Dubai: UAE-based families face a cost of almost Dh1,000,000 for the education of a child from pre-school to college, new research released on Tuesday shows.

Research by Zurich International Life Limited, Middle East, shows the cost of education UAE resident families face is Dh933,945 ($253,962) throughout the educational lifetime of a child.

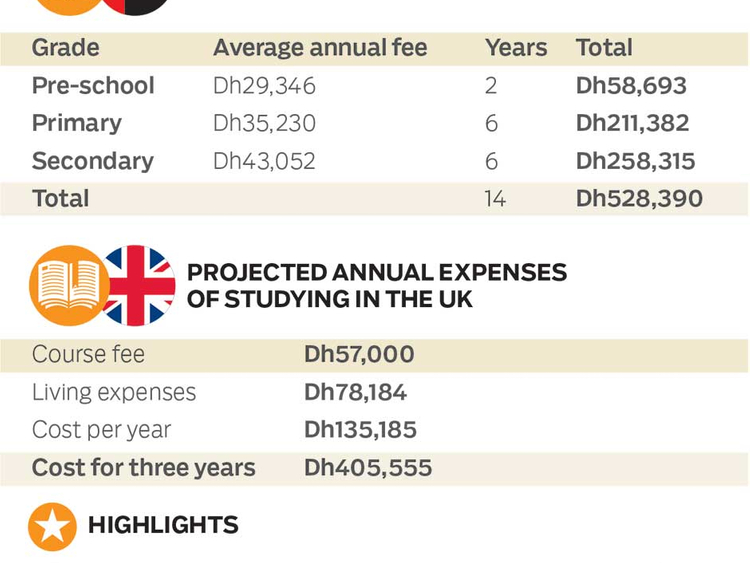

The figure, which excludes compound interest rates, is based on the total cost of education of two years at pre-school, six years at primary school, six years at secondary school and three years at a British university.

In the UAE, pre. primary and secondary school costs add up to an average of Dh528,390 per child. These costs exclude other fees such as the cost of books, trips and uniforms. Additionally, these costs could increase by up to 40 per cent for top tier schools, the study said.

It added that UAE-based universities average Dh76,492 per year, while in the UK it costs an average of Dh57,000 annually.

Tertiary education fees differ from country to country. For example, the average yearly cost of tuition in Australia and Canada is Dh55,163, while the US has annual fees averaging Dh84,428.

In addition to upfront costs of education, basic living expenses raise the costs even further, with accommodation, food, utilities, travel and day-to-day living expenses all adding to the burden on families. These extra costs equate to as much as Dh234,551 for one student over a three-year UK course, according to research published in 2015 by the University of Edinburgh.

“A typical family with two children could look at spending as much as Dh2 million on education,” said Amrita Sethi, Head of Marketing and Communication, Zurich International Life, Middle East.

“While some employers in the UAE contribute to education costs at primary and secondary level, the majority of people are left having to pay these costs themselves, with 70 per cent of parents funding their child’s university education from day-to-day income, according to HSBC’s recent The Value of Education Foundations for the Future report.

“The report also revealed parents based in the UAE spend the most on children’s higher education compared with other parents globally. It’s a huge expense that, without proper savings and financial planning, is very difficult to meet and often at the opportunity cost of planning for other important goals, such as retirement.”

HSBC’s report also revealed 64 per cent of parents would be willing to get into debt to fund their children’s university education and 41 per cent of parents think funding their child’s education is more important than contributing to their own retirement.

Sethi highlighted the need for families to start planning and creating savings plans to fund help their children’s education.

“Adding up the costs may seem overwhelming at first, but the good news is committed financial planning will help families achieve these important saving goals. Start your savings plan sooner rather than later, spread the costs over the long term and remain disciplined and committed,” she said.