UAE economy to reap oil windfall gains

Habshan-Fujairah oil pipeline seen to be fully operational by end 2012

Abu Dhabi: The UAE economy will benefit greatly from the high oil prices during 2012 although given the investment programmes and handout schemes which were announced during 2011, much of the money has already been earmarked for spending, say experts.

“Still, Abu Dhabi — and by extension the UAE — should benefit from achieving a healthy budget surplus, despite the generous spending plans,” Samuel Cizsuk, Consultant at the UK-based KBC Process Technology Ltd told Gulf News.

“Thanks to high oil prices this year, we think that the UAE will run a fiscal surplus of around 10 per cent of GDP (gross domestic product). However, our house view is that oil prices will fall next year as the global economy (and thus oil demand) weakens. We expect oil prices to fall to $85 per barrel and, as such, think the UAE’s fiscal surplus may narrow to around 5 per cent of GDP,” William Jackson, Emerging Markets Economist at the London-based Capital Economics Ltd told Gulf News.

“But even if oil prices do fall as we expect, the UAE’s fiscal position is still pretty healthy. As such, the authorities should have ample scope to cushion the blow from external headwinds by increasing their spending,” Jackson added.

The extra-cash being generated from high oil export revenues would likely help the UAE government boost its investment in the national infrastructure projects and meet its GDP growth target for next year.

The UAE finance ministry said in October the state recorded a budget surplus of Dh36.2 billion ($9.9 billion) in 2011. According to a Reuters calculation, the surplus revealed was equivalent to 2.9 per cent of the 2011 GDP of the UAE.

“[High oil prices] is good news as the investment need in Abu Dhabi’s oil and gas sector also is very high in the coming years ahead, particularly in 2014 and onwards, when a renewal of the ADCO concession -in whatever form is finally decided on - will unlock significant project investment not only from the international oil companies, but also from Adnoc itself,” Cizsuk added.

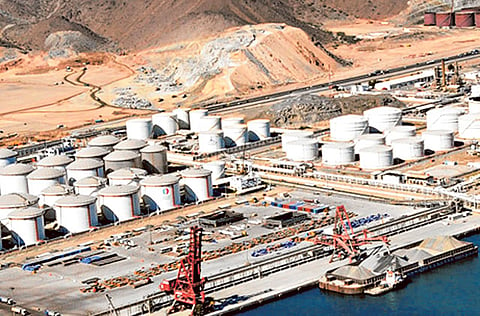

As matters stand, the UAE is well placed to derive maximum gains from the high global crude prices. It now has a strategic advantage over its regional peers after it commissioned the strategic Habshan-Fujairah oil pipeline in July this year. The pipeline gives the world’s third-largest oil exporter a direct access to the Indian Ocean and the option to bypass the Strait of Hormuz for its crude shipments, if that critical water channel ever gets choked. At present, almost a third of the world’s seaborne oil passes through this water channel.

By the end of the year, this 1.5 million-barrels-per-day pipeline will be fully operational, which is almost 70 per cent of the UAE’s crude output.

Burgeoning demand from China and India has kept oil prices on a boil in 2012 despite flagging demand from the U.S. and Europe where the Euro member countries continue to grapple with high sovereign debt and economic slowdown issues. Brent crude, which has seldom dropped below $100 a barrel in 2012 is a pointer to the fast-narrowing demand-supply gap in the oil market.

However, in October, the Paris-based International Energy Agency (IEA), which advises 28 industrialised countries on energy policy, reduced its forecast for global demand, saying slower economic growth may limit fuel consumption.

Oil prices declined after the IEA cut the outlooks for 2012 and 2013 by 100,000 barrels a day each from a month earlier. The IEA forecast world oil demand of 89.7 million barrels a day this year and 90.5 million in 2013.

Economic expansion isn’t happening fast enough to curb unemployment, said International Monetary Fund (IMF) Managing Director Christine Lagarde.

The IEA also said global markets will become better supplied in the next five years as demand growth slows and production rises in North America and the Middle East.

Worldwide fuel consumption is projected to rise to 95.7 million barrels a day in 2017 from 89 million last year, the IEA said. Output is forecast to advance about 1.5 million barrels a day each year to 102 million barrels a day in the same period.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox