Manama: A debate is raging on Qatari social networking sites on rising indebtedness in the community amid claims that a large number of people are taking huge bank loans mostly for unproductive use.

One camp in the debate favours state intervention to either write off these loans or at least provide a reprieve to the borrowers for one or two years.

However, the other camp strongly rejects the idea of waiving off the loans saying that would be unjust since not every citizen would benefit from the "largesse".

Studies suggest that a majority 75 per cent of the Qatari population is in debt with average loan burden per capita amounting to no less than QR250,000, Qatari daily The Peninsula reports on Monday.

Community sources estimate that writing off the loans could cost the exchequer dearly—a staggering QR37.5bn. But those advocating state intervention argue that it ‘shouldn't be a big deal' for gas-rich Qatar to dole out the sum to ease the community's woes.

Those calling for a reprieve in servicing the loans argue that relief for a year or two could be given to the borrowers to enable them to strengthen their financial position and the loans could subsequently be rescheduled.

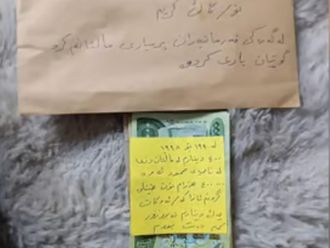

Community sources told the daily that nationals mostly take bank loans for unproductive use and splurge them on things like buying a new car, marriage or overseas fun trips.

"We as a community lack the culture of savings and are always locked in a meaningless struggle for social one-upmanship. If our neighbour has a new car we must also have one," one source said.

Likewise, if a family in the neighbourhood goes on an overseas trip during summer or spring vacation, it would trigger a chain reaction with just every other family in the vicinity following suit.

Marriage for young Qatari men remains one of the most expensive propositions entailing spending of between QR750,000 and QR1m on average and most would-be couples rely on bank loans to tie the knot.

About the ‘compulsion' of a Qatari family to go vacationing overseas, a Qatari columnist wrote recently: "The problem is that our children are under peer pressure in school. They are asked by friends about where they went holidaying."

Experts, however, blame the banks and the banking regulator for liberal dispensation of personal loans.

"Banks have surplus liquidity and lack innovative and socially responsible products and services so it is easier for them to entice people to seek loans on easy terms," said an expert. "While in other countries there are education, medical and marriage loans, here you only have personal loans and the margins are quite exorbitant."

Banks in other countries banks actively encourage entrepreneurship and give away loans to people to launch projects or for some investment. However, in Qatar, the banks have no such products with the end result being their growing exposure to personal loans, the daily said.