London: Opec and its allies gathered for a third successive day of meetings in Vienna to give the final sign-off to an oil-production increase.

Major producers outside the Organisation of Petroleum Exporting Countries — including Russia, Mexico and Kazakhstan — will meet ministers from the cartel on Saturday to endorse a nominal output increase of 1 million barrels a day, which in real terms would add about 700,000 barrels a day of crude to the market starting next month.

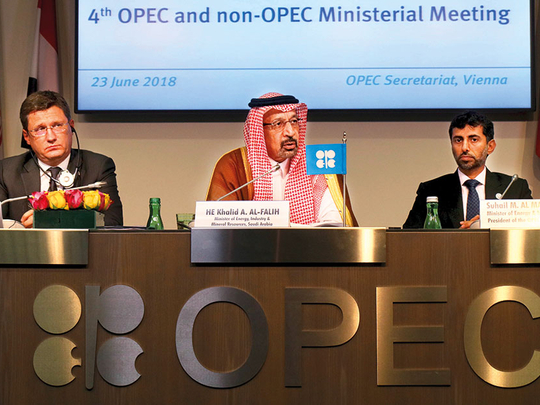

The non-members have already agreed to ratify the deal, which was sealed on Friday after a last-minute compromise between Saudi Arabia and Iran, said delegates. Talks in the Austrian capital will focus on how to distribute the increase among each nation, they said, asking not to be identified because the agreement hasn’t yet been formalised.

“I think 1 million at this point is pretty reasonable,” Russian Energy Minister Alexander Novak told reporters in Vienna. “This is in line with current view on what should be done for the market.”

Friday’s agreement was a fudge in the time-honoured tradition of Opec, committing to boost output without saying which countries would increase or by how much. It gives Saudi Arabia and Russia — holders of the largest spare capacity in the group — the flexibility to respond to disruptions and moderate prices at a time when US sanctions on Iran and Venezuela threaten to throw the oil market into turmoil.

The terms of the deal were rather convoluted. The group’s agreed production increase of 1 million barrels a day was described as “nominal” by Saudi Energy Minister Khalid Al Falih. In reality, the accord will add a smaller amount of oil to the market because a number of countries are unable to raise their output.

Every minister seemed to have his own interpretation of what this meant for the market. Iran saw no more than 500,000 additional barrels a day, Nigeria predicted 700,000 and Iraq said it could be as much as 800,000. The official communique from the meeting didn’t mention any specific production numbers, instead pledging that the group would focus on restoring its output cuts to the level originally agreed in 2016.

Predictions

Some traders were far from confident that such an agreement will meet the multiple challenges Opec faces. The situation in Venezuela is volatile, with a wide range of predictions of how much further its production could slump as its industry unravels. There are also growing signs that the renewed US sanctions on Iran could have a larger impact than the 1 million-barrel-a-day reduction in exports seen in 2012.

Iran doesn’t believe its customers will get waivers from the US government that would allow them to continue crude purchases, Oil Minister Bijan Namdar Zanganeh said in a Bloomberg Television interview on Friday. American officials are said to have asked Japan to completely halt oil imports from Iran, going beyond the cuts demanded during the Obama-era sanctions.

Crude prices surged on Friday following the vaguely worded Opec agreement. West Texas Intermediate crude jumped 4.6 per cent to $68.58 a barrel, the biggest gain in six months.

US. President Donald Trump, whose tweets played a part in prompting Saudi Arabia to push for a production increase, indicated on Friday that he’ll be watching the progress of their new agreement closely.

“Hope Opec will increase output substantially,” Trump said on Twitter. “Need to keep prices down!”