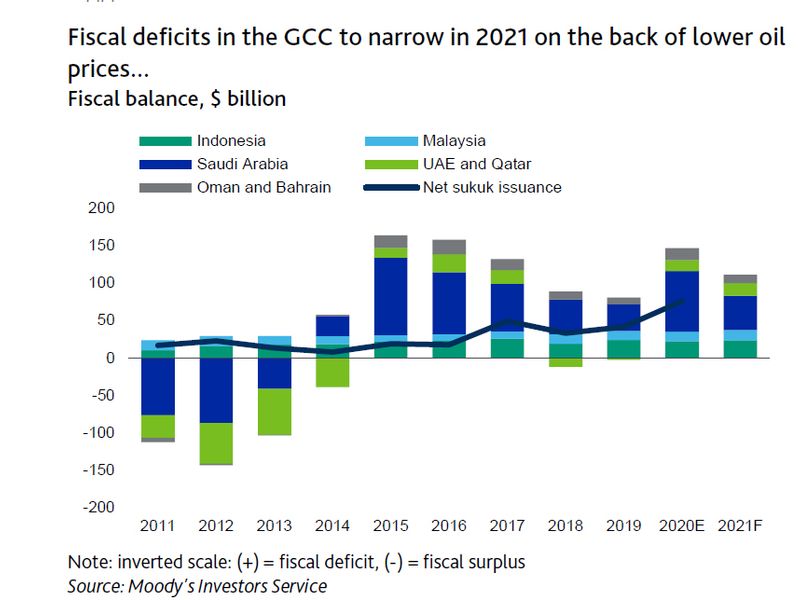

Dubai: Sukuk issuances across GCC and key Islamic finance markets will moderate in 2021 as fiscal deficits decline amid higher oil prices, lower coronavirus-related expenditures and accelerating economic activity according to rating agency Moody’s.

“Following a record year in global long-term sovereign sukuk issuance driven by the extraordinary increase in gross financing requirements for major sukuk-issuing sovereigns, we expect issuance to decline slightly this year as financing needs narrow,” said Thaddeus Best an analyst at Moody’s.

GCC leads sukuk issuance

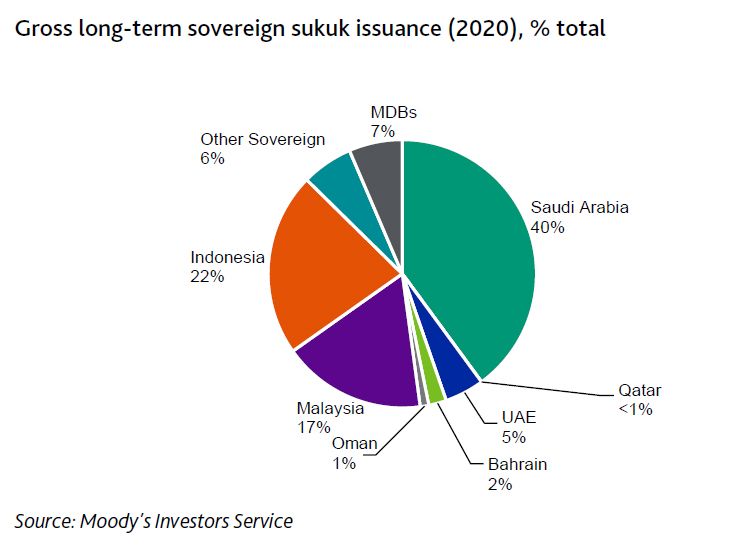

Long-term global sovereign sukuk issuance surged by 49 per cent, reaching $109 billion in 2020, compared to $73 billion in 2019, according to Moody’s.

The principal rise in the supply of sukuk came from the GCC sovereigns where issuance expanded 89 per cent year-on-year in 2020. The combined fiscal deficits of GCC sovereigns widened to $150.7 billion in 2020 from $60.2 billion in 2019, triggered primarily by the decline in oil prices.

Saudi Arabia’s gross sukuk issuance rose to $44.5 billion compared to $21.6 billion in 2019 as lower oil prices drove a doubling of the government’s fiscal deficit last year. Domestic issuance accounted entirely for the growth in issuance.

In the UAE, gross issuance was $5.2 billion compared to $1.9 billion in 2019. Sharjah issued $1.99 billion in sukuk last year, of which $1.45 billion was in dollars.

In 2020, the coronavirus pandemic drove fiscal deficits sharply wider across major sukuk-issuing sovereigns, leading to a sharp spike in issuance in the second half of the year as market conditions improved. Sovereign sukuk issuance continues to be dominated by the GCC, Malaysia and Indonesia, which together accounted for 87 per cent of outstanding sovereign sukuk as of the end of 2020.

Within the GCC, Saudi Arabia has increasingly become the dominant issuer since the inception of its domestic sukuk issuance programme in 2017, accounting for 29% of outstanding sukuk as of December 2020.

Deficits to narrow in 2021

Moody’s expects narrowing fiscal deficits in the GCC to drive a fall in new sukuk issuance in 2021. Gross long-term global sovereign sukuk issuance will amount to $96 billion in 2021, below the $109 billion issued in 2020. Despite the decline, the rating agency forecasts issuance to remain above the pre-pandemic annual average of $65.7 billion in 2017-19.

Oil prices moved higher at the beginning of this year, supported by Saudi Arabia’s surprise decision to cut an additional one million barrels per day (mbpd) out of the market. This will support an increase in government revenues sovereigns in the GCC, including major sukuk issuers.

In addition to rising oil revenues, the expected rebound in economic growth and the unwinding of some of last year’s coronavirus related spending measures will also help narrow fiscal deficits in the GCC and result in the easing of financing needs including in the form of sukuk.

“In 2021 we expect to see a slight decline in sukuk issuance, as higher oil prices and recovering economic activity support government revenue growth while pandemic-related spending should fall,” said Best.

Refinancing needs

While higher oil prices and recovering economic activity will continue to narrow the fiscal deficits of major sukuk-issuing sovereigns, gross issuance will be supported by more than $41 billion in maturing sukuk that will need to be refinanced, mainly by Saudi Arabia, Malaysia and Indonesia.

Notably, Saudi Arabia’s lower domestic issuance in 2022 will more than offset the continued rise in scheduled sukuk repayments, the bulk of which we expect will be refinanced with new sukuk in domestic markets. In 2022 alone, Saudi Arabia’s maturing sukuk issuances amount to just under $11 billion. We estimate that scheduled GCC sukuk repayments will increase to $14.9 billion a year on average between 2022 and 2024 from an average of $2.5 billion a year between 2018 and 2021.