Adnoc signs $4b investment deal to boost pipeline infrastructure

US-based institutional investors BlackRock and KKR tie up with Adnoc

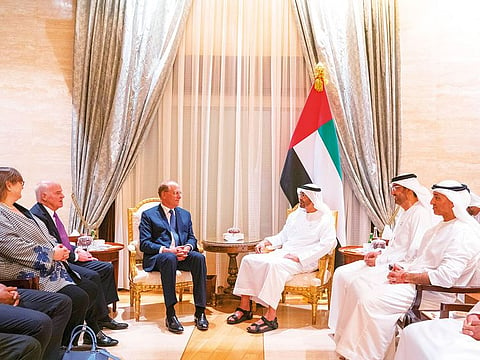

Abu Dhabi: Abu Dhabi National Oil Company (Adnoc) on Sunday entered into a $4 billion partnership agreement with the US-based institutional investors KKR and BlackRock to boost pipeline infrastructure for transport of crude oil and condensate in the UAE.

As part of the transaction, a newly formed entity called Adnoc Oil Pipelines “will lease Adnoc’s interest in 18 pipelines”, transporting stabilised crude oil and condensate across Adnoc’s offshore and onshore upstream concessions, for a 23-year period.

The entity will, in turn, receive a tariff payable by Adnoc, for its share of volume of crude and condensate that flows through the pipelines, backed by minimum volume commitments.

Funds managed by BlackRock and KKR will form a consortium to collectively hold a 40 per cent interest in the entity, while Adnoc will hold the remaining 60 per cent majority stake. Sovereignty over the pipelines and management of pipeline operations remain with Adnoc.

This transaction marks the first time that leading, global institutional investors have deployed capital into key midstream infrastructure assets of a national oil company in the Middle East, according to a statement from Adnoc.

“The level and sophistication of the investors that we are attracting as financial partners to invest, alongside Adnoc, in these select pipeline assets is a clear reflection of the UAE’s stable, attractive and reliable investment environment,” said Dr Sultan Al Jaber, UAE Minister of State and Adnoc Group CEO.

“It also demonstrates the global investment community’s validation of Adnoc’s progressive and smart approach to unlocking value from its portfolio of assets while retaining control over their ownership and operation.”

KKR’s investment was made through its third Global Infrastructure Investors fund, which closed in September 2018 at $7.4 billion. KKR invests in infrastructure assets on a global basis, with $12.6 billion in assets under management within its Infrastructure strategy.

BlackRock, on the other hand, is investing through its Global Energy & Power Infrastructure Fund (GEPIF) series, which, for the last decade, has invested in stable, high-quality contracted energy infrastructure in North America, South America, Europe and Asia.

“Public-private partnerships are essential for investment to drive continued economic growth in the region, and we believe that today’s agreement among Adnoc, BlackRock and KKR will be followed by many more such partnerships to invest in the future growth of the region,” said Laurence D Fink, Chairman and CEO of BlackRock.

In similar comments, Henry Kravis, Co-Founder, Co-Chairman and Co-CEO of KKR, said: “We have created an innovative core midstream infrastructure platform alongside Adnoc and BlackRock that can be a catalyst for further foreign investment and broader economic transformation in the UAE.”

The latest deal follows other initiatives including Adnoc’s debut capital markets transaction, the issuance of the Abu Dhabi Crude Oil Pipeline (Adcop) bond, the IPO of Adnoc Distribution, the recent strategic equity and commercial partnerships between Adnoc Drilling and Baker Hughes as well as Adnoc Refining and Eni and OMV.

Bank of America Merrill Lynch and JP Morgan acted as financial advisers to Adnoc while Moelis & Company acted as an independent financial adviser to Adnoc. The deal will result in upfront proceeds of approximately $4 billion to Adnoc and is expected to close in third quarter of 2019, subject to customary closing conditions and all regulatory approvals.

A long stretch

The collection of 18 pipelines being leased by Adnoc Oil Pipelines has a total length of over 750km, and a total aggregate capacity of approximately 13 million barrels per day, Adnoc said on Sunday.

Adnoc produces about 3 million barrels of oil and 10.5 billion cubic feet of raw gas a day. Its integrated upstream, midstream and downstream activities are carried out by 14 specialist subsidiary and joint venture companies.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox