Choosing a regulated broker in the UAE

Should be legally able to satisfy the financial standards set by the region’s regulator

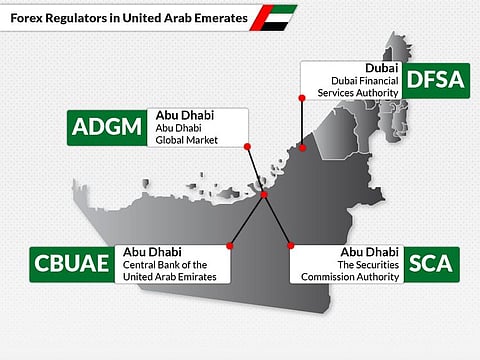

When choosing a forex broker, you should always choose a broker that is regulated for your region. If you are in the United Arab Emirates (UAE) then you need to choose a broker that is overseen by one of the four recognised financial authorities for the region. Selecting an appropriately recognised broker ensures the broker is legally able to offer their trading services in the UAE and satisfies the financial standards set by the region’s regulator.

To offer their trading services in the UAE, forex brokers must use one of the following regulators,

● Dubai Financial Services Authority (DFSA)

● Abu Dhabi Global Market (ADGM)

● Central Bank of the United Arab Emirates (CBUAE)

● The Securities Commission Authority (SCA)

With four different regulators in the UAE region, it can help to know the differences between each regulator and how they protect you.

Why choose a UAE regulated broker

If you are located in the UAE, is important to choose a broker that has oversite with one of the financial regulators for the UAE region as it ensures you can legally trade with them. Justin Grossbard of CompareForexBrokers says that while many brokers use respectable regulators from other countries such as Australia (ASIC), the United Kingdom (FCA) and Europe (CySEC, BaFIN), unless these brokers are also using one of the four UAE regulators, to operate in the UAE they will still need local regulation.

Regulators protect you by implementing safeguards so you do not lose your investments. This means setting the policies and practices the broker must abide by, these are safeguards to give you confidence in the broker and protect you. One such safeguard is the requirement that your funds are kept in a segregated account based in the UAE. Using a segregated account means the broker cannot access your funds and thus ensures you have full control of your finances.

Another regulatory requirement is that the broker regularly submits their financial books for review. This ensures the broker does is not at risk of going insolvent and therefore placing their client’s funds at risk. Brokers must have a minimum reserve of capital to ensure the worst does not happen.

Brokers are also required to document their trading practices and processes. This not only helps ensure clients know what they are getting for their products but allows the regulator to enforce these practices. Having a documented system ensures the broker’s operations are honest and transparent. An example of this is an established local complaints process, which allows for clients an avenue to seek recourse for any disputes.

Using a regulated broker means the broker must have top security in place so your data remains private and secure does not get hacked or improperly used. Brokers will also be required to follow to Anti-Money Laundering (AML) practices and know your client (KYC) practices.

Sharia Law

As the UAE is a Muslim majority country, the country observes sharia law. Regulators are able to ensure the brokers comply with the sharia requirements. This means financial accounting practices comply with requires of Islamic law.

UAE Mainland vs Free Zone

The seven emirates consist of two types of regions, Mainland and Free zones. All of the UAE is considered mainland except for 52 free zones which designated areas set aside to encourage foreign investment in the UAE. If these free zones, two of them are of interest to forex brokers, the Dubai International Financial Centre (DIFC) in Dubai and the Abu Dhabi Global Markets (ADGM in Abu Dhabi).

Businesses can choose to set up as a ‘mainland’ company inside or outside the free zone or as a foreign-owned company within the free zone.

Mainland Companies

Forex brokers that wish to do business directly with the local market need to set up as a mainland company. To do this, the company needs to have 51% local ownership, however, it means maximum freedom when dealing with local markets.

Since these brokers serve local markets, these brokers must have a local office that benefits you since it means local customer support.

One of the requirements of being a mainland registered broker is that

Forex brokers that choose this structure need to be regulated by the Central Bank of the UAE (CB UAE) or the Securities and Commodities Authority (SCA).

Mainland companies and Islamic accounts

Since mainland companies are intended for local markets, it follows that mainland brokers products must be suitable for domestic clients. For this reason, Mainland companies must or are more likely to offer a swap-free account that strictly complies with sharia law.

Swaps are a form of interest or a Riba and while many companies in the free zone offer swap-free accounts, they do not necessarily strictly comply with sharia law since they replace the compensation in other ways. This might be as wider spreads or an administration charge.

Securities and Commodities Authority (SCA)

The SCA is the financial regulatory authority for UAE for derivatives trading. This is the body that set the guidelines that other financial regulators must follow for securities and futures trading. While other regulators like DFSA and ADGM FSRA can set their own rules, they must work within the parameters set by the SCA.

Central Bank of UAE (CB UAE)

The CB UAE is responsible for protecting the financial integrity of the UAE. Currently, they provide regulation of forex brokers across the UAE however they will be handing this responsibility over to the SCA in 2022.

UAE Free Zones

The UAE government have set aside free zones in Dubai and Abu Dhabi to attract foreign investment. Foreign companies are attracted to set up in the free zones thanks to a range of initiatives from the UAE government which tailor to a more western-style business environment. Initiatives include the free zones having:

1. Ability to set up an office with 100% foreign ownership

2. Their own judicial system and courts have jurisdiction over corporate, commercial and civil matters within their respective free zone.

3. Laws are written in English

4. 0% taxation

The Dubai Financial Services Authority (DFSA)

The DFSA is the financial authority for the Dubai International Financial Centre (DIFC) in Dubai. This free zone is the largest financial hub in the UAE so is a popular choice for forex brokers to locate. As a result, you will find more UAE brokers offer DFSA regulatory protection than other UAE financial oversight.

Abu Dhabi Global Market Financial Service Regulatory Authority (ADGM FSRA)

The ADGM FSRA is much the same as the DFSA, except they regulate the Abu Dhabi Global Markets Freezone. Unlike the DFSA which was founded in 2004, the ADGM has only been operating since 2015 so is not yet as established. However, the ADGM growth rate is faster than the DIFC so in time the ADGM is expected to become more prominent.

Conclusion

When choosing a forex broker, as long as the broker is regulated by one of DFSA, ADGM FSRA, CBUA or SCA you are safe to trade in the UAE. If you are looking for the largest range of brokers to choose from then look for a DFSA regulated broker, while if you want to be sure the broker offers a complete compliant sharia product and has a local presence then look for a mainland regulated broker.

Sign up for the Daily Briefing

Get the latest news and updates straight to your inbox