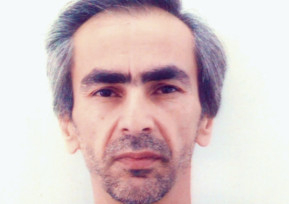

Dubai: Ask any parent how much they value their child’s education and like Noor Sulaiman they would probably say no cost is too high. But in the case of Sulaiman, a Palestinian-Jordanian, spending 40 per cent of the family’s income on the tuition of two university students has proven to be difficult.

Sulaiman, a journalist by profession, is the only breadwinner of the family of eight that includes his stay-at-home wife, two children who go to university and four others who go to school.

Sulaiman’s freshman year daughter studies accounting at a university in Ajman that charges Dh40,000 per year while his elder son is studying civil engineering at a university in Abu Dhabi that costs Dh55,000 per year.

The universities were chosen because, in comparison, they are cheaper than others. However, they are still too expensive for him, he says.

How does he manage?

By taking loans. Sulaiman has already taken two loans totalling Dh150,000.

What are the challenges?

The process of procuring financial aid, he says, is quite stressful as he has been asked to divulge extremely personal details such as a break-up of his family expenses, etc, apart from having to provide a salary statement, which he says he finds demeaning. Then there are the expenses. “I pay for four students’ school fees, which is equivalent to one university student’s fees; I have to pay my bills and other house expenses as well. I also have responsibilities abroad as I support my parents. It is really difficult to cope with all this.”

In addition to the expenses mentioned above, Sulaiman said university books and transportation fees don’t make it any easier. “Per ride, my daughter has to pay Dh35 for the bus from Sharjah to Ajman and another Dh35 to get back home. That amounts to Dh70 per day; a taxi would cost a fraction of this, not to mention the university books, which are very expensive.”

Having his children help fund their younger siblings once they graduate and take up jobs and loans is the only options Sulaiman is willing to avail of. Asking people for help is not an option for the father who is a proud man. He hopes that fees will decrease by the time his third son is ready to join university.

What are the sacrifices involved?

“Many sacrifices have been made and, unfortunately, they have all been made at the expense of the younger children’s welfare. They missed out on many activities they have the right to experience in order to help with their development and personality growth. For example, my younger children have not gone on a vacation in two years."

What is the ROI (Return On Investment)?

The quality of education of higher education, he said, is not worth the cost. “I think the education they provide is worth Dh7,500. Universities are all about making profit.”

But since it is near impossible to find a job that pays well without earning a degree, going to university is a must.

He tried sending his son to study in Jordan for a semester but, according to Sulaiman, being accustomed to the comfortable life in the UAE made it difficult for him to cope so he returned. As for his daughter, due to cultural reasons, he said it is difficult to send a girl to study abroad on her own.