Abu Dhabi: The Abu Dhabi National Oil Company (Adnoc) on Wednesday said it had awarded China National Petroleum Corporation (CNPC) stakes in two of Abu Dhabi’s offshore concession areas, in a deal valued at Dh4.3 billion.

Under the terms of the agreement, CNPC — through its majority-owned subsidiary Petro China — has been granted a 10 per cent stake in the Umm Shaif and Nasr concession and a 10 per cent stake in the Lower Zakum concession.

Petro China contributed a participation fee of Dh2.1 billion for the Umm Shaif and Nasr concession, and a fee of Dh2.2 billion for the Lower Zakum concession.

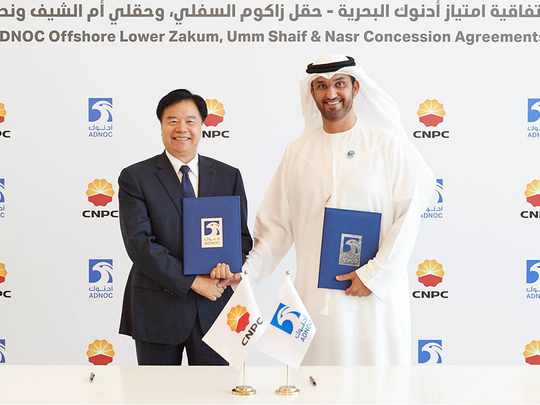

The agreements, with a term of 40 years, are back-dated to March 9, 2018, and were signed by Dr Sultan Ahmad Al Jaber, Adnoc Group CEO, and Wang Yilin, chairman of CNPC in Abu Dhabi.

CNPC joins Eni (10 per cent) and Total (20 per cent) as participants in the Umm Shaif and Nasr concession. It also joins the ONGC Videsh-led consortium (10 per cent), Inpex Corporation (10 per cent), Eni (5 per cent) and Total (5 per cent) as participants in the Lower Zakum concession.

Adnoc retains 60 per cent majority shares in both concessions.

This is the second major concession agreement for CNPC in Abu Dhabi. In February 2017, CNPC was awarded 8 per cent interest in Abu Dhabi’s onshore concession, operated by Adnoc Onshore. It also has a 40 per cent stake in the Al Yasat concession with Adnoc.

Al Jaber said the expanded collaboration with the CNPC further strengthens and deepens the strategic and economic relationship between the UAE and China, the world’s second-largest economy and the number one oil importer globally.

“These agreements are new milestones in Adnoc’s thriving partnership with CNPC and also represent an important platform upon which we can explore opportunities further downstream,” he stated.

CNPC, through Petro China, produces 52 per cent of China’s crude oil and 71 per cent of its natural gas production, and has exploration and production activities in more than 30 countries in Africa, central Asia-Russia, America, the Middle East and the Asia-Pacific region.

In 2016, Petro China produced 772.9 million barrels of crude oil and 3.46 trillion cubic feet of natural gas in China.

Edward Bell, commodity analyst from Emirates NBD, told Gulf News that bringing CNPC on board will help enhance the energy relationship between the UAE on the back of CNPC and CEFC getting stakes in the onshore concession last year.

“For Adnoc, bringing in companies from countries with fast-growing energy demand helps to secure [the] long-term off-take of their crude exports,” Bell said. “For China it shows a growing push to expand its economic presence and influence abroad. It also helps to maintain security of supply which has been a long-term priority for Asian energy importers.”

China and the UAE have made a number of co-investments in the energy sector in the past year. In February 2017, the CNPC was awarded minority stakes in the UAE’s onshore oil reserves and in November Adnoc and CNPC signed a framework agreement covering various areas of potential collaboration, including offshore opportunities and sour gas development projects.