After UPI, India’s Reserve Bank will now launch unified lending interface for speedy credit access

ULI aims to speed up appraisals for rural borrowers and simplify technical integration

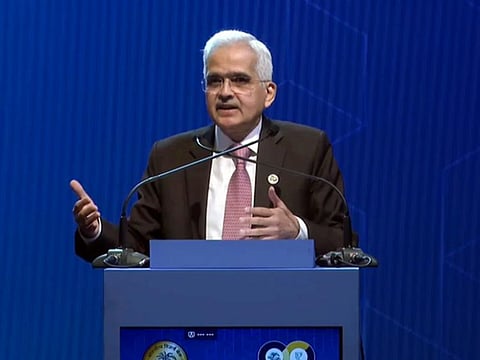

Bengaluru: The technology platform for providing ‘frictionless credit’ launched by the Reserve Bank of India (RBI) last year as a pilot project will be introduced nationwide soon, Reserve Banks of India Governor Shaktikanta Das announced Monday.

This technology platform, the Unified Lending Interface (ULI), facilitates a seamless, consent-based flow of digital information, including land records of various states, from multiple data service providers to lenders.

Das said the technology platform introduced last year as a pilot project cuts down the time taken for credit appraisal, especially for small and rural borrowers.

He announced this while speaking in Bengaluru at the event of the Global Conference on Digital Public Infrastructure and Emerging Technologies.

Governor Das said, “Just like UPI transformed the payments ecosystem, we expect that ULI will play a similar role in transforming the lending space in India. The ‘new trinity’ of JAM-UPI-ULI will be a revolutionary step forward in India’s digital infrastructure journey.”

Das stated that the ULI architecture has common and standardised APIs designed for a ‘plug and play’ approach to ensure digital access to information from diverse sources.

“This reduces the complexity of multiple technical integrations. It enables borrowers to benefit from seamless credit delivery and quicker turnaround time without requiring extensive documentation,” the RBI Governor said.

“By digitising access to customer’s financial and non-financial data that otherwise resided in disparate silos, ULI is expected to cater to large unmet demand for credit across various sectors, particularly for agricultural and MSME borrowers,” he stated.

Showing confidence in the newly launched ULI, Das said, “Just like UPI transformed the payments ecosystem, “we expect that ULI will play a similar role in transforming the lending space in India.”

Das remarked that the ‘new trinity’ of JAM-UPI-ULI will be a revolutionary step forward in India’s digital infrastructure journey.

Speaking about the success of the Unified Payment Interface (UPI), Das said, “The current ecosystem of digital payments in India offers a bouquet of simple, safe, and secure options for instant or quick transfer of funds, both large and small value, for businesses and individuals.”

Das further stated that the apex bank consistently tries to secure the country's financial system.

“We are constantly working on devising policies, approaches, systems and platforms that will make our financial sector stronger, nimble and customer-centric,” Das said.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox