Panipat, Haryana: Tilak Raj Bathla's tiny weaving factory is one of the few still humming on a once busy road in the northern Indian city of Panipat, known as the country's "textile city".

Nearby, more than two dozen other workshops are locked from the outside, while dogs and cows roam through other abandoned factories. Scrap dealers enquire about idle powerlooms.

India launched the Goods and Services Tax (GST) just over a year ago, its biggest ever tax reform, aiming to replace more than a dozen federal and state levies and unify the sprawling economy.

The move improved economic efficiency but critics say the complexities of the new regime have driven many small enterprises out of business and forced hundreds of thousands out of jobs.

#BJP supporters celebrate #GST bill at #Rajpath #newdelhi #GSTForNewIndia #GSTIndia @htTweets @htdelhi pic.twitter.com/85uJBQ4QTp

— Ravi Choudhary (@choudharyview) June 30, 2017

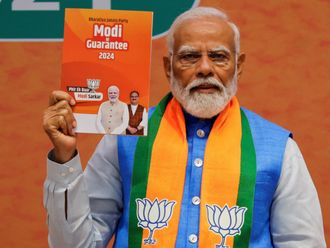

For Prime Minister Narendra Modi, the drawbacks of the GST, especially the job losses, could prove costly in major state elections later this year and a general election in mid-2019.

Bathla says his neighbours, most of them unschooled, could not comply with monthly online filings required under the GST regime. Some of his customers and suppliers could not afford to hire accountants to navigate a system which has been amended more than 200 times already, while others struggled to cope with delays in tax returns caused by glitches in the centralised software.

"I have a GST registration, but I can't work as my vendors and buyers are unable to comply with a complex tax structure," the 50-year-old said, adding his monthly sales had fallen to about 250,000 rupees($3,511) from about one million rupees before the GST. Only two of his 10 powerlooms are currently being used.

The government has said it is simplifying the tax measure to make it accessible to everyone. Finance Ministry spokesman D.S.

Malik said requests from small businesses have been considered "from time to time." But he declined to comment on job losses.

Nevertheless, India's economy gathered pace in the April-June quarter, expanding 8.2 percent compared to 5.6 percent in the same period a year earlier. Economists said the number was coming off a low base as companies held off production in the year-ago period ahead of the implementation of the tax measure in July last year.

Small firms hurting

But while big firms have since shaken off the effects of the change and are set to gain from a uniform tax regime, small businesses across the country are still hurting.

A survey by the All India Trade Union Congress (AITUC) in July found that a fifth of India's 63 million small businesses contributing 32 percent to the economy and employing 111 million people - faced a 20 percent fall in profits since the GST rollout, and had to sack hundreds of thousands of workers.

Readymade garments, gems and jewellery, leather, handicraft and basic machinery manufacturing are hit the most, industry bodies from across the country say.

According to estimates by the Centre for Monitoring Indian Economy, a Mumbai-based consultancy, nearly five million workers lost their jobs over the past year. But it was not clear how many were from small enterprises.

India's unemployment rate rose to 6.4 percent in August from 4.1 percent in July last year despite an additional 17 million people joining the workforce.

But it did not give data on how many people were laid off or from which industries.

India's labour ministry releases jobs data once in five years, last reporting unemployment at 5 percent in 2015/16 (April-March).

More than 50 workers and factory owners Reuters spoke with in Panipat, about 90 km (55 miles) north of New Delhi, said over a third of the city's 10,000 weaving units had closed or curbed production.

From my #whatsappwonderbox Day 1 of #GSTIndia & it looks like no one's getting left behind. We've all 'digested' it well! pic.twitter.com/rJSDcqsBDi

— anand mahindra (@anandmahindra) July 1, 2017

Chand Multani, president of the Panipat Handloom Owners' Association, pointed to the tax headaches behind a bedsheet that costs barely $2 dollar as an example.

The weaving of the sheet, its dyeing, ironing, embroidering and packaging are all done by separate businesses. Under the new system, each business has to pay GST at each stage of production which the businesses can claim back provided they have registered with tax authorities and have a GST number.

For a lot of small businessmen this is way too much work.

"How can all these different operations comply with tax rules?" asked Multani, waving the sheet in the air.

Opposition seizes on GST

The GST replaced several federal and local taxes and tore down tariff barriers between India's 29 states, but critics say that has been to the benefit mainly of large, nationwide businesses.

For Panasonic Appliances, India's leading electric goods maker, GST has meant cutting costs by 4-5 percentage points, for example. India's consumer goods stock index has risen 26 percent in the past year, outpacing the broader Mumbai market.

"GST ... has improved the competitiveness of the manufacturing sector," Panasonic India CEO Manish Sharma said.

Modi, in an Independence Day speech on Aug 15, said the businesses that faced "teething difficulties in adopting GST had accepted the challenge and the country is now moving ahead." But Rahul Gandhi, his main challenger in next year's election, has zeroed in on the job losses and shuttered businesses.

"This GST is a way of removing money from the pockets of the poor," he said last month. "This is not GST, this is Gabbar Singh Tax," he said, referring to the villain in one of Indian cinema's most popular movies.

It happens only in INDIA.#GSTIndia #GST #GSTrates #gstcouncil #TuesdayThoughts #GSTNews #gstbill #DawnTraitorIndianFunded pic.twitter.com/GCMej5P7xl

— हर्ष दुबे 🇮🇳🚩 (@RKHD008) June 20, 2017

Modi's popularity fell below 50 percent in July from 53 percent in January, while Gandhi's rose to 27 percent, up from 22 percent, according to a survey by India Today magazine.

Eighteen months ago, the score was 65 per cent to 10.

To address grievances, the GST Council, which administers the tax measure, has approved more than 200 amendments since the law came into force.

M.S. Mani, senior partner at Deloitte, said too many changes to rules and rates were damaging, particularly for small businesses.

The Federation of Indian Export Organisations estimates that nearly $2 billion of tax credits, mainly of small exporters, were yet to be refunded, mainly because of software glitches in the system and the difficulties in matching the hundreds of thousands of invoices.

About 230,000 small businesses have closed down due to compliance and cash flow problems, leading to large-scale job losses, said Amarjit Kaur, national secretary of the All India Trade Union Congress.

"GST has proved a death warrant for us," Ravinder Kashyap, 22, who lost his job as a powerloom operator earlier this year, said in a small rented room in Panipat that he shares with four friends.

He said his employer had lost sales orders because of the mess caused by the tax and so had let him off along with scores of others. "If this carries on for one or two years, we'll have to commit suicide."

Fact file:

Over 200 tweaks in India's biggest tax reform create confusion

India introduced a new national Goods and Services Tax (GST) in July last year, aiming to unify its $2.6 trillion economy and 1.3 billion people into a single market for the first time.

After 14 months, small businesses are struggling to keep up with over 200 tweaks in the tax system.

Below is a description of the tax and some of the major changes:

What is it?

The GST replaced more than a dozen central and state tariffs, duties and fees levied - often at different rates across India's 29 states - into a single tax.

All goods and services have been put into one of five tax brackets ranging from 0 percent on food products to 28 percent and above on luxury goods such as sports utility vehicles and "sin" goods like cigarettes. Other goods and services are taxed at 5, 12 and 18 percent.

Changes in tax rates

July 2017 : Government raises GST on cigarette makers within a month from launch, causing a dip in share prices of tobacco companies.

Sept 2017: GST on medium-to-large cars and sports utility vehicles raised by up to 50 percent, which led to an increase in retail prices of up to 7 percent.

Oct 2017: Government reduces tax rates on 40 goods and services, including food and textiles, in response to public protests.

Nov 2017: Government lowers tax rates to 18 percent from 28 percent on 178 items and cuts penalties for late filing of tax returns.

May 2018: Government takes over GSTN - the IT company handling tax filing data.

Aug 2018: Government cuts GST rates on 88 consumer items

Changes in tax rules

July 2017: Government first extends tax return filing dates after software glitches. Authorities have been forced to extend the deadline several times since.

Oct 2017: Tax deposit rules relaxed for small firms with an annual turnover of less than 15 million rupees.

April 2018: It becomes mandatory to inform the taxman on planned inter-state transport of goods.

Aug 2018: Government seeks parliament approval for 46 amendments.

Other common complaints

State authorities have different interpretations of which category some items fall into, resulting in different tax rates for the same items in some cases. For example some states said solar plant installation work should be taxed at 18 percent while others said it fell under the 5 percent category.

Small differences between items can lead to big differences in tax rates: coffee and tea are taxed at 5 percent but coffee beans and green tea leaves face no tax.

The government has yet to issue its standard form for tax return applications for the fiscal year that ended in March.

Software glitches mean that some invoices don't match and many manufacturers and exporters say large sums of money are stuck with tax authorities causing them cash flow problems.

Petroleum and alcohol products remain outside GST and subject to higher taxes.