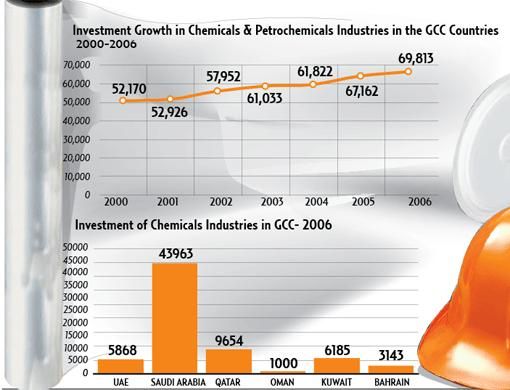

Dubai: Arab Gulf countries invested about $70 billion in chemical and petrochemical industries in 2006, five per cent more than they did in 2005, a pan-Gulf organisation that monitors such projects said.

Saudi Arabia accounted for nearly 63 per cent of total Gulf Cooperation Council (GCC) investment made in petrochemical projects, Qatar-based Gulf Organisation for Industrial Consulting (GOIC) said.

The investment in the petrochemical sector was 59 per cent of about $118 billion the region spent on all industrial projects during the year.

The UAE's investment in the sector was $5.8 billion, which represented 46 per cent of total investment in industrial projects.

Rank

Qatar was the second biggest GCC investor in petrochemical industries at $9.6 billion, followed by Kuwait with $$6.1 billion.

GOIC said the average growth of Gulf investments in petrochemicals and chemical industries between 2000 and 2006 was about five per cent. The number of people employed in these industries last year increased 4.9 per cent to 163,134 last year compared with the previous year.

Investment in petrochemical facilities is driven by availability of cheap feedstock and the region's proximity to large markets of Asia such as China and India.

More than 30 million tonnes per year of ethylene capacity will be added in the Middle East by 2012-13, according to London-based Chemical Week.

The new capacity is also likely to put pressure on global petrochemical markets. Steam crackers coming onstream from 2008 in Kuwait, Qatar and Saudi Arabia will cause an imbalance in worldwide supply and demand, lowering petrochemical plant operating rates and leading to a softening in prices, it quoted industry analysts as saying. Some projects may be delayed or cancelled as engineering, procurement and construction costs in the Middle East have inflated faster than other places.

In Saudi Arabia, development costs of several projects have been raised sharply in recent months.