It is becoming clear that a multipolar word order is taking shape and the process will accelerate after the Russia-Ukraine conflict. The nucleus of this multipolar order started in the recent years due to radical changes in global economic relationships and which is a complete revision of the power alliances after the Second World War.

So, what are the radical differences between the present and the past? Earlier, the struggle between two superpowers - the US and the Soviet Union - was limited to military and geopolitical aspects, but did not include the geo-economic. Even though it was centred around two competing economic systems - the first of which was capitalism with absolute US hegemony. Capitalism emerged stronger due to the US financial power that dominated important organisations such as the International Monetary Fund (IMF) and the World Bank (WB).

The second one was socialism, a populist system that was unable to leverage all its available wealth and economic capabilities because of the nature of public ownership that hindered the creation of sustainable economic structures. Therefore, it was a marginal system in economic terms, despite its military power and major geopolitical influence.

A reshaping of influence

Now, the world is into this multipolar rearrangement of influence. China and Russia form two sides of the triangle shaping this system besides the US. All have fully integrated capitalism’s financial and economic ways. What we have is a sole capitalist way of economic growth, including the one operated by China, which is ruled by the Communist Party. This clearly means the multipolar order has added a third prong to the military and geopolitical aspects.

Here lies the most serious threat to the former US financial domination, posed particularly by the Chinese dragon, which has created technological, financial and economic institutions that compete on equal terms against their American counterparts. This status was never attained by the former Soviet Union, which was exhausted by the arms race because of its poor economic infrastructure. This is what Russia is now trying to avoid, and has made a significant progress.

In contrast to American tech giants, Chinese companies have churned out their products and services at competitive prices and managed to sweep through the developing world, and even into developed economies such as Germany and Britain.

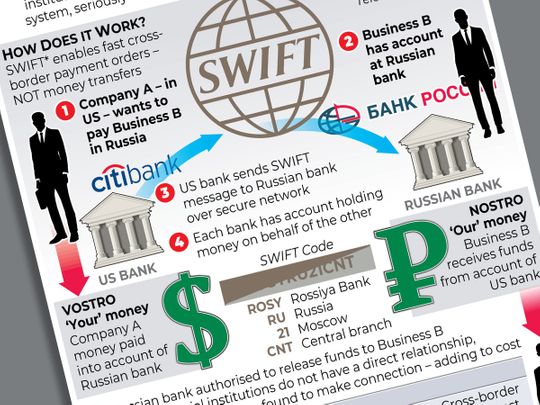

This is why Washington applied pressure on the UK to rebuff the Huawei agreement under the pretext of national security. On monetary and financial transactions, as opposed to the US CHIPS system, China created its own cross-border Interbank Payment System (CIPS) to boost the use of its yuan currency in international transactions. It thus provided an alternative to the US version and even to the more widely used SWIFT system - the worldwide interbank financial communication – based out of Belgium.

Breaking up a monopoly

These developments mean that for the first time there will be two global financial systems through which funds can be transferred, rather than one system controlled by one power using its own currency. In other words, there will be an erosion of its earlier dominance.

Obviously, Russia is trying now to benefit from China's CIPS system after it was cut off from the SWIFT system, as it was one of its key users following the US. This reflects the significance of the Russian economy.

Except Russia, other economically and financially important countries, such as India, have expressed their willingness to use China's financial system, despite their strained relations with China caused by border disputes. This has not prevented the search for alternatives in the new multipolar global order. However, widespread use of the Chinese financial system will take time.

Accordingly, the immediate future will see a reshaping of powers of influence between two powers, of which one is regressing while the other makes strong progressing. This will have a positive impact on international financial and commercial transactions thanks to the breaking of the monopoly and the availability of alternatives.