US retailers compete early for seasonal workers amid strong jobs market

Retailers such as J.C. Penney Co. and Kohl’s Corp. already are posting help-wanted ads for their busy season

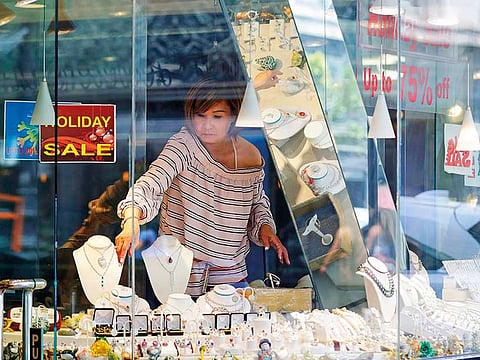

While the nation’s big retailers battle for consumer dollars they’re now also waging a fight for seasonal workers.

Retailers such as J.C. Penney Co. and Kohl’s Corp. already are posting help-wanted ads for their busy season, weeks or even months earlier than usual. That means Americans looking for a seasonal job with a retailer — starting with the upcoming back-to-school season and then through the Christmas holidays — are enjoying their best prospects in years, thanks to the strong US economy and employment picture.

That’s put the onus on retailers to hire the best seasonal workers as early as possible because those looking for work have considerable employment choices, analysts said.

Retailers have unveiled plans to hire thousands of seasonal workers, and those announcements “are a reaction to the job market,” said Penelope Brackett, practice development manager at RiseSmart, an outplacement-services firm.

“Workers now have options to go somewhere else,” she said.

That might seem surprising after two years of dreary headlines about certain brick-and-mortar retailers closing stores, laying off workers or filing for bankruptcy in the face of consumers’ massive shift to online shopping, notably to Amazon.com.

The victims included Toys R Us Inc., clothing seller Gymboree Corp. and the Sport Chalet and Sports Authority sporting-goods chains, to name just a few.

“There’s been a restructuring going on in a large part of retail” as many of the remaining chains resized their operations and widened their online offerings to complement their physical stores, and “I think we were misguided by some of the reports of the so-called apocalypse of retail,” said Jack Kleinhenz, chief economist for the National Retail Federation trade group.

Now, with the US economy showing solid growth, “the jobs machine in the United States has really kicked in and that includes retail,” Kleinhenz said.

Indeed, there were 776,000 retail job openings nationwide in May, up from 654,000 a year earlier and more than double the 352,000 openings in May 2012, according to the most recent data from the US Bureau of Labor Statistics.

The US jobless rate edged up to 4.0 per cent in June from an 18-year low of 3.8 per cent in May mainly because thousands of Americans started looking for work with the economy getting stronger, the Bureau of Labor Statistics said.

In California, unemployment in June was 4.2 per cent, a record low for a survey that began in 1976, according to the state Employment Development Department.

Seasonal jobs can include not only sales and cashier positions but jobs in customer service, in-store stocking and styling for chains with sizeable beauty counters, such as the Sephora counters at J.C. Penney. There also are a variety of stocking and sorting jobs at the retailers’ distribution and fulfilment sites.

J.C. Penney said it’s begun hiring 18,000 workers for the back-to-school season alone, including 350 in the Los Angeles area.

“We know that hiring top talent across the country is critical,” which is why the department-store chain launched the back-to-school hiring a month early, in June, spokesman Joey Thomas said in an email.

Kohl’s in late June said it launched its seasonal hiring “earlier than ever” to ensure workers were fully staffed and trained. Kohl’s did not say how many seasonal jobs it was offering but said positions were available at 10 Kohl’s stores in Southern California, including outlets in Downey, Yorba Linda, Irvine and Redlands.

Walmart Inc., the nation’s largest retailer, stopped hiring seasonal workers two years ago, saying it preferred to offer extra hours to its current employees. Target Corp. and Macy’s Inc. did not respond to requests for comment but they, too, are expected to hire thousands for seasonal work.

The back-to-school shopping season is critical to the retailers because it’s the second-largest shopping period behind the fall/winter holidays. It also portends how much consumers will be spending during the holidays.

Total spending for students in kindergarten through college is expected to reach $82.8 billion this year, nearly matching last year’s $83.6 billion (Dh403 billion), the National Retail Federation estimates.

Despite the shift to e-commerce, the NRF said the top destination for consumers shopping for back-to-school items are department stores, followed by online retailers and clothing stores.

Retailers are competing not only with other retailers for workers but with other firms that have seasonal hiring surges, such as distribution and shipping companies and transportation-services firms such as Uber and food-delivery outfits, said Andy Challenger, vice president of Challenger, Gray & Christmas Inc., a job-search and outplacement firm.

“All these [retail] companies are trying to get ahead of the rest of the pack” by hiring early, Challenger said. “The labour market has gotten so tight.”

The stout employment picture also means “the retailers are having a hard time keeping people” because “a lot of individuals are leaving to get into higher-paying jobs, such as manufacturing, professional business services and health care,” said Chris Christopher Jr., executive director of IHS Markit, an economics research firm.

Retail jobs often mean earning the minimum wage, but that wage is rising.

On July 1, the minimum hourly wage in Los Angeles, Santa Monica and Pasadena rose to $13.25 for large employers from $12, and smaller companies with 25 workers or less saw a $1.50 increase to $12 an hour. Unincorporated areas of L.A. County had the same increases.

They’re part of the plan to raise the hourly minimum wage in the municipalities to $15 for large employers in 2020 and for small firms in 2021. California overall is heading toward $15 an hour in 2022.

But as retailers try to garner the best seasonal workers — and to keep those workers from being hired by competitors — they might offer hourly pay above the minimum wage, depending on the position, the NRF’s Kleinhenz said.

“There is still flexibility on their part to use wages as an incentive to attract and retain employees,” he said.

Challenger agreed. “Wages have been really slow to rise over the last 10 years,” he said. But now, “companies are going to have to start really competing hard on wages to keep people.”

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox