Dubai's Gold Souq retailers want six-month rent waiver

They say six-month waiver is only way businesses can survive until tourists return

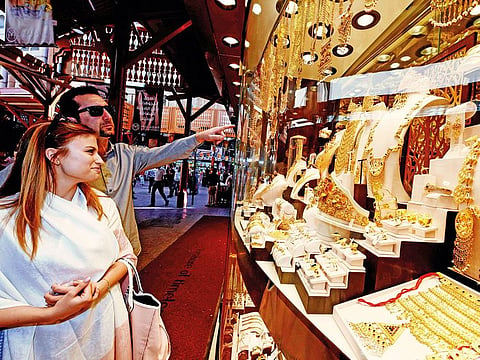

Dubai: Jewellery retailers at Dubai’s Gold Souq are calling on their landlords to offer a six-month waiver on rents - until tourist shoppers return in strength to the centre of UAE’s gold trade.

And for next year, these landlords should consider up to a 50 per cent reduction on rents. Retailers say it’s the bare minimum requirement to ensure they survive through this crisis.

“There are no incoming flights as yet – and even after flights do start, we do not expect to see many tourists coming,” said Anil Dhanak, Managing Director at Kanz Jewels. “Our sale to tourists from the Gold Souq store was at 93 per cent last year.

“This figure is based on the numbers who bought from our store and then claimed VAT (value added tax) refunds at the airport. Other retailers at the Gold Souq too would have more or less similar numbers – that location is a must-see for a majority of visitors to Dubai and it will return to being that.

“But it will take time for that to happen – and we will need some support from landlords to see us through this period.

“We certainly do not expect to make sufficient revenues with the remaining 7 per cent of local buyers as they will look to any jewellery purchase as a last preference and only after all their essential needs are fulfilled.”

What are rents like at Gold Souq?

A single-shutter store of 300-400 square feet currently starts from about Dh500,000 annually. Retailers typically operate multiple locations within the Souq, and until four or five years ago, they would also have to shell out millions of dirhams as “key money” for access to an outlet.

We certainly do not expect to make sufficient revenues with the remaining 7 per cent

Stark reality

After street-side jewellery stores started re-opening in Dubai from April 25 – after a month-long break - retailers discovered shoppers were in no mood to return to their gold buying ways. Visitor traffic has averaged less than 15 per cent and over the last few days have dropped even further as gold shot up at seven-year highs of $1,740 an ounce plus. (The Dubai Gold Rate for 22K touched Dh200 a gram on Monday (May 18), and is now at Dh199.)

Will landlords listen?

Gold Souq retailers will, by the looks of it, face an uphill struggle to convince landlords on waiving rent for up to six months. Even getting them to drop their rents drastically will be one tough task.

“They just don’t seem to understand the situation – they were willing to reduce by 2-3 per cent when we made the request,” said Deepak Soni of Marhaba Jewellers. “We are thinking of closing down two to three shops in the Gold Souq from the current six.

“My request is fairly straight forward – the Gold Souq has always relied on the tourist buyer. So, please do not charge us until flights are back to normal and the tourists return.

“Right now, even a 50 per cent reduction in rents for a certain period won’t make sense – because there’s no footfall at all.”

Pressure piles up

The next few weeks will be critical for the Dubai gold trade – no one has a clear outlook on when shoppers, resident and tourists, will return to the stores. And current prices will prove a deterrent to buying. There are only a limited number of shoppers wanting to buy at Dh199/Dh200 a gram now on the expectation that prices will shoot up further.

It’s definitely not that kind of market now.

The Gold Souq has always relied on the tourist buyer. So, please do not charge us until flights are back to normal and the tourists return

Wave of closures

Without adequate cashflow, more retailers in the trade are thinking of reducing the number of stores rather than keep handing out multiple cheques to landlords. Many of them believe that the fear of vacant stores will be the only way landlords can be convinced to make changes.

“Many companies are in the planning stage of store closures,” said Vishal Dhakan, Managing Director of Dhakan Jewellers. “There are several who have already started giving vacating notices.

“In the coming months, there will definitely be a consolidation phase where retailers will reduce their number of outlets.”

That could apply even for the bigger retailers with stores across the UAE. Senior sources at these companies have privately confirmed that a reduction in their network size will be an immediate priority. “We sent out feelers to landlords during the shutdown phase, we continued to do so during Ramadan, and we will remain hopeful,” said the head of marketing at one retailer.

“I don’t think anyone wins if landlords keep turning a deaf ear to our requests.”

A crisis like never before

Dhanak says that no one can afford to have a blinkered vision of what the immediate future holds. There’s no point in thinking the problems will resolve by themselves.

“Over the last four decades landlords at the Gold Souq have only seen a crisis twice - during the Kuwait War in 1991 and later during the 2008 Global Financial Crisis.,” he added. “But this time it’s a global crisis that’s going to last very long.

“No one can escape its consequences.”

Can the gold grouping help?

According to market sources, the Dubai Gold & Jewellery Group, which represents more than 400 members, has been trying to work out some rent relief packages.

“The Group has approached the government departments and most malls - but individual landlords at the Gold Souq are not being approached,” said Dhanak. “I have approached a few landlords in an individual capacity over the phone.

“I have not been able to meet any of them in person and that will only be possible after Eid. There is a feeling that they are waiting for the government to give guidelines.”

A six-month waiver

Ever since the COVID-19 crisis struck, retailers from every category has been on the phone with their landlords asking for some sort of rent relief. Most of these discussions have been about a three-month rent-free relief, while others have made requests/demands for a rent reduction until businesses get back to normalcy. A six-month rent waiver is still the exception as tenants and landlords start counting the cost of the virus attack. But one landlord in Saudi Arabia has already announced a six-month relief for its tenants. Raza Inc, the real estate arm of Saudi Public Pension Agency (PPA), announced flexible rent payments and rent deferrals for a period of up to six months. The rent deferral programme benefits businesses that operate in Raza’s property portfolio across Saudi Arabia. Between March 1 and August 31, Raza will hold off from issuing any rental invoices to businesses and will not have to pay any late payment fees during this period. “The pandemic is uniquely challenging and unprecedented that puts immense pressure on managing business cashflow,” said Waleed Aleisa, CEO. The Raza portfolio includes the Digital City in Riyadh, a 450,000 square metre development.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox