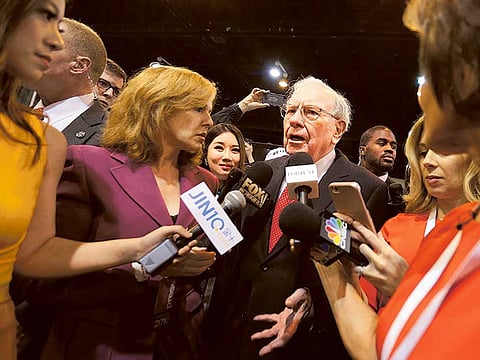

When Warren Buffett sours on Goldman Sachs, time to worry

Crisis has spooked America's forever optimist so much so that he's fled airline industry

Just as some U.S. states begin to reopen and try to mend the virus-stricken economy, Warren Buffett delivered a harsh reminder that things may be anything but normal for a long time.

The crisis has spooked America's forever optimist so much so that he's fled the airline industry entirely, and now even certain automobile and banking stocks, according to a regulatory filing Friday detailing Berkshire Hathaway Inc.'s investing moves for the first quarter. This included dumping 84% of Berkshire's stake in Goldman Sachs Group Inc. and reducing its JPMorgan Chase & Co. position by 3%. Buffett, 89, said proudly just two weeks ago that he thinks "nothing can stop America," but it's getting harder to believe him.

Exit Goldman

While Buffett made his about-face on airlines known during Berkshire's atypically morose shareholder meeting two weekends ago, the near-exit of Goldman was the latest shocker. Shares of the investment bank dipped 2% in late trading and are down more than 25% for the year. Occasionally, some big Berkshire investment decisions have been made by Buffett's deputies, Todd Combs and Ted Weschler; however, Buffett said exiting airlines was his call, and it's fair to assume that selling all that Goldman stock wouldn't happen without his blessing.

When it comes to banks, Berkshire itself is looking more and more like one as it sits on an ever-rising pile of cash. Its war chest stood at $137 billion as of March, and for what seems to be the first time ever, Buffett isn't looking to spend it. "The cash position isn't that huge when I look at the worst-case possibilities," the billionaire told his virtual listeners on May 2 during the meeting, which was filmed from an empty Omaha auditorium that would normally be lined with some 40,000 of his devoted followers. Indeed, for one of the world's most famous investors, he isn't doing much investing lately.

Worst is yet to come?

Still, Buffett did explain that the U.S. Federal Reserve's extraordinary actions to help buoy financial markets are partly why he hasn't been able to strike his usual sweetheart deals "- like the Goldman stake he acquired during the 2008 financial crisis. Investors also may not have seen the worst of things yet; Buffett's actions clearly suggest that he sees the possibility for further pain. If he saw buying opportunities, he'd be buying. The Fed even warned Friday in its financial-stability report that asset prices are "vulnerable to significant declines" if this public-health crisis worsens.

Even if Buffett's outlook for the coming months is quite bleak, there are some long-term holdings he seems comfortable holding onto: Berkshire's sizable stakes in Apple Inc., American Express Co., Bank of America Corp., Coca-Cola Co. and Wells Fargo & Co. were all unchanged. Of course, much has happened in the six weeks since the last quarter ended.

Buffett may always be America's biggest cheerleader, but he's an investor first and this is what that looks like. He's also only an investor, as even he'll admit, and only health officials can really say where we go from here.