The past two years (2016 and 2017) have been particularly important for the region as they have enabled regional governments to take some bold decisions to align with the low oil price environment. Additionally, regional governments focused on fiscal consolidation through subsidy cuts and by curtailing public spending, in addition to introducing alternative measures to boost government receipts. This strategy has been widely applauded by the international community, which is now expecting the region to reap the benefits of measures taken during the period. The budget announcements are also further testimony that the authorities are in a much better position for expansionary budgets to support the broader economies and stage a much anticipated recovery. This has been further supported by the recent surge in oil prices, which will not only boost economic activity but also gradually help in increasing government spending but in a structured manner.

In 2017, the consistent improvement in global growth and the on-going market rebalancing led to an impressive recovery in the oil prices. The average price of Brent in 2017 was $54.80 (Dh201.28) per barrel compared to $45.10 in 2016, an increase of 21.7 per cent during the year. This trend has been in effect from the start of 2018 but the reasons for such sharp increase differ from those in 2017, which reasons prices to a high of $80 in mid-May from the lows of the high $20s seen in early 2016.

The two main reasons are the US decision to withdraw from Iran’s nuclear deal and the political and economic instability in Venezuela. This impressive run up in oil prices is making oil producers increasingly optimistic about future prices. However, it also means that it becomes more viable for US oil companies to increase production going forward.

Hence, the sustainability of current oil prices is questionable, which might be the reason for the region to remain focused on their long-term plans and alternatives measures to boost economic activity.

Although the oil price recovery is expected to give impetus to the government’s spending plans and boost economic activity going forward, it is unlikely to trigger an economic boom similar to the ones witnessed during 2008 and the 2012-13 periods. This is because in the past regional governments were not exposed to an extended period of depressed oil prices.

Conscious effort

Further, regional governments have made a conscious effort to embrace the new reality and accordingly took this as an opportunity to take bold steps to shore up government receipts through alternative streams. As a result, the region is unlikely to go on a spending spree and take a more calculated approach to increasing spending plans going forward.

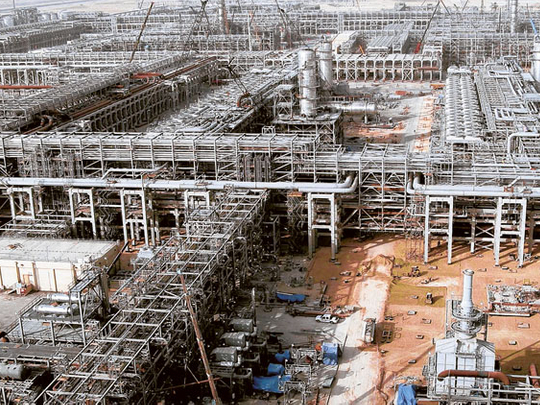

For example, the trend in the GCC’s construction sector suggests that the growth has been more or less aligned with regional economies. According to Ventures Onsite, contractor awards across the region’s building, infrastructure and energy markets are expected to be worth $148.7 billion in 2018, recording only a marginal hike on the 2017 figure ($147.8 billion). Around $79.1 billion worth of construction contractor awards will be attributed to buildings, followed by energy projects ($44.9 billion), and infrastructure ($24.6 billion).

Since oil prices are likely to remain volatile in the near future, the focus of regional authorities is on the non-oil economy, which has depicted impressive growth in the aftermath of oil crisis. According to the International Monetary Fund (IMF), the GDP of oil exporters in the Middle East & North Africa (Mena) region is expected to rise 2.8 per cent in 2018 and 3.3 per cent in 2019, compared to 1.7 per cent in 2017 and 5.4 per cent in 2016.

On the other hand, the GCC’s GDP is expected to rise 1.9 per cent in 2018 and 2.6 per cent in 2019, compared to a contraction of 0.2 per cent last year.

If oil prices are to remain at the current levels and average at around $65 in 2018, Kuwait and the UAE are likely to experience improvements in government net asset positions, while the fiscal strength in Bahrain (minus 11.6 per cent of GDP), Saudi Arabia (minus 7.3 per cent of GDP) and Oman (minus 5.7 per cent of GDP) are expected to continue to erode on the back of accumulation of government debt.

Saudi Arabia, which had projected a budget deficit of 195 billion Saudi riyals ($52 billion; Dh190.7 billion) in 2018 — down from 230 billion riyals last year — posted a deficit of 34.3 billion riyals in the first quarter, around 18 per cent of the total gap forecast for 2018.

The kingdom needs oil prices to average $85-87 this year to balance the state budget by 2023. This effectively means that most of the GCC countries would need to further cut government expenditure or raise non-oil revenues in order to improve their fiscal positions.

In conclusion, the recovery in oil prices will certainly improve the economic outlook of the region and further support the government in gradually increasing the spending plans. However, the current economic scenario is different from the earlier periods of boom as the region has never experienced a prolonged period of low oil prices earlier.

Further, the recent surge in oil prices might not be sustainable as factors that have led to the recent rise might fade out coupled with US companies increasing production, both of which might be a deterrent on prices going forward.

Shailesh Dash is an active entrepreneur and fund manager and has promoted several financial service, health care, retail and logistics companies.