Dubai: UAE residents’ comfort factor with robots is getting stronger by the year – a good majority are now OK with robots helping them out on personal finances.

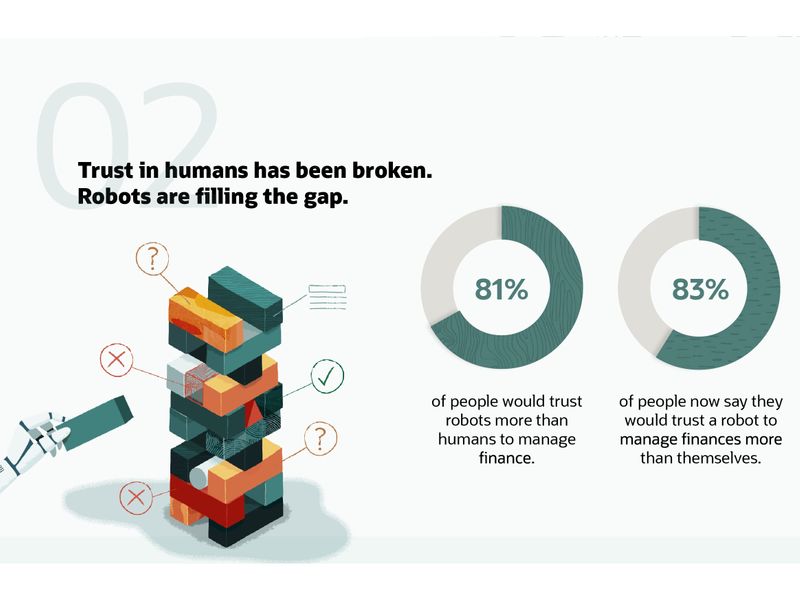

That’s right - 70 per cent of consumers and business owners are willing to trust a robot more than a human to manage finances. With business heads, the feeling of trust is even more intense - 79 per cent will go by what a robot says than trust themselves to manage their funds. And 81 per cent now trust robots over their own finance teams, as per new findings from Oracle, the Silicon Valley giant.

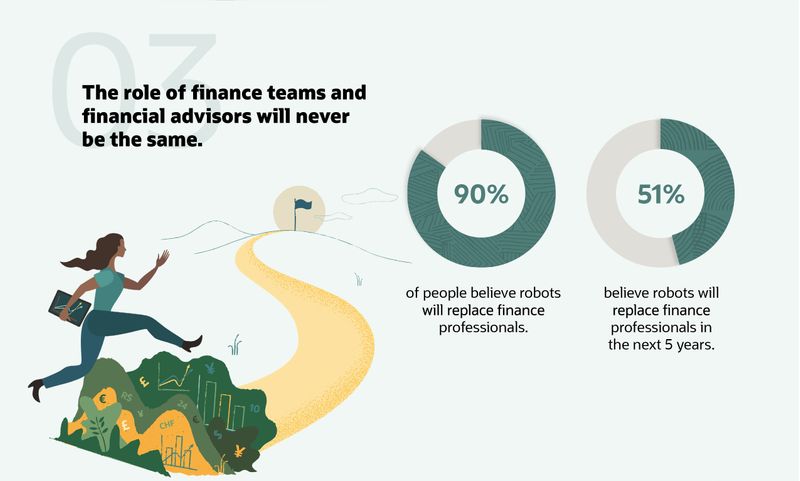

The global study polled 9,000 consumers and business leaders in 14 countries, including in the UAE. The response was that COVID-19 has increased financial anxiety, sadness, and fear and "changed who and what we trust to manage our finances". They are also "rethinking the role and focus of corporate finance teams and personal financial advisors...".

What explains all this growing feeling of security with machines? Has the ‘Year of COVID-19’ forced individuals to think different?

According to a senior official at Oracle, robots are just another way of going with digital. “Financial processes in our personal and professional worlds have become increasingly digital for years - the events of 2020 accelerated that trend,” said Juergen Lindner, Senior Vice-President, Global Marketing. “Digital is the new normal and technologies such as artificial intelligence and chatbots play a vital role in managing finance.

“Our research indicates that consumers trust these technologies to accelerate their financial well-being over personal financial advisors and business leaders see this trend reshaping the role of corporate finance professionals.”

A pattern in play

Similar research by Oracle in the last two years emphasise this. First, respondents said they were fine with seeing more robots at their workplaces, and last year, the feedback from respondents was that these machines seem to offer better help in tackling matters of the mind.

From there to placing more trust in robots to help with the finances is a small step.

Because 76 per cent of consumers believe robots can help with managing finances by assisting to detect fraud (37 per cent); reduce spending (24 per cent); and make stock market investments (21 per cent). (On the last point, it’s already happening given the app-created investing frenzy that’s happening in the US, led by Reddit and Robinhood.)

“Managing finances is tough at the best of times, and the financial uncertainty of the global pandemic has exacerbated financial challenges at home and at work,” said Farnoosh Torabi, host of the So Money podcast.

“Robots are well-positioned to assist – they are great with numbers and don’t have the same emotional connection with money. This doesn’t mean finance professionals are going away or being replaced entirely, but the research suggests they should focus on developing additional soft skills as their role evolves.”

- 87% of consumers say the pandemic has changed the way they buy goods and services.

- 90% say the events of 2020 have changed how they feel about handling cash, with people feeling anxious (36%); fearful (28%); and dirty (19%). More than a quarter say that cash-only is a deal-breaker for doing business.

- Businesses have been quick to respond as 83% of business leaders have invested in digital payment capabilities and 68% have created new forms of customer engagement or changed their business models in response to COVID-19.

- 63% of organizations are already using AI to manage financial processes.

- 96% of business leaders say organizations that don’t rethink financial processes face risks, including falling behind competitors (55%); more stressed workers (47%); inaccurate reporting (41%); and reduced employee productivity (42%).