Dubai: Global sukuk issuance volumes are expected to recover and reach last year’s levels in 2020 despite the unprecedented stress from the coronavirus pandemic, according to Fitch Ratings.

As market conditions further recover, sukuk supply is expected to increase with increased funding needs.

“We expect sukuk supply to increase and continue to be a significant part of the total funding mix in key Islamic finance jurisdictions. Volume in the full year 2020 is expected to be similar to 2019 levels,” Fitch said in a report.

Sovereign demand

Sovereigns are expected to remain the major contributors to overall sukuk volumes as they face widening fiscal deficits and high borrowing needs, caused by coronavirus-related economic disruptions and lower oil prices. Issuance from financial institutions and corporates is also set to increase as they face challenging business conditions and take advantage of lower funding costs.

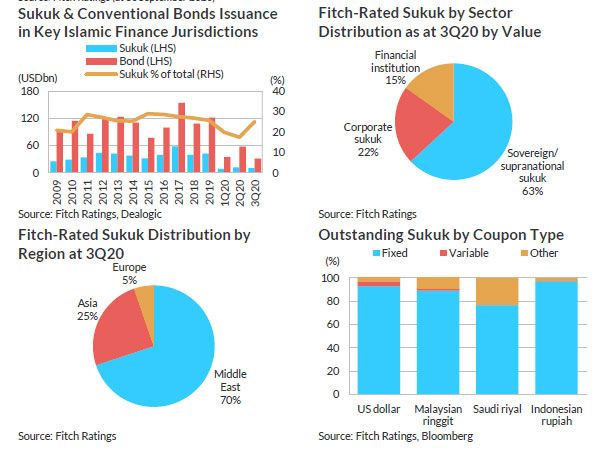

Sukuk issuance with a maturity of more than 18 months from the Gulf Cooperation Council (GCC) region, and Malaysia, Indonesia, Turkey and Pakistan reached $10.5 billion in the third quarter of 2020, 14.2 per cent lower than in the second quarter of 2020. The proportion of sukuk in the total funding mix in these jurisdictions reached 25 per cent.

“We expect sovereigns to remain major contributors to overall sukuk volumes as they face widening fiscal deficits and elevated borrowing needs, caused by coronavirus related economic disruptions and lower oil prices,” Fitch said.

The volume of outstanding Fitch-rated sukuk reached $116.2 billion at end of third quarter, of which about 24 per cent is estimated to mature in 2020-2022. About 81 per cent of issues were investment-grade and 19 per cent speculative-grade.

Fitch forecasts oil prices will average $41/bbl and $45/bbl in 2020 and 2021 respectively. Issuance from financial institutions and corporates is also set to increase as they face challenging business conditions and take advantage of lower funding costs.

Green issuance

The volume of outstanding Fitch-rated Green & Sustainability sukuk reached $7.2 billion at end of third quarter 2020, representing 6.2 per cent of the total sukuk portfolio. All of the issues were investment-grade. The third quarter also witnessed the first green-sukuk from Saudi Arabia issued by Saudi Electricity Company.

“Despite the modest growth, the Green & Sustainable sukuk market is still in its infancy and not likely to become a sizeable part of the sukuk market in the short term,” Fitch said.

Ibor impact

The discontinuance of Libor [London interbank offered rate] could adversely affect the value of floating-rate sukuk referencing IBOR [Interbank offered rates] or any other such benchmark. Sukuk also face the complexity of ensuring sharia compliance throughout the transition process. However, the bulk of the sukuk market is fixed-rate and so unaffected by the Iibor transition planned for major currencies by end- 2021.

Fixed-rate issues constitute 93 per cent of the dollar sukuk market. Sukuk with floating rates now increasingly include fall-back provisions designed to accommodate changes in the reference rate.

Standardisation

The International Islamic Financial Market (IIFM), a standard-setting body, launched the new Sukuk-Al Ijarah documentation in October. While adherence to the IIFM’s standards should increase, success depends on adoption by market participants. In the third quarter of 2020, the Central Bank of Kuwait formed the Higher Committee of Shariah Supervision, and Turkey is also reported to have launched the legal infrastructure for participation finance.