securities in line with a declining deficit.

“It’s not going to be one for one,” Ader said. “But the market will be surprised by how balanced it will be.”

- Bloomberg