When deciding to buy or to lease residential property, it is important to consider the costs associated with your choice. While most people would rather buy and not pay rent, the difference in the initial costs are quite significant, and often leasing is initially preferred to save enough funds to purchase property.

Costs of buying in Dubai

When buying residential property, a purchaser has significant initial upfront costs for which proper budgeting is essential.

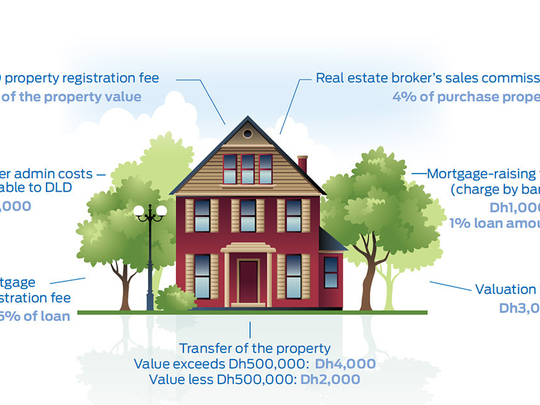

Over and above the deposit requirements, the biggest cost (along with the commissions payable to the real estate brokers as set out below) is the property registration fees payable to the Dubai Land Department (DLD), which amount to

4 per cent of the value of the property. The value of the property is not necessarily the same as the purchase price, and the DLD reserves the right to charge the registration fee on either the purchase price or a valuation of the property as determined by the DLD, whichever is higher in most cases.

The law states that the registration fees are payable equally by the purchaser and the seller unless agreed otherwise. However, in most cases the sellers insist that the purchaser pay the full 4 per cent. The other costs payable to the DLD, over and above the registration fees, include title deed issuance fees, map issuance fees (based on the type of real property) and a knowledge fee, all of which total up to under Dh1,000.

At registration of the transfer of the property from the seller to the purchaser, the purchaser will also be liable to pay further registration fees to the registration trustees, who are the appointed representatives of the DLD who attend to the registration process on behalf of the DLD. An amount of Dh4,000 is payable if the property value equals or exceeds Dh500,000 and Dh2,000 where the property value is less than Dh500,000.

The final cost that must be budgeted for is the real estate broker’s sales commission, which amounts to 4 per cent of the purchase price. Once again, this amount may be shared between the seller and the purchaser. However, it is usually also passed on to the purchaser to settle in full.

If a purchaser takes up a mortgage to finance a portion of the purchase price, 0.25 per cent of the mortgage sum is payable to the DLD as the mortgage registration fee, together with a nominal knowledge fee of Dh10.

A further point to remember is that raising fees will be payable to the mortgagee bank — usually an application fee of Dh1,000 plus 1 per cent of the sum of the mortgage amount as processing fee and valuation fee of about Dh3,000 payable to the valuer appointed by the bank. The banks usually also require annual property insurance, as well as life insurance to cover the outstanding balance of the loan.

There are a number of costs and these have to be carefully considered before signing a sale and purchase agreement to ensure that the purchase is affordable.

Cost of leasing in Dubai

A distinction is drawn between leases of up to 10 years, and those of 10 years until a maximum term of 99 years. Here, we will only discuss leases of up to 10 years.

The cost of leasing a residential property is considerably less than the cost of purchasing property. A tenant intending to lease a property will be required to budget for the letting broker’s commission, usually 5 per cent of the total rental amount of the lease. Certain letting brokers charge a minimum sum, which may be more than

5 per cent on lower-value leases. The commission is usually payable upon signing the tenancy agreement.

Although not actual costs, a tenant must also budget for a security deposit of at least 5 per cent of the annual rent, which is payable to and held by the landlord for the duration of the lease and refunded when the contract is terminated and after the property is inspected for damage. The lease agreement usually makes provision for normal wear and tear and the refund of the deposit cannot be retained by the landlord in such circumstances, .

A registration fee of Dh210 is payable to the DLD for the registration of the lease agreement (tenancy contract) on the Ejari system, which is a regulatory requirement before utility services will be delivered to the property. Tenants are also charged 5 per cent of the annual rent as a housing fee, which is prorated over the period of the lease and charged to the tenant’s monthly Dubai Electricity and Water Authority (Dewa) account.

DIFC

The Dubai International Financial Centre (DIFC) has its own requirements and fees relating to the transfer and lease of real property within the DIFC. Purchasers of property in the DIFC must obtain suitable advice regarding the cost implications prior to purchasing. There are also particular fees payable in respect of warehouses, long-term leases, usufructs and musataha rights for which specific advice should be obtained prior to entering into such transactions.

The information and figures set out herein provide only general guidance. When signing a purchase and sale agreement or tenancy agreement, it is best to take advice regarding the specific details to ensure the buyer or tenant is fully aware of the costs associated with the specific transaction.

John Peacock is a senior associate in the Commercial and Real Estate Department and Robert Mitchley is an associate in Corporate and Real Estate at BSA Ahmad Bin Hezeem and Associates.