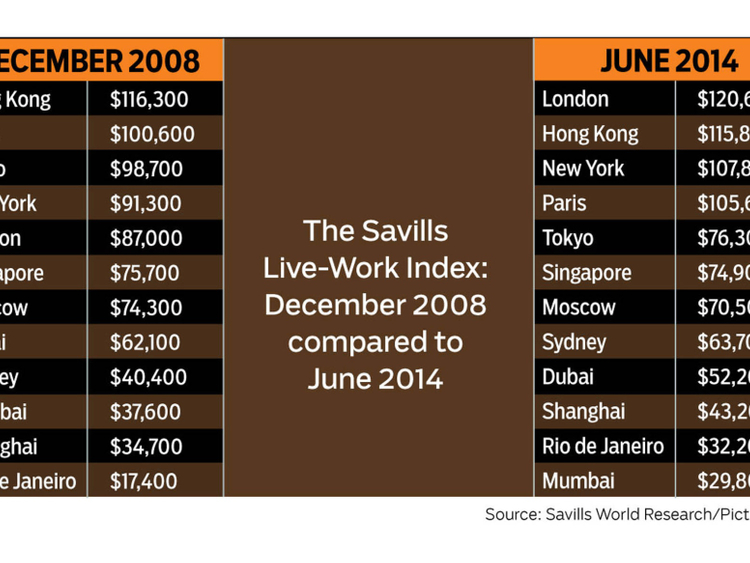

According to the Savills Live-Work Index released to GN Focus, Dubai is fast becoming more expensive to live and work in. It says, “As global interest in the city increases, total costs for corporations have grown by 25 per cent in the year to June alone.” Even then, out of 12 cities surveyed, Dubai ranks ninth, and is 16 per cent below 2008 levels.

Hong Kong, having topped the ranking for the past five years, has conceded the top slot of being the most expensive city to rent living and working spaces to London.

What has primarily worked in London’s favour is the sterling’s appreciation against the US dollar. This, coupled with significant increase in office rents, has pushed up London’s total costs in dollar terms. A combination of falling residential rents and a weakening currency has altered Hong Kong’s cost competitiveness.

Meanwhile, according to transaction data from the Land Department of Dubai, investors are using mortgages to buy prime properties (above Dh10 million), even as the segment has slowed down in comparison to the mainstream.

Victoria Garrett, Associate Partner — UAE Residential, Knight Frank, tells GN Focus, “The Land Department says 35 per cent of the prime market is buying with mortgages. Moreover, transactions that have come through the Land Department show the mainstream recovering more quickly than prime property in terms of transaction volumes and prices.”

Global interest in the emirate is becoming apparent in the form of investment funds looking seriously at income from various types of properties. As Chinese investors show interest in off-plan properties, GN Focus has learnt that sovereign wealth funds from other regions are poised to enter Dubai’s booming hospitality market in a matter of days, with deals structured to retain ownership while freeing up capital.

Nick Maclean, Managing Director, CBRE Middle East, says “Very little institutional money has come in historically. This is the power of real estate markets here.”