It is an exclusive club of 12 member states that virtually sets the pace for the industrialised world. We are talking about the Organisation of Petroleum Exporting Countries, or Opec, which celebrates its 50th anniversary on September 14.

Not too many people know about the huge influence the Opec exerts on the global economy, nor how the group really functions. Information about the organisation's internal functioning is hard to come by, as are interviews with its general secretary or senior members.

"We have agreed that we appear as a singular entity and speak with a singular voice to the outside [world], which is either general secretary Abdullah Salem Al Badri or current president Germanico Pinto," an Opec spokesperson said.

During press conferences at the Opec headquarters in Vienna, it is usually the general secretary who talks to journalists and answers their questions. Press material issued by the group appears to be comprehensive and details its history, presence and structure.

Opec staff members are friendly and readily invite those eager to know more about the organisation to explore its extensive library.

Complex influence

However, if journalists occasionally shoot a question about whether or not the organisation uses its powerful and complex influence on oil prices to its advantage, the response is guarded.

"It was not the high oil price we experienced before the global economic crisis that led to recession," Opec's former president Chakib Khalil said at a press conference in 2008. "Bad economic policies and the property crisis in the US have been the reasons for this — and the immense oil price speculation at the commodity exchanges." It had nothing to do with supply and demand of oil, he added.

Unlike in Western countries, where the group's reputation that it is a "cartel" has gained currency over the years, the group describes itself more as an organisation which aims to coordinate and unify petroleum policies among its member countries — "in order to secure fair and stable prices for petroleum producers, an efficient, economic and regular supply of petroleum to consuming nations and a fair return on capital to those investing in the industry", according to the Opec statutes.

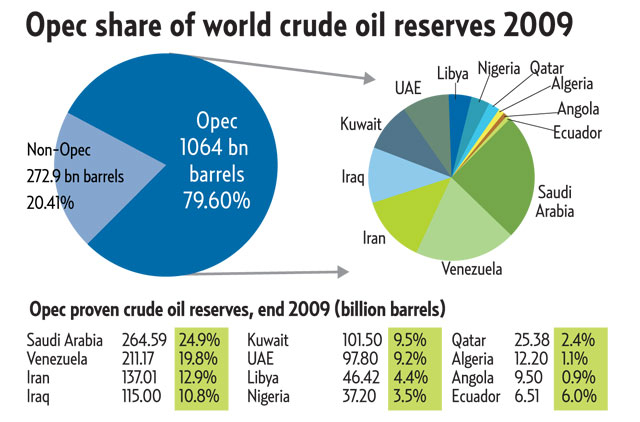

The 12 countries control more than 40 per cent of global oil production and two-thirds of all known oil reserves on the planet. No wonder that wars, crises and political power games have played out in the context of oil price controls over the past 50 years.

Low profile

The political impact of the Opec has always been significant, but the group has managed to maintain a low profile.

For example, the organisation's long-time former headquarters in Vienna, established in 1965 after Opec decided to move from unstable Baghdad to neutral territory, revealed nothing about the fact that it used to house one of the most powerful economic organisations of the planet.

The austere three-storey building on the banks of an arm of the river Danube could easily have been overlooked as squeezed between the huge office complexes of IBM and a leading local banking institution.

Only an unobtrusive Opec sign on the rooftop gave a clue about the location's significance. That is if you didn't count the number of limousines with diplomatic licence plates in the car park.

In March 2010, Opec's headquarters were finally moved into Vienna's inner city near the historic stock exchange building, after the organisation threatened to leave the city for good. The Austrian government and the city of Vienna agreed to bear the annual rental costs for the building — 1.8 million euros (Dh8.4 million), according to a spokesperson for Vienna's mayor Michael Häupl.

Currently Opec in Vienna employs 150 people, including 60 Austrians.

Until 1973, the year of the first oil crisis, Opec was only familiar to a small group of insiders. It was only then that Europeans and Americans began to realise that their everyday lives were more dependent on oil than they might have thought, not knowing on what the oil price development really is based on.

German magazine Der Spiegel wrote in an editorial in 1973 after the world was shocked by a sudden oil price surge: "It is the first time that civilisation is threatened by an economic war rather than am armed war".

"Arabian oil policy has destabilised the fine-tuned energy supply system of the West," the magazine's editorial complained.

Production quotas

The trigger for the oil crisis was Western support for Israel during the October War in 1973.

In response to this, Opec reduced oil-production quotas by five per cent and later stopped oil deliveries to the US, South Africa and some European countries.

As a result, the oil price surged from $3 (Dh11) to $12 per barrel, causing widespread disruption in the global economical system.

The West perceived the action as an "attack" on its living standards and blamed Opec for artificially inflating oil prices. In reality, the organisation had only sought to put an end to the decade-long practice of oil-price dumping by the US and several global oil companies, which meant Opec played an important role in member countries being able to overcome colonial dependencies.

The second oil crisis occurred 1979 in the United States in the wake of the Iranian Revolution. When Iranian oil exports were later resumed under the new regime, they were inconsistent and at a lower volume, which pushed prices up.

Widespread panic

Opec nations increased production to offset the decline, and the overall loss in production was about four per cent.

However, a widespread panic resulted, driving the price far higher than would be expected under normal circumstances.

In the 1980s, the Opec was forced to realign oil production again after over-production and lower demand led to a decline in oil prices.

The Gulf Wars of the 1990s, the attack on the World Trade Centre in New York and the Iraq invasion also each had an effect on Opec's production policy.

The organisation's ability to influence the oil price has diminished slightly since then, due to the discovery and development of large oil reserves in Canada and Alaska, the North Sea and the Gulf of Mexico.

However, the next largest group of producers — members of the Organisation for Economic Cooperation and Development (OECD) and the post-Soviet states — together produce less than 40 per cent of the world's total oil output.

This means that Opec still plays a leading global role.

Only recently, it announced plans to invest heavily in downstream activities over the coming years despite uncertainty about the global economic climate.

"Over the next decade, members were expected to invest around $40 billion in refining capacity expansion," general secretary Salem Al Badri said last month.

He added that, in 2009, around 30 projects came onstream in Opec-member countries, resulting in an increase of 1.5 million barrels per day in net crude and distillates capacity.

Furthermore, over the next five years 140 projects were expected to be completed and this would add about 12 million barrels per day of gross crude and liquids capacity.

Comfortable cushion

Al Badri said this represented a huge level of investment, estimated at $160 billion. However, it should be enough to satisfy the growing demand for Opec crude and provide a comfortable cushion of capacity which already exceeded six million barrels per day.

The Organisation of Petroleum Exporting Countries (Opec) was founded in Baghdad, Iraq, with the signing of an agreement in September, 1960 by Iran, Iraq, Kuwait, Saudi Arabia and Venezuela.

They were to become the organisation's founding members. These countries were later joined by Qatar (1961), Indonesia (1962), Libya, Abu Dhabi (1967 — 1971 as UAE), Algeria (1969), Nigeria (1971), Ecuador (1973), Gabon (1975) and Angola (2007). From December 1992 until October 2007, Ecuador suspended its membership. Gabon terminated its membership in 1995. Indonesia suspended its membership effective January, 2009. Currently, the organisation has a total of 12 member countries.

The Opec statute distinguishes between its founding members and full members — those countries whose applications for membership have been accepted by the Opec conference.

The statute stipulates that any country with a substantial net export of crude, which has fundamentally similar interests to those of member countries, may become a full member of the organisation, if accepted by a majority of three-fourths of full members, including the concurring votes of all founding members. The statute further allows for associate members, which are those countries that do not qualify for full membership, but are nevertheless admitted under such special conditions as may be prescribed by the Opec conference.

Development

Opec not only oversees the oil price for its members, it is also the home of an institution which aims to develop the world's poorer countries. The Opec Fund for International Development (Ofid) was set up as a multilateral development-finance institution to promote co-operation between Opec member states and other developing countries.

Ofid was conceived at a summit in Algiers in March, 1975. Ofid is a collective source of finance, and its resources are in addition to those already made available by Opec members through bilateral and multilateral channels.

The resources of Ofid consist mainly of voluntary contributions by Opec members and income derived from Ofid's investments and loans. Currently, the fund's resources are valued at around $5.5 billion, according to Ofid. All non-Opec developing countries are, in principle, eligible for Ofid assistance.

However, the least developed and other low-income countries are accorded priority and, therefore, receive a larger share. Over the years, the fund has spread its financing to 125 countries, of which 51 are in Africa, 42 in Asia, 28 in Latin America and the Caribbean, and four in Europe.

Price control mechanism

The Opec says its mission is to ensure market stability which depends on the co-ordination and unification of the petroleum policies of member countries. One way this can be achieved is through agreement on each country's production allocation, also known as Opec quotas. These are discussed at meetings of the Opec conference. The quotas are a constant subject of dispute, as richer countries such as Saudi Arabia or the UAE can easily cope with a more moderate oil price than others such as Venezuela or Iraq, which need a higher oil price to achieve their budget targets.