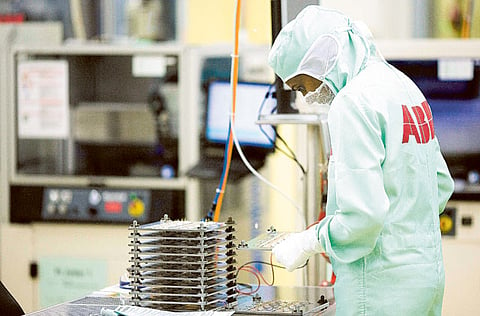

ABB bets on solar power with $1 billion takeover

ABB to acquire Power-One for $6.35 per share in cash

Zurich: Swiss industrial group ABB is to buy solar energy firm Power-One Inc for about $1 billion (Dh3.67 billion), betting growth in emerging markets will revive a sector ravaged by overcapacity and plunging demand in recession-hit Europe.

The world’s biggest supplier of industrial motors and power grids said on Monday it had agreed to pay $6.35 per share in cash for Power-One, the world’s second-largest maker of solar inverters that allow solar power to be fed into grids.

That is 57 percent above Power-One’s closing price on Friday, though well below its 2010 highs of over $13.

“We consider the acquisition of Power-One as a smart strategic move for ABB to broaden its solar product portfolio at the right time,” Vontobel analysts said.

Peers like Germany’s Siemens and Bosch recently ended ventures in the solar industry after oversupply, weak economies and a cut in government subsidies triggered a collapse in demand for solar panels and prices slumped, leading to a wave of insolvencies in the industry.

Germany’s SMA Solar, the world’s biggest maker of solar inverters, last month reported a 58-percent drop in 2012 operating earnings, saying sustained lower prices from competitors could severely impair its business.

ABB, however, said falling prices for solar systems and rising electricity costs meant solar panels were now a competitive source of energy.

“Solar is long term the fastest growing renewable generation market in the world. ABB believes in this market,” ABB Discrete and Motion head Ulrich Spiesshofer said in a company video.

He said ABB was buying in this market now because it saw a shift in solar energy demand towards emerging markets, such as China and the Middle East.

“Also some traditional markets like Japan are waking up and focussing very strongly on the solar field,” he said.

Renewable energy is one of ABB’s strategic priorities. It took a 35 percent stake in Germany’s Novatec Solar in 2011.

At 0750 GMT, ABB shares were up 0.9 percent at 20.1 Swiss francs, outperforming a flat European sector. SMA Solar shares were up more than 10 percent.

PROJECTED GROWTH

The solar inverters market is forecast to grow by more than 10 percent per year until 2021, driven by increasing energy demand, especially in emerging markets, rising electricity prices and declining costs, ABB said.

In 2012, total revenues in the solar inverter industry reached $7 billion, according to research firm IHS.

ABB chief executive Joe Hogan said the deal should boost net income within a year. He added the firm had no interest in buying solar panel or machinery makers.

Sarasin analyst Martin Schwab said the bid price for Power-One seemed high, at about 21 times estimated 2014 price to earnings, but that the deal might pay off in the future.

Vontobel analysts called the price reasonable, given the target’s net cash position and positive operating cash flow.

ABB said it would pay for the transaction from its own funds and that it included Power-One’s net cash of $266 million.

Subject to shareholder and regulatory approvals, the deal is expected to close in the second half of 2013.

Power-One employs almost 3,300 people, mainly in China, Italy, the United States and Slovakia and had sales of around $1 billion in 2012. The firm posted a fourth-quarter loss per share in January.

Credit Suisse acted as financial adviser to ABB, and Cleary Gottlieb Steen & Hamilton LLP acted as legal adviser. Goldman Sachs & Co. acted as financial adviser to Power-One, and Gibson, Dunn & Crutcher LLP as legal adviser.