Dubai: Credit growth is expected to decline across GCC countries due to volatile oil prices, higher interest rates and weaker demand conditions impacting non-oil economic growth, according to the International Monetary Fund (IMF) and Institute of International Finance (IIF).

“Increases in policy interest rates in the GCC, in line with US Federal Reserve monetary policy normalisation, and declines in real estate and equity (Dubai, Oman) prices have led to tighter domestic financial conditions, restraining non-oil activity,” the IMF said in its latest regional economic outlook.

Pressures from tighter global financial conditions led to net capital outflows in the region during the second half of 2018, contributing to lower domestic liquidity growth. However, global easing of financial conditions in early 2019 is expected to reduce the adverse impact on capital inflows.

“Headwinds from tight financial conditions and a tense geopolitical environment continue to dampen private sector economic activity [in GCC],” said Garbis Iradian, Chief Economist, Middle East and North Africa, IIF.

The IIF has projected an overall GCC GDP growth to 1.8 per cent in 2019, dragged down by stagnation in oil production in the context of the Opec+ agreement. For 2019, the IMF has projected 2.8 per cent real GDP growth compared to the earlier forecast of 3.6 per cent. According to the latest IMF projections, the UAE economy grew by 1.7 per cent against the October forecast of 2.9 per cent in 2018. GDP growth in GCC countries is expected to improve slightly to 2.1 per cent in 2019, up from 2 per cent in 2018.

Expo 2020 — related spending in Dubai and Abu Dhabi’s fiscal stimulus is expected support near-term growth in the UAE. However, the growth outlook of GCC as a whole is expected remain tepid in 2.1 per cent in 2019.

“Government spending and multi-year infrastructure plans will likely provide some support to economic activity in Kuwait, UAE and Saudi Arabia. In Qatar, the beginning of the Barzan Gas Project operations will underpin hydrocarbon production, but nonhydrocarbon growth is projected to moderate in 2019. Non-oil growth is also expected to slow in Bahrain from planned fiscal consolidation under the authorities’ fiscal balance programme,” said Jihad Azour, the IMF’s Mideast and Central Asia department director.

Fiscal dilemma

The IMF has warned that the relationship between government spending and growth has weakened in recent years, owing to the predominance of external shocks, and that potential growth is likely to lower relative to the period of high oil prices, high investment, buoyant sentiment, and a stronger external environment.

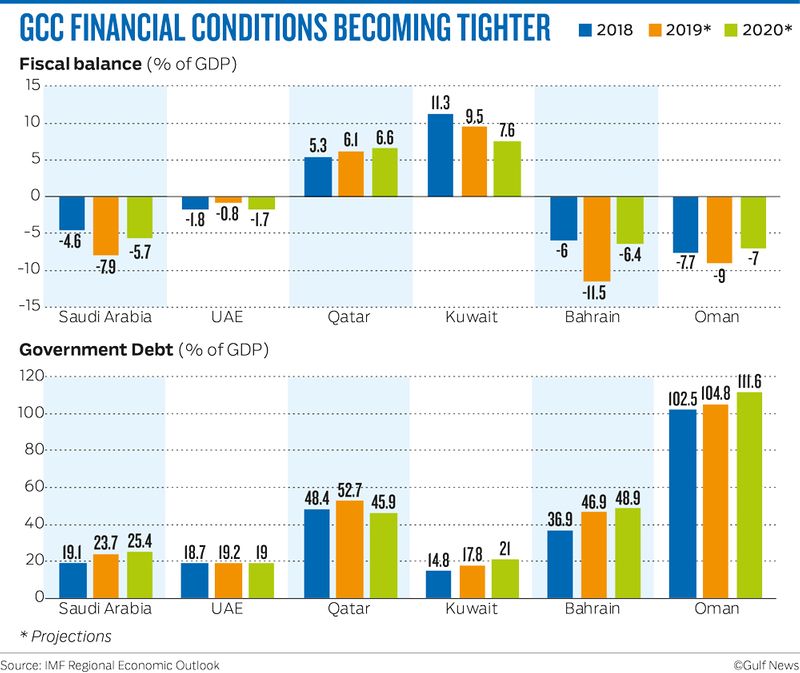

Fiscal consolidation in the region began in 2014, following the decline in oil prices, but slowed with the rebound in oil prices last year. While fiscal consolidation across the GCC is expected to slow down further this year, the IMF expects further fiscal expansion in Saudi Arabia.

“Slower fiscal consolidation amid lower projected oil prices would heighten the near-term vulnerability of some countries with limited fiscal space, including from elevated public debt. But countries with strong external positions including forex official reserves and asset positions of sovereign wealth funds stands to weather in turbulence better,” said Azour.

The IIF is projecting a spike in fiscal deficits across the GCC. Lower oil revenues and higher spending will raise the aggregated fiscal deficit from 1.5 per cent of GDP to 4 per cent in 2019.

Facing a less certain outlook for oil prices, weaker external conditions, and stalled non-oil growth prospects, the IMF has called on GCC countries to resume gradual fiscal adjustment to rebuild buffers, while deepening and broadening structural reforms.

“Resuming adjustment in underlying fiscal positions is needed until sustainable spending levels are achieved — and beyond, to rebuild fiscal space and insulate economies from oil price swings,” the IMF said in a recent report.

Anchoring fiscal policy in a strong medium-term fiscal framework with a clear objective (such as a debt ratio, an intermediary target based on the non-oil primary balance, or a multi-year budgeting rule) would help resist spending pressures and vulnerabilities that could emerge from sustained bouts of oil price volatility.

While a sustainable fiscal framework would support improvements in current account balances, particularly since oil prices are unlikely to rise in the near term fiscal break-even prices remain significantly above the current oil price trajectory, highlighting the significant medium-term fiscal challenges facing the region from lower projected oil prices, particularly for countries with sizeable debt obligations.