Average rent: Studios begin at Dh35,000 and three-bedrooms at Dh75,000.

Pros: From luxurious villas to cheap apartments, Al Barsha has a mix of different cultures, nationalities and lifestyles.

Cons: Traffic, congestion, unfinished roads

BEST THING ABOUT IT: Mall of the Emirates and Lulu hypermarket are a five-minute drive away. Image Credit: XPRESS ARCHIVE

Dubai: Home and office rents continued to soften in the second quarter of this year in both Dubai and Abu Dhabi, new research showed Wednesday.

Residential lease rates in Dubai during the second quarter of this year showed minimal movement over the previous quarter but eased by as much as 33 per cent over the same period in 2009, property consultants CB Richard Ellis said.

Areas such as Barsha, Bur Dubai, Shaikh Zayed Road, Marina, Greens and Jumeirah Lakes Towers (JLT) saw rents drop as new supply came into the market. The highest drop in the freehold category has been in JLT and the Greens which saw lease rates easing by 40 and 36 per cent, respectively.

Among non-freehold locations, Barsha witnessed the biggest drop in lease rates with a decline for 44 per cent from the market peak.

"It is difficult to look at the market on an overall basis as individual developments continue to do well while others are seeing a decline," Matthew Green, head of research and consultancy at CB Richard Ellis Middle East, told Gulf News.

The decline in occupancy and lease rates has meant landlords are seeking more security in their lease agreements to stop tenants from terminating their contracts prematurely in favour of lower rents.

Falling rentals have also resulted in a continuing shift of tenants into Dubai from the northern emirates says Craig Plumb, MENA Head of Research for Jones Lang LaSalle.

A large number of new residential units is still expected to be handed over during the last two quarters of this year with rents likely to fall further. Average rentals and sale prices in Abu Dhabi also continue to decline. Apartment rentals are seeing a year on year decrease of 16 per cent according to the latest Abu Dhabi Real Estate market overview by Jones Lang LaSalle.

Under-supply

Abu Dhabi continues to suffer from an under-supply situation, particularly in the lower mid-market sections. This has prompted the City's Urban Planning Council to mandate that all large developments must provide an "affordable rent" component. "There remains a mismatch between demand and supply [in Abu Dhabi]. The market is becoming over-supplied at the upper segments of the market but under-supplied for affordable and mid-market housing," David Dudley, head of the Abu Dhabi Office at Jones Lang LaSalle, told Gulf News.

As banks reduce their loan-to-value (LTV) ratios for mortgages, liquidity remains strained in the property sector.

"Liquidity will not improve in the short term. There are banks that are willing to lend, but the general mentality is that people are not quite ready to lend anywhere near the same levels as in 2008. This won't change much in the course of this year," said Green.

Dudley agrees: "There is still strained liquidity. In the near future this will improve with groups like Abu Dhabi Finance Company offering more competitive finance rates with more flexibility on payment plans."

Commercial

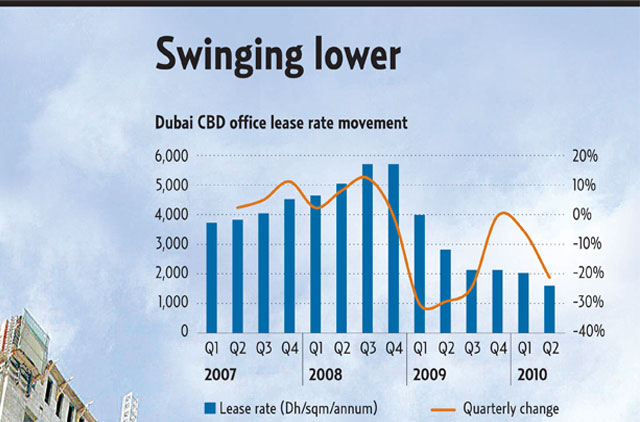

In Dubai's central business district, lease rates dipped sharply in the second quarter after six months of relative stability, CBRE said. New stock coming into the market has increased competition and reduced rents by up to 17 per cent.

"Currently vacancy throughout Dubai stands at about 40 per cent of total stock, but this varies wildly through the various business districts and free zones. For example, the vacancy rate for international-quality office buildings under a single ownership within the CBD stands at under 15 per cent," Matthew Hammond, Head of Agency at Jones Lang LaSalle MENA, told Gulf News.

Office space in the DIFC area has seen a drop of 7.5 per cent in rental rates. Current lease rates within the DIFC are around Dh3,982 per square metre per annum while space from private developers is going in the range of Dh2,690 to Dh3,014.

"Commercial rents are now more in line with other major centres within the EMEA region," said Hammond.

The main concentration of upcoming office supply will come from the Business Bay development. However this is expected to happen in 2011. "There are various infrastructure issues with a lot of completed towers sitting there," said Green.

The key areas that will see new commercial supply are Al Barsha, Tecom C, Jumeirah Lakes Towers, Port Saeed, Al Mamzar, Airport Road and Diyafa Street.

In Abu Dhabi, office market rents also continue to fall as new supply comes online. Rents decreased 27 per cent on-year in the second quarter, and 12 per cent on-quarter, according to Jones Lang Lasalle.

Office vacancy rates which reached 8 per cent in second quarter 2010 are expected to increase over the coming year as new supply enters the market. "Over the next 18 months significant supply will be coming on stream which means vacancy rates in buildings will decrease and rents will continue to soften. "This is a good thing as it will make Abu Dhabi a more competitive business location with companies more inclined to relocate to new buildings and increase their presence," said Dudley.

- 40% rent easing inJumeirah Lakes Towers

- 36% rent easing inThe Greens

How much have you saved this year compared to last? Are you planning to move to take advantage of the drop? Has the drop in rent made life more affordable?