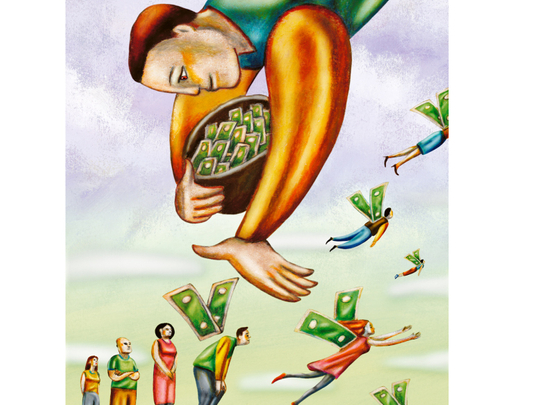

When it comes to providing loans to small to medium-sized enterprises (SMEs), banks in the UAE are taking the approach of teaching a man to fish. After the global downturn, financial institutions are not content with merely handing over the cash and waiting for returns; instead, many now act as incubators and nannies to baby enterprises. Additionally, the UAE government has firmly put its weight behind its entrepreneurs. To aid, support and fund SMEs, each emirate has its own organisation — the Khalifa Fund for Enterprise Development in Abu Dhabi, Dubai SME, Ruwad Establishment in Sharjah and Al Tomooh Finance Scheme in Ras Al Khaimah are some examples.

The most recent of these initiatives was announced in late January by the Dubai Business Women Council (DBWC) and MasterCard. Encouraging women to submit their business proposals on a microsite until the end of this month, Ro’Ya (meaning Vision in Arabic) will award the top three women entrepreneurs cash prizes of $50,000 (about Dh183,630), $30,000 and $20,000 for start-up costs.

“Once the winners are announced, MasterCard and DBWC will continue to work with them on a one-on-one basis as they begin starting up their businesses,” Ngozi Megwa, Vice-President, Business Development, Key Relationships — Middle East and Africa, MasterCard, tells GN Prime.

MasterCard is just one of the many financial institutions focusing on this sector. In November last year, HSBC launched its International Growth Fund committing Dh1 billion to UAE’s international SMEs, open to those with a sales turnover of more than Dh30 million.

Emirates NBD has introduced three separate programmes for the sector, including a credit guarantee scheme, a privileges programme and a networking system. SMEs using its business banking service get discounts on products and services, including printing and stationery, retail, logistics, event management and marketing. Launched last year, its new initiative Rise aims to provide SMEs in the UAE with a platform to learn, network and grow their businesses. The bank also signed a strategic partnership agreement with Dubai SME to provide up to Dh50 million in loans to Emirati SMEs last year.

“Everyone is focusing on this sector,” Vikas Thapar, Head of Business Banking, ENBD tells GN Prime. “SMEs, over a period of time, are more resilient to changes in the economic cycle. Because they’re small companies, they don’t have too many overheads; they’re more agile and articulate their strategy quickly compared to big companies. It is a very, very important sector and been our core one for the past few years for our top and bottom line. We have not faced any losses in this sector — very, very low, to be considered almost negligible. In the past few years we have been growing our business 25-30 per cent.”

Putting money where its mouth is, last year the bank doubled its lending targets to SMEs — Dh1 billion compared to the Dh500 million it lent in 2012. According to the Dubai Statistics Centre database, cited by Dubai SME, SMEs account for 95 per cent of all businesses in Dubai, employ around 42 per cent of Dubai’s workforce and comprise 40 per cent of Dubai’s income.

While monetary assistance is at the heart of many of these programmes, the enabling environment helps too in making companies more resilient. “The environment is being created in this country — by the government through its Corporate Governance Code, by the UAE Institute of Internal Auditors, training courses being held by other risk management associations — for SMEs to adopt good governance practices. Chances are bright that in due course the environment will influence its constituents, gradually,” Porus Pavri, Partner, Logos Consultants, a risk management consultancy, tells GN Prime.

Bridging channels

In Dubai, for instance, DBWC was created to fill a very large gap in the Dubai economy as a platform for mutually beneficial business relations. “The Network Majlis events are hosted monthly by DBWC in order to provide information about the latest knowledge, skills and best practices for women entrepreneurs and leaders,” says Nadine Halabi, Coordinator, DBWC.

These advisory and support services are in high demand, says Thapar. “Only about 30-40 per cent [of our SME customers] would need loans. When you talk about SMEs everyone thinks that it is all about lending. It is not. Worldwide, the SME strategy of a bank includes many other services. Our SME customers want transaction banking services, cash management, they want trade advisory and foreign exchange solutions when they buy and sell all over the world. They want wealth management advisory service for their owners. It’s a growing sector.”

Within SMEs, Thapar says that logistics, food and beverage, transportation and media are thriving sectors, as is manufacturing, which is gaining importance steadily.

One of the results of institutional encouragement is increasing risk resilience. Whether it is Dubai SME 100, which ranks the top 100 companies in the emirate, or Pitch for Investment announced at SME Congress and Expo in Abu Dhabi in December last year, or Ro’Ya, competitions prepare hundreds of enterprises to look into their governance structures and accounts.

Pavri says this is necessary as along with being agile and nimble, SMEs are also more vulnerable — a factor mitigated by creating support systems. “Because they lack the financial and political clout of their big brothers, they cannot withstand external or internal shocks to their existence as well. So, unless someone within the organisation, either by himself, or with the help of an external consultant, identifies the risk universe for the SME, they cannot even begin to put relevant controls in place to address those risks. Even if some controls are in place, there is no assurance that those controls address the risks in the order of their importance/criticality.”

When these factors are taken into account, growth is assured. “We have seen people investing in management, setting up committees and a board of directors,” says Thapar. The new business environment is ideal for growth.

Risk Resilience

In 2011, the Dubai government issued a Corporate Governance Code for SMEs which is, as yet, a voluntary framework, setting out the key ingredients of corporate governance that should ideally be put in place by SMEs. Porus Pavri, Partner, Logos Consultants, shares the steps in risk management.

1. Identify risks that are critical to the survival and growth of business.

2. Rank these risks in a weighted manner considering impact and likelihood.

3. Devise audit plans (prioritising audit effort based on risk scores) to assess if the identified risks are being addressed through various kinds of controls.

4. Carry out tests of those controls based on audit plans. Tests will reveal if controls may be inadequate to cover the risks they were meant to cover. Some controls, even though adequately designed, are not executed in the manner they were meant to be, so that the related risks are exposed.

5. Discuss exceptions with the group or team that operates those controls, then report on them to senior management.

6. Regularly follow up recommendations to ensure that either they get actioned or, the situation has changed such that the recommendation is not required to be implemented.

7. Use the formal audit opinion, at least annually, on the overall systems of governance, risk management and internal control for the organisation.

8. For individual projects, use internal control reviews, special investigations, project feasibility studies, agreed-upon procedures, financial statement reviews and compilation.