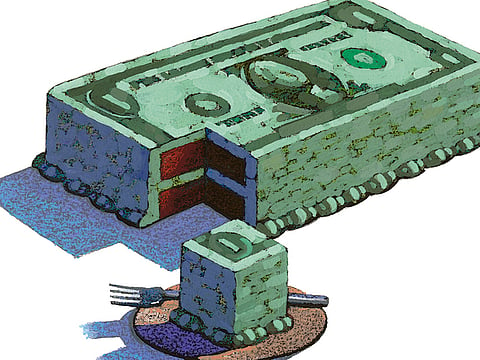

Slim pickings amid oil slump

Wealthy investors in the UAE become risk-averse as macroeconomic challenges rise

Stagnating oil prices and geopolitical uncertainty have resulted in wealthy investors in the UAE becoming more risk-averse, say bankers and wealth managers.

Oil has traded at about $42 (Dh154) a barrel this month, down from $106 when oil prices peaked in June 2014. As a result, the UAE, whose economy largely depends on income from oil, will expand slower than forecast this year. The IMF in April cut its growth forecast for the country to 3.2 per cent, 0.3 percentage points lower than its January prediction. This was the second time in six months the IMF cut its growth outlook for the UAE. In October 2014, the IMF forecast growth of 4.5 per cent for 2015. Meanwhile, in the Middle East, Yemen, Iraq, Syria and Libya continue to be wracked by conflict and instability.

Property interest

“I consider that most, if not all, investors have became more cautious given the international and the regional economic situation,” says Eyad Abdulnabi, Executive Director at Emirates Investment Bank. “For now, they are looking to preserve their wealth rather than for wealth creation.”

For many investors in the UAE, this means a return to spending on property, a perennial favourite. Many investors “are looking to put money in low-risk/secure investments like the real estate market and attractive yield investments rather than the equity market because of the high volatility and the high risk in stocks”, explains Abdulnabi.

“For them, the number one investment is real estate and, with the expected correction in the local markets, investors are waiting for attractive prices. Real estate is the investment that’s expected to come back to its real value in the short term.”

The Dubai property market was one of the worst-performing globally in the second quarter of this year, according to real estate broker Knight Frank in September. Prices are on track to have fallen 10 per cent over the course of 2015.

Growth sources

As the decline in oil prices starts to dent growth locally, many investors are also increasingly placing their funds overseas, says Anthony Habis, Managing Director and Head of Global Family Office and Key Clients Middle East at Citibank. “Overall, clients have become more risk averse,” adds Habis. “As concerns grow over the region’s stability, as well oil prices starting to show impact on the local economy, investors are turning to allocate more to their international portfolios.

“The core continues to be their local/regional operation, but the international piece is starting to get much more attention and a greater balance than it had previously as they look for diversification and sensitise for the inherent regional political concerns.”

Apart from the UAE and GCC countries, Europe and the US continue to attract interest from high-net-worth individuals, bankers say. “Europe and the US have been the top destinations due to the preference for blue-chip names,” explains Rohit Walia, Executive Chairman at Alpen Asset Advisors. “Emerging markets were interesting until mid-2014, but clients have been redeeming in anticipation of the US Federal Reserve’s rate hikes and weaker emerging market currency performance.”

Economists are widely predicting that the Fed will increase its benchmark overnight interest rate at its December 15-16 policy meeting after a slew of encouraging economic data. Meanwhile, the European Central Bank has said it remains committed to using all available measures to address sluggish growth in the eurozone.

UAE investors are also displaying signs of remaining “yield hungry” as they seek to preserve wealth as they generate some income. “With current interest rates lows and high volatility… if it’s an attractive yield and if it’s a secure investment, they will be there,” says Abdulnabi.

Habis agrees. “In general, regional investors enjoy a fair balance of yield versus capital growth. This is now becoming more evident as they look to sensitise for risk. It is always comforting to lock away some profits, and yield does exactly that.”