Record profits at top UAE banks set upbeat tone for busy earnings season ahead

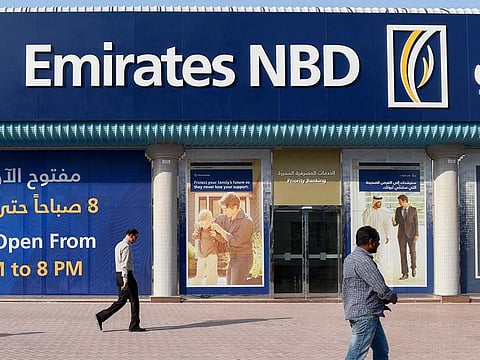

Blue-chip bank Emirates NBD latest to post massive profits, after ADCB and FAB

Dubai: In a stellar start to the corporate earnings season, the biggest banks of the UAE collectively continued to post record level profits, with Emirates NBD being the latest and yet another top lender to record upbeat results in the past week. This not only brightens the industry's prospects, but the economy's as well.

Coming on the heels of UAE’s biggest bank First Abu Dhabi Bank (FAB) last week propelling their nine-month net profits to Dh12.4 billion – a spike of 58 per cent, and Abu Dhabi Commercial Bank posting a 24 per cent increase in net profit to Dh5.75 billion, Emirates NBD too logged its personal best on Thursday, with net profit soaring 92 per cent to Dh17.5 billion.

Hesham Abdulla Al Qassim, vice chairman and managing director, said lending to small and medium businesses rose 34 per cent in the UAE, "supporting this important sector and bedrock of the economy".

'Bedrock of the economy'

While two of the three blue-chip banks, Emirates NBD and Abu Dhabi Commercial Bank, primarily attributed their profit growth to strong loan demand in the UAE, FAB beat profit expectations with a boost from higher interest income, which is the difference between earnings on loans and payouts on deposits.

Shayne Nelson, group chief executive officer of ENBD, said the remarkable profit growth was on the back of “significant loan growth, a stable low-cost funding base, increased transaction volumes and substantial recoveries.”

Islamic banks too joined the profit growth march, with ADIB reporting a 53 per cent increase in net profit at Dh3.75 billion for the first nine months of 2023, while Dubai-headquartered EIB seeing a 56 per cent growth in profit to Dh1.65 billion.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox