Dubai: Hosting a global sporting event is not what it used to be. While the pandemic remains a distraction, there is also the small matter of handling all the supply chain requirements. And these days, it means preparing well in advance.

“The build up to the event happens a whole lot earlier – keep in mind that parts of China, the world’s factory, are still under shutdown,” said Daniel van Otterdijk, Chief Communications Officer at DP World, which is now playing host to the Dubai Desert Classic. “There are still issues to be reckoned with all sorts of goods not being sent as half the world’s containers are stuck in one area.

“It costs $30,000 to send a container from Los Angeles to Asia, whereas it used to be $3,000. The only solution when sporting events are being planned is to plan better. If it means X number of golf balls can be brought in from a different source, then that’s how it will be.”

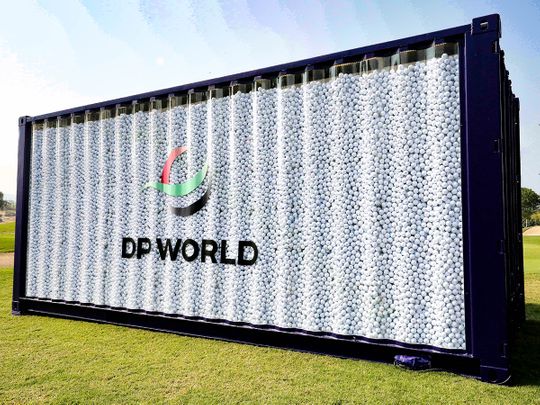

The container, which is made from a repurposed shipping container, can house up to 200,000 golf balls. Its first stop will be the Fan Zone of the Slync.io Dubai Desert Classic, the Rolex Series event on the DP World Tour, which takes place at the Emirates Golf Club from January 27 to 30.

DP World will deploy real-time container tracking technology to the golf container, allowing fans of the sport to follow its journey between tournaments.

Guy Kinnings, Deputy CEO of the European Tour, said: “Golf is becoming increasingly popular in the region with 388,966 rounds played annually across 124 courses, and in Dubai it’s an industry that creates an annual turnover of Dh975 million. Supporting this demand with a seamless supply chain is imperative to the continual growth of the game, and we are fortunate that DP World has the network and infrastructure to alleviate the pressure.”

‘Near-shoring’

This is where ‘near-shoring’ comes in. If there are options source goods from nearer destinations than wait longer for traditional suppliers to do it, then go with the closer option. “This is something that traders and retailers have been doing for the last two years,” said van Otterdijk. “People keep looking for a greater sense of supply chain resilience.

“Whether it’s at the supermarket or for a sporting event, if near-shoring means having supplies in place on time, that’s what will be done.”

Give ‘sense of control’

These days, clients require to have instant update on where their goods are at any point of the shipment, “whether in the container or being delivered at the doorstep,” the official added. “It has meant that entities such as ourselves are making that information available – no player in the logistics business can afford not to. The supply chain has significantly chained its operational perspective in the last two years.”

Still some distance away

A return to the pre-pandemic world will take longer for the supply chain trade. DP World’s reckoning is that it could be by the “middle or back-end of 2023” that some signs of normality ensues. “There is no great incentive for shipping lines to carry empty containers,” said van Otterdijk.. “Until then, it’s going to be more of near-shoring. It makes the most sense.”

The same study, commissioned by DP World, also found that higher transport costs are limiting imports into the Middle East for 41% of companies.