Dubai: The aggregate net profit of the top 10 UAE banks declined by 38.3 per cent year on year in 2020, on the back of lower operating income and increased provisions, according to data analysed by Alvarez & Marsal (A&M).

A&M expects the operating environment for the UAE’s banking sector to remain less volatile in 2021 compared to last year; banks might witness deterioration of their asset quality after the completion of Central Bank of the UAE’s deferral programme in June 2021.

“The anticipated economic recovery in 2021 should support the operating environment and the fundamentals of banks in the UAE. Profitability in the sector has shown signs of vulnerability with declining interest income and increased provisioning weighing on the net profit,” said Asad Ahmed, A&M Managing Director and Head of Middle East Financial Services.

Low asset yields resulting from low interest rates along with higher provisions impacted bank profitability last year. Net interest income (NII) decreased about 2 per cent year on year, as system-wide rates decreased substantially after the Central Bank of the UAE slashed rates to counter the effects of the Covid-19 pandemic. However, net interest margins improved as banks were able to reduce their funding costs further.

The anticipated economic recovery in 2021 should support the operating environment and the fundamentals of banks in the UAE. Profitability in the sector has shown signs of vulnerability with declining interest income and increased provisioning weighing on the net profit.

Decline in income streams

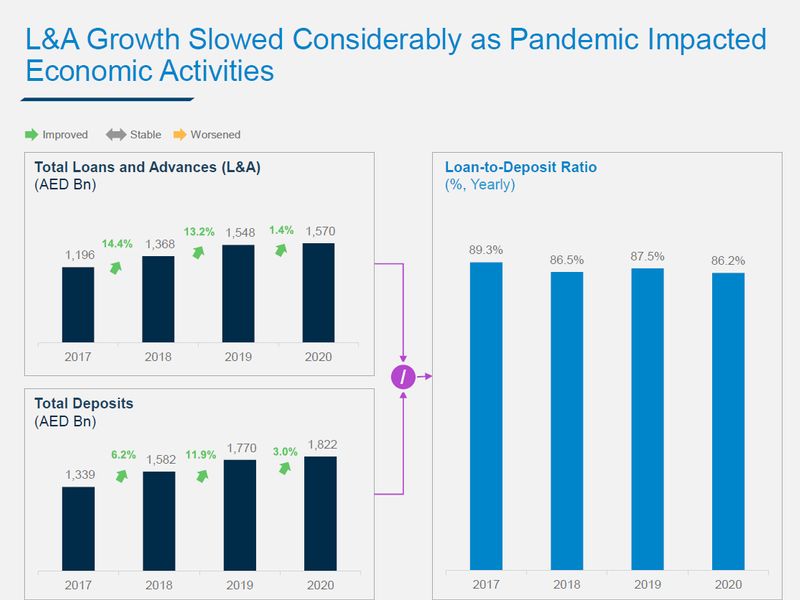

Growth in aggregate loans and advances increased at a marginal rate of 1.4 per cent year on year in 2020, as economic slowdown due to the outbreak of the pandemic impacted credit demand. Similarly, deposit growth slowed to 3 per cent during the period. Consequently, aggregate loans to deposits ratio fell to 86.2 per cent from 87.5 per cent.

Operating income decreased, as low interest rates impacted income stream. Total operating income declined 4 per cent YoY. Fee income decreased 9 per cent YoY, as lockdown affected the income arising from cards and new business volumes.

Strain on profitability matrixes

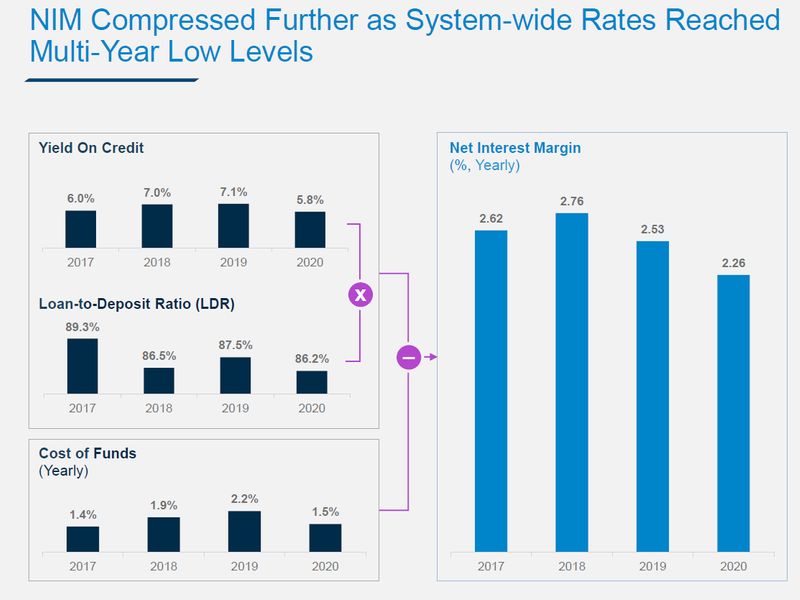

Net interest margin improved for most of the banks in in the fourth quarter of 2020. Aggregate net interest margin (NIM) was compressed further by 28 bps year on to 2.3 per cent in 2020, largely on the back of low interest rate environment.

Yield on credit declined by 129 basis points (bps) year on year, while cost of funds fell 69 bps. Despite the increase, aggregate NIM continue to remain at multi-period low levels in the UAE banking sector.

Thus, profitability ratios such as return on equity and return on assets declined to 7.7 per cent and 0.9 per cent from 13.3 per cent and 1.6 per cent, respectively.

Spike in impairments

Total loan loss provisions increased by 79 per cent year on year Dh28.1 billion, as challenging economic environment and exposure of banks on several high profile publicly disclosed cases resulted in higher impairments. Cost of risk increased sharply by 69 bps year on year to 1.71 per cent. Coverage ratio also declined to 91.9 per cent from 97 per cent a year ago. Aggregate NPL ratio increased to 6.1 per cent at the end of 2020 from 4.6 per cent at the end of 2019.

Operating efficiency

Cost-to-income (C/I) ratio of top 10 band increased by 1 per cent year on year to 34.5 per cent, despite 1 per cent decline in operating expenses. C/I ratio increased as operating income dropped at a higher rate compared to operating expenses. The decrease in expenses can be partially attributed to cost cutting measures implemented by major banks like ADCB and ENBD.

Despite a challenging business environment, aggregate capital adequacy ratio of the UAE banks remained robust at 17.6 per cent at the end of December 2020, compared to 17.3 per cent at the end of December 2019.

A&M expects 2021 to be less volatile for the UAE banking sector compared to 2020. “Events such as Expo and a gradual economic improvement are expected to be the key catalysts for the sector in the near term. However, post the end of the loan forbearance period in June 2021, banks might have to book additional provisions which could be detrimental to their profitability and asset quality,” said Ahmed.

The country’s 10 largest listed banks analysed are First Abu Dhabi Bank (FAB), Emirates NBD (ENBD), Abu Dhabi Commercial Bank (ADCB), Dubai Islamic Bank (DIB), Mashreq Bank (Mashreq), Abu Dhabi Islamic Bank (ADIB), Commercial Bank of Dubai (CBD), National Bank of Fujairah (NBF), National Bank of Ras Al-Khaimah (RAK) and Sharjah Islamic Bank (SIB).