Giesecke+Devrient CEO sees Gulf countries as important business partners

G+D develops technology for payment, connectivity, identities and digital infrastructures

Leading security technology firm Giesecke+Devrient (G+D) is seeking to grow its business in the Gulf region by introducing sustainable tech solutions. G+D develops customized technology in four major playing fields: payment, connectivity, identities and digital infrastructures.

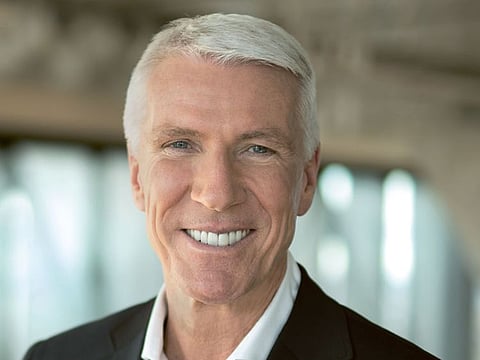

Dr. Ralf Wintergerst, Chairman of the Management Board and Group CEO, Giesecke+Devrient, and chair of the North Africa Middle East Initiative of German Business (NMI), outlined the German-headquartered company’s plans for expansion into the GCC, saying, “The Gulf countries are important business partners of G+D as well as other large German technology suppliers and small and medium-sized enterprises (SMEs) for many years. We are very committed to the region, one of the reasons why we have a hub office in Dubai for more than 20 years. Today, it is one of our most important locations worldwide covering functions like sales, project management, services and logistics – it serves as our customer hub for the whole region and beyond.”

According to Wintergerst, Germany and GCC countries share many similarities as “they all embrace digital transformation and recognize the great opportunities it involves for their economies. There is a high acceptance and demand for next-generation technologies which goes in line with a growing awareness for sustainable solutions, especially among the younger generation in these countries.”

Among the innovative technologies that G+D hopes to roll out in the region is its recently launched “Green Banknote” which is made with ecological, resource-saving materials and production processes.

“But we aim to realize our sustainable vision in all areas of business, not only cash. An increasing part of our payment cards is based on sustainable material made of recycled PVC or even biomass-based PLA, which is industrially compostable. Another good example is the Green SIM which significantly reduces plastic waste as it is already installed in a mobile device. Therefore, to change a SIM card no physical SIM card is needed any longer as everything is done digitally. This avoids plastic waste as neither physical cards nor packaging and logistics along the supply chain are required any longer. As you can see, there’s a growing number of initiatives as we all can contribute to a more eco-friendly payment lifecycle,” he continued.

G+D invented the physical SIM 30 years ago and is now trailblazing the evolution of this technology with the introduction of the eSIM.

Another industry where G+D hopes to introduce innovations is the digital payments ecosystem. “There are a multitude of payment options, be it cash or digital, as well as the emergence of new forms of private digital money. However, there is currently only one way for people to have access to a universal means of payment, legally backed by a central bank, and this is cash,” Wintergerst explained.

However, the rapid digital acceleration is reshaping the way people pay, especially in the region. The MENA Fintech Association recently published a report titled Shift, where it highlights that 69 per cent of Middle East payments will be cashless starting next year.

Amidst this development, Wintergerst sees the potential of introducing a Central Bank Digital Currency (CBDC) in the region. Explaining further he said, “CBDC solves several challenges in today’s payment and crypto-currency world. CBDC solutions, like our product G+D Filia, are now enabling central banks to provide secure public currency for the digital age. A CBDC connects the dots: enabling everyone to participate safely and easily in the digital economy while creating new platforms for innovative business opportunities.”

In addition, Wintergerst noted that central banks in the GCC are exploring the potential of CBDCs, like the vast majority of central banks globally. “Many are already testing use cases in sandbox environments to simulate a digital currency under real world conditions. They are also conducting pilots to determine the features required for their specific jurisdiction. The uptake of such a technology is quite impressive and the pace is quick. We, therefore, strongly encourage central banks in the GCC region to move forward with their CBDC initiatives,” he added.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox