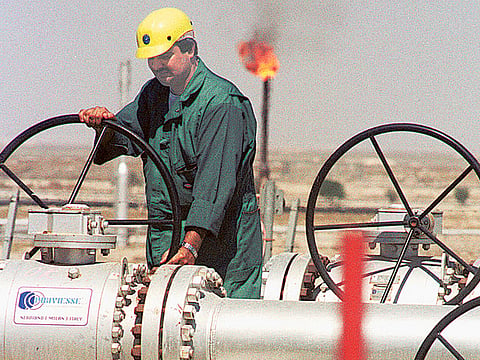

Oil rebounds toward $61 as OPEC+ seen rolling over supply curbs

Economic data and forecasts continue to point to a recovery, boding well for oil demand

Dubai: Oil rebounded ahead of an OPEC+ meeting on Thursday at which the group will decide on output policy, with the alliance expected to maintain its cautious stance on adding supplies given near-term concerns on demand.

West Texas Intermediate rose 0.6 per cent after falling 1.6 per cent on Tuesday. In the run-up to the closely-watched ministerial session, an OPEC+ panel revised down demand estimates for the year, delegates said. Still, the group also expects the surplus built up during the pandemic to be mostly gone within the next quarter.

Economic data and forecasts continue to point to a recovery, boding well for oil demand. In Asia, an official gauge of China's manufacturing rose to 51.9 in March, topping estimates. Next week, the International Monetary Fund will upgrade its forecast for global growth - driven by better outlooks for the U.S. and China - while warning of new virus strains that may slow the rebound.

Oil has pulled back in recent weeks, paring a quarterly rise, as the Covid-19 situation deteriorates in parts of the world ahead of a widely anticipated demand rebound once enough people are vaccinated. Stricter lockdowns in parts of Europe are showing up in traffic data and fuel use, while in the U.S., data from OPIS by IHS Markit show gasoline sales trailing pre-pandemic levels by 16 per cent. A rise in the dollar has added a headwind for prices of commodities.

"The rough patch for oil endures as the short-lived bounce from the Suez Canal blockage has given way to a mighty U.S. dollar and the Covid-19 resurgence," said Stephen Innes, chief global market strategist for Axi. That raises more questions than answers on how fast global demand recovers, he said.

The Organization of Petroleum Exporting Countries and its allies will debate whether to revive part of the 8 million barrels of daily output - about 8 per cent of global supply - they're withholding. After surprising traders at the last session by not easing curbs, the group is now expected to prolong that stance.

Cautious Saudi

The principal advocate of the cautious OPEC+ approach has been Saudi Arabia, one of the group's two main leaders along with Russia. Energy Minister Prince Abdulaziz bin Salman has made the case that given the risks to consumption still posed by the pandemic a conservative stance is merited. He's also said higher prices won't trigger a concerted rise in supply by U.S. shale producers.

At the same time, Saudi Aramco, the state-owned oil giant, is expected to raise its Arab Light official selling price for May supplies by 30 cents a barrel, according to the median estimate in a Bloomberg survey of refiners and traders. The possible upward adjustment comes despite continued flows of Iranian crude into China, and challenging conditions for many Asian refiners.

Among those expecting OPEC+ to hold the line on production for now, Australia & New Zealand Banking Group said the alliance was likely to roll over most of its April quota for May, while Saudi Arabia would extend a separate, unilateral cut. "We expect them to remain relatively cautious," the bank said.

Brent's prompt timespread was 3 cents in backwardation. While that's a bullish pattern - with near-term prices trading above those further out - it's down from 16 cents a week ago, and 67 cents at the start of the month.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox