What investors should watch next week: Earnings, tariffs, a test of market momentum

Markets ended the week with a wobble — and coming days could bring more twists

Dubai: After hitting fresh all-time highs, U.S. stocks pulled back slightly on Friday, as renewed tariff threats from Donald Trump rattled investor confidence.

Trump’s talk of a 50% import duty on Brazilian oil and possible blanket tariffs of 15% to 20% on global trade partners spooked markets and lifted the dollar.

Meanwhile, long-term U.S. government bonds slipped further, as fears grew that inflation and fiscal risks may not be fully priced in.

What's moving markets next week?

Investors will have plenty to watch. Here’s what’s on the radar:

1. Earnings season kicks off

All eyes are on major U.S. banks, which will start reporting quarterly earnings. Analysts expect strong trading revenues, but overall second-quarter results may not match the first. Some investors say expectations are low enough that even decent results could boost the market.

2. Tariff tensions remain high

Trade rhetoric is heating up again. While economists say higher tariffs could slow the U.S. economy in the second half of the year, many top stocks in the S&P 500 are seen as protected from direct tariff risk. Still, the uncertainty may drive short-term volatility.

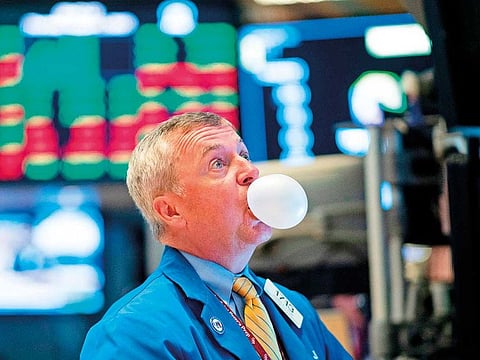

3. Is a pullback brewing?

After five record highs in just nine trading days, some experts warn the market is overbought. With valuations stretched and policy risks growing, a short-term correction isn’t off the table. “The market is ripe for a pullback,” says one strategist.

4. AI spending and investor sentiment

Despite caution, optimism around AI investments remains strong. Investors expect companies to double down on tech spending — a theme that could help support select sectors even if broader markets cool.

Bottom line

Next week could test just how strong the current rally really is. With earnings, tariffs, and inflation in play, investors should prepare for potential swings — but not panic. The bigger picture? A slower path forward, but not necessarily a reversal.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox