UAE's NMC Health staff feel the pressure

Staff morale is getting eroded following NMC CEO Manghat's sacking, share slide and probe

Dubai: The pain is not going away for NMC Health – the staff are facing a bitter loss of morale amidst their CEO getting "unceremoniously" fired and principal shareholders tending their resignations from the Board of Directors, according to highly placed sources in the company.

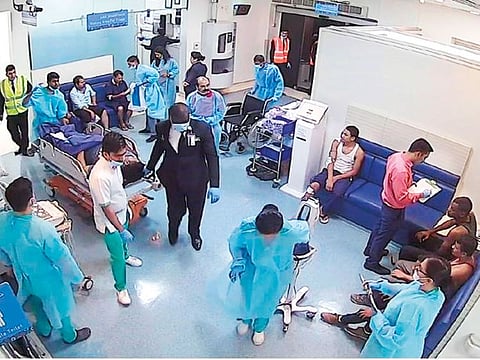

NMC Health, headquartered in Abu Dhabi, is the biggest healthcare operator in the UAE, with its portfolio featuring both hospitals and speciality clinics for fertility and long-term care. It employs around 18,000 people across its network.

Not just that, on Thursday, the London stock market regulator, where NMC Health is listed, launched a “formal enforcement investigation” into the company and the disclosures it has made in the recent past. On the same day, the NMC stock was put under “temporary suspension” at the request of the company, to offset any further price volatility in the coming days. By the looks of it, the next few days and weeks could indeed be stormy.

And it’s also telling on staff morale – “Every day for the last two weeks, we head home thinking the worst is over after some new – embarrassing - disclosures about the shareholders of the company,” said a senior official. “What’s most concerning is that this is happening despite there being nothing wrong in the way NMC is going about its day-to-day work.

Also Read: UAE: NMC Health CEO dismissed

“In the 29 days of this February, we will still have done better than the whole of January – despite the constant problems the company is facing related to its shareholding, etc. We had introduced new medical programmes and doctors at NMC Royal in Abu Dhabi, and these are showing results. At the same time, we integrated our operations in Dubai and leading to increased capacity utilisation and lower costs. These are showing the desired results.

“But in this climate of uncertainty, nothing seems to matter what we do operationally.”

The group treats more than 8 million patients annually.

Highly placed sources said that there have been quite a few resignations of senior staff, including on the management side. This could, in some cases, hamper the ongoing internal investigations, they add. The current CFO, Prashanth Shenoy, has been placed on extended leave.

A formal comment from NMC on ongoing business operations is yet to be issued.

Delayed results

Many had been hoping for the 2019 financial result announcement to bring some much needed cheer. Now, it seems would be delayed to April – “There’s an internal investigation on and they will need to have a look at the audited 2019 financials before any release,” said a source.

The stock, once a high flier on the FTSE 100, had been through extreme volatility owing to "alleged" hedge fund attacks since late last year, falling nearly 70 per cent before inching up in the last two months. It had revenues of $2.1 billion in 2018.

New head to steer fortunes

Thrust into the limelight is Michael Davis, currently serving as Chief Operating Officer, to take on the role of Interim CEO.

“Thankfully, Davis already has inside view of NMC and that would be a big help in the coming days,” said the source. “The only thing that’s missing was involvement in our banking relationships and that will be a priority for him from Day 1.

“He will need to learn all facets as fast as possible; also external consultants, from among the Big 4 firms, could be roped to do the restructure of the company. Davis brings on board enormous experience in such initiatives.”

Fingers crossed

How fast the restructure takes place will depend on the nature of the findings by the internal review. Insiders are braced for more body blows, even as the sacking of the "celebrity" CEO, Prashant Manghat, sinks in.

The review will also need to look at reconstituting the Board of Directors, which was depleted after Dr. B.R. Shetty, the founder, submitted his resignation at the time of the investigation being announced. Dr. Shetty's exit was preceded by that of the vice-chairman, Khalifa Butti Omair Yousif Ahmed Al Muhairi, and two other board members.

“It was then Manghat's turn to exit the Board after his dismissal; so, out of the 11 members, only six are remaining,” said a source at NMC. “We don’t know whether filling the remaining positions is a priority.”

Listing on a high

It was in April 2012 that NMC was listed in the “premium segment” of London Stock Exchange. NMC is a constituent of the FTSE 100 Index, with a market capitalisation of $8 billion plus at its peak.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox