Nvidia Corp.’s wild ride this week is headed for the record books. The world’s third-most-valuable company has added a record $329 billion in value - obliterating the single-day record that it has repeatedly set in the past few months.

The 13 per cent rally comes a day after a 7 per cent rout wiped out more than $193 billion from the now $2.9 trillion company, continuing a run of volatility that makes even notoriously turbulent assets like Bitcoin look stolid.

In July alone, the shares have endured routs that account for four of the eight biggest market cap wipe-outs, according to data compiled by Bloomberg.

The volatility comes as investors grapple with a violent rotation out of high-flying technology shares into left-behind companies that would benefit from Federal Reserve rate cuts. The chipmaker rallied 150 per cent in the first six months of the year before better-than-expected inflation stoked bets that the central bank would cut as soon as September.

Investors pocketed profits rung up on artificial intelligence bets and piled into banks and cyclical companies. The rotation accelerated a week ago, when Alphabet Inc.’s AI spending left investors worried profits would be a long time coming. Those worries eased somewhat after Advanced Micro Devices Inc. gave an upbeat forecast on the back of its AI efforts, prompting a fresh rush back into tech. Enthusiasm for the sector, and Nvidia, accelerated Wednesday after Fed Chair Jerome Powell said an interest-rate cut in September was on the table.

“The volatility in Nvidia shows how confused investors are right now,” said Matt Maley, chief market strategist at Miller Tabak + Co. “They’re worried that the huge capital investment into AI will not create the kind of return on investment that people have been hoping for over the past year.”

The swings are exacerbated by company- and sector-specific events, such as AMD’s results and Microsoft Corp.’s pledge to spend billions more on its AI infrastructure. Macro news, especially around the timing of Fed rate cuts and geopolitical stresses, also drive market-wide moves that engulf even the biggest companies.

“Microsoft’s announcement of increased capital spending, primarily driven by cloud and AI-related demands, fortifies Nvidia’s near-term sales outlook,” said Bloomberg Intelligence analyst Kunjan Sobhani.

Meta Platforms Inc., another big-tech firm spending billions in AI, is slated to report after markets close on Wednesday. The Facebook-owner’s investors are hoping it can do a better job than Microsoft and Alphabet in convincing them that these lofty investments will yield dividends sooner, rather than later.

While large stocks like Microsoft and Apple Inc. have had big stock-market days following significant catalysts, Nvidia is increasingly producing sharp swings on wider sentiments.

Investors “worry that the capital investment story might fade,” Maley said. “However, they also know that NVDA is still doing extremely well and FOMO still plays a role every time the stock bounces after a meaningful decline.”

Nvidia has been on a wild ride recently as investors suddenly rotated out of high-flying technology stocks ahead of an expected Federal Reserve rate cut in September. That reversed on Wednesday after competitor Advanced Micro Devices Inc. gave an upbeat revenue forecast, reflecting strong demand for artificial intelligence. Nvidia shares surged 13 per cent and added a record $329 billion in value, bringing its year-to-date gain to 136 per cent.

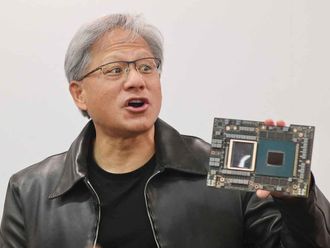

Huang, 61, is the world’s 14th-richest person, just behind Michael Dell. He has been steadily capitalizing on Nvidia’s outperformance, unloading stock as part of a 10b5-1 trading plan. He sold shares worth nearly $169 million in June, the most he’d netted in a single month, as insatiable demand for the chips used to power artificial intelligence drove the stock to fresh peaks, and is set to surpass that level in July.

He’s not the only insider selling. Company executives and directors unloaded more than $700 million of shares in the first half of this year, a dollar amount that dwarfs any other period in company history.