Jitters over Greek swap worries

Collective action clause and immense pressure will see programme scrape through

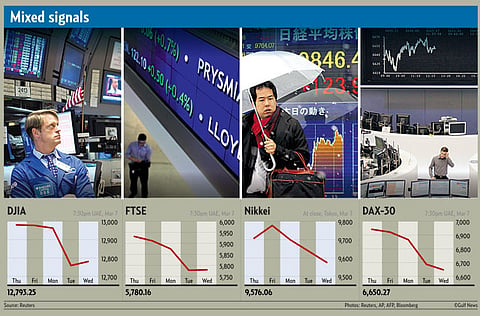

Dubai: Anxious markets across Asia and the Middle East declined yesterday as European equities traded flat amid worries about the outcome of the private debt swap in Greece heightened with its deadline expiring later today.

Greek private creditors have until tonight to participate or reject the bond exchange programme that forms part of the bailout that will enable Greece to avoid a default.

So far, a number of big bondholders, including European banks and pension funds, have signed up. However, a significant number of Greek pension funds and some foreign institutional investors have rejected the offer which comes with a 70 per cent write-down in the value of their holdings.

Contagion

The Greek government, which set a 75 per cent participation rate as a threshold for proceeding with the transaction, said it will use collective action clauses (CAC) to force bondholders to accept the swap if it receives sufficient consent from investors.

Markets fear that a failure to achieve the swap target could result in a disorderly default, triggering claims on credit default swaps (insurance against bond default) ultimately resulting in contagion spreading to southern Europe and limiting their ability to borrow in the market.

"As the deadline approaches for investor acceptance of the Greek PSI (Private Sector Initiative) on Thursday night it is almost inevitable that anxiety is returning to markets," said Tim Fox, chief economist at Emirates NBD.

The objective of the bond exchange is to reduce the €206 billion (Dh996.26 billion) of privately held Greek debt by 53.5 per cent.

Despite the growing worries over the success of a voluntary bond exchange, some analysts said the collective action clause and the immense political pressure on European institutions will see the programme scrape through ahead of the deadline.

"If participation is less than 66 per cent Greece will default directly, if between 66 per cent and 75 per cent it will lead to CAC-based enforcement, above 75 per cent will be spun as a "great success". To us, only below 66 per cent matters, and it is very unlikely, considering the political pressure and dependence on the ECB from the involved parties," said Steen Jakobsen, chief economist of Saxo Bank.

Warning

The Institute of International Finance, the bank lobby group that negotiated the deal, has warned that failure to secure the swap deal could result in recapitalisation costs close to $200 billion (Dh735.6 billion).

Earlier this week, Greece threatened to use CAC enforcement to force the dissenting Greek and European investors to accept the swap deal.

However, analysts have warned any use of force to accept the deal that carries a nearly 70 per cent haircut could adversely impact the cost of borrowing and market credibility of countries such as Spain, Italy and Portugal that are waiting to tap the bond markets.

Analysts say using the CACs could trigger payouts on CDS and potential legal action from bondholders, particularly hedge funds.