Global luxury goods sector catches a cold

Virus scare will force China’s wealthy to curb spending on brands and bling

London: For a while there, the major luxury companies appeared to be impervious to hard times in Asia. Even as prolonged unrest in Hong Kong hurt sales, and trade talks between the US and China ground on, their stocks kept climbing.

That changed this week as fears grow about the spread of a deadly virus in China. With China restricting travel for 40 million people on the eve of Lunar New Year, the question of what it all means for demand for high-end watches and handbags is obviously of minor concern.

Yet it’s an unwanted reminder of just how dependent the industry is on Chinese consumers. Shoppers from the world’s most populous nation, probably accounted for about 35 per cent of global luxury goods sales last year, according to Bain & Co. and Altagamma. What’s more, they generated the lion’s share — 90 per cent — of all growth.

There’s no reason to think they won’t be just as crucial to the sector’s performance this year too. One analyst, Flavio Cereda at Jefferies, says he expects the bulk of his estimated 5 per cent sales growth (excluding currency movements) in 2020 global luxury sales to come from the Chinese, putting their expected impact at 4 percentage points.

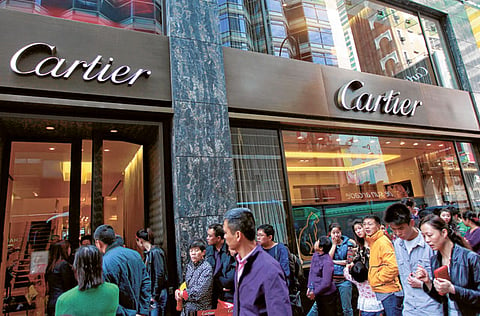

Some companies in particular, including Burberry Group Plc and watchmakers Swatch Group AG and Cartier-owner Richemont, have an exposure above the industry average.

More pressing concerns

It’s too early to say what will be the impact of this new coronavirus that’s gripping China as hundreds of millions of people travel for the Lunar New Year — traditionally a time when revellers spend on goods from the top luxury brands. On Friday, the World Health Organisation stopped short of calling it a global health emergency.

After first appearing in the central Chinese city of Wuhan, it has spread to locations including Singapore, Hong Kong, Thailand and the US. Chinese authorities have been working to revise or cancel planned holiday activities in an attempt to stop any further spreading.

If the crisis intensifies, it could become more problematic. People wanting to avoid the risk of catching the virus will likely curtail anything but the most necessary travel, and avoid crowded areas, with shopping malls among them. That will hurt companies that managed to make up some lost Hong Kong sales at their stores in mainland China.

No Chinese buyer influx

It will also hit sales to Chinese tourists the world over. Although Hong Kong and Macau, which has cancelled all of its Lunar New Year festivities, remain the most popular destination for Chinese travellers, Japan, the US, Italy and France are also high on their itineraries. Chinese tourists are the highest spenders across most of Europe, according to payments provider Planet, typically splashing out for goods worth about four times that of domestic shoppers.

In the US, a number of retailers, including diamond jewellery specialist Tiffany & Co., have already said they’ve been impacted by having fewer tourists due to the dollar’s strength.

Even though Chinese shoppers have recently been spending more at home, as excursions to Hong Kong fall, they still make the bulk of their purchases when they travel, a time when people are more inclined to blow the budget on impulse buys.

Any slowdown in international travel would also hit demand in duty-free shops, including luxury behemoth LVMH’s DFS business and Dufry AG, in which Richemont has a 5 per cent stake.

There’s also a broader risk to spending at home and abroad. Luxury thrives when consumers feel happy and wealthy, not when people fears for their health, and that of friends and family.

And if the virus has any knock-on effects on the Chinese economy, that would cause ripple effects elsewhere as well. The situation is bringing back memories from 17 years ago when the severe acute respiratory syndrome, or SARS, killed about 800 people.

At the time, Chinese shoppers probably accounted for about 10-15 per cent of global luxury sales.